Posted by Richard at 17:41 Printable Version Print Posted by Richard at 13:59 Printable Version Print Posted by Richard at 01:05 Printable Version Print Posted by Richard at 19:41 Printable Version Print Posted by Richard at 18:22 Printable Version Print Booker in The Daily Mail reckons that this crisis could not only deep-six the euro, but the whole of the EU as well. Posted by Richard at 16:31 Printable Version PrintThursday, October 09, 2008

It ain't working … yet

If the point of yesterday's "rescue" was to ease liquidity in the banking sector, it has not had any discernible effect on the all-important Libor (London inter-bank offered rate).

If the point of yesterday's "rescue" was to ease liquidity in the banking sector, it has not had any discernible effect on the all-important Libor (London inter-bank offered rate).

According to Bloomberg, the Libor dollar rate has jumped to the highest level in the year and the credit is staying frozen.

The rate for three-month loans rose to 4.75 percent, the highest level since 28 December and, while the overnight rate fell to 5.09 percent, it was still 3.59 percent more than the US Federal Bank's 1.5 percent target rate. The three-month rate in euros held at a record high of 5.39 percent.

Says Barry Moran, a currency trader in Dublin at Bank of Ireland - the country's second-biggest bank, "To see little or no reaction in the fixings is very disappointing and reinforces the fact that Libor is broken and the transmission mechanism from central banks isn't working … Things are still very stressed and we don't know what's going to fix it."

Alessandro Tentori, an interest-rate strategist in London at BNP Paribas SA, adds to the gloom, saying that, "I don't see a wave of liquidity coming into the market … People are still holding on to their cash because there's still a great deal of uncertainty out there."

Then we get Cezar Bayonito who tells us that, "Libor spreads are still wide, which suggest offshore banks are not willing to take more risks lending to other banks." Bayonito is a liquidity trader at Allied Banking Corp. He adds: "Interest-rate cuts will be of little help in the near term because the issue is trust, not rates."

Interestingly, Bloomberg then gives us a little background, telling us that Libor, set by 16 banks in a daily survey by the British Bankers' Association at about noon in London, determines rates on $360 trillion of financial products worldwide, from home loans to derivatives.

That actually puts the bank rescue in perspective. Of the two sums on offer from the Bank of England, £200 billion as lending and £250 billion as loan guarantees, this is supposed to kick-start a market of $360 trillion. Given the paper losses arising from the write-downs under the mark-to-market accounting system, this is a drop in the ocean.

Mervyn King, governor of the Bank of England (pictured), had better get his printing presses cranked up.

COMMENT THREADThe politics of denial

An overnight communication from a trusted source - very close to the "horse's mouth" – put the final pieces into place.

An overnight communication from a trusted source - very close to the "horse's mouth" – put the final pieces into place.

It confirmed beyond any doubt that the UK's bank rescue plan was not a unilateral action but – as we had suspected – part of a carefully structured and co-ordinated plan devised at Ecofin, building on the foundations laid at the "summit" in Paris on Saturday.

Thus, when Darling and the Gordon Brown stood up in parliament yesterday, the one during a ministerial statement and the other during PMQs, they may have taken on the familiar mantle of Her Majesty's ministers. In fact, they were speaking as representatives of a bigger entity, the government of Europe (or, more specifically, the government of the European Union).

This is not some grand fantasy – not some deep, dark conspiracy. It is fact. The evidence is there for those who want to see, apparent in part from the contrast between events here and those in the United States.

Confronted with a global crisis, in the US a plan was formulated in broad daylight, subjected to intensive public scrutiny and debate, put before Congress for approval and again subject to massive debate before being approved by the democratically elected representatives of the country and put into action.

Over here, what do we see?

As the crisis develops, the complaint arises of government "dithering" – reacting to events rather than taking the initiative with a pro-active strategy. The main action we see is a series of meetings with the European "colleagues" behind closed doors, poorly reported and completely misunderstood.

Then, after the final, key meeting of Ecofin on Tuesday, we see action taken. Parliament is not consulted. There is no debate. Parliament is simply told what is going to happen. It is then allowed to discuss the issues. But there is no vote, no approval. None is needed. Your government has spoken – the government of Europe.

Therein lies the difference – on the one hand in the United States we see, with all its imperfections, a functioning democracy in action. Here, we see a cabal of rulers working behind closed doors, coming out into the daylight only to inform us what they have done and how much it is going to cost us.

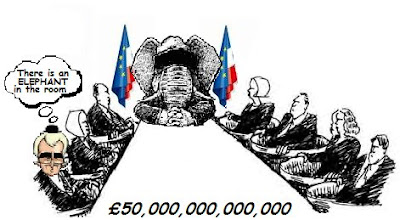

Why the "elephant" that now runs our government should remain so invisible is a subject all on its own. We touched on it in this post and many others. We will, undoubtedly, return to the issue many more times.

The bottom line, though, probably lies in psychology. Essentially, the political collective, the media and the hangers-on are in a state of collective denial. The phenomenon itself, helpfully described here, is triggered in the individual when he or she "is faced with a fact that is too uncomfortable to accept and rejects it instead, insisting that it is not true despite what may be overwhelming evidence".

The response to being confronted by further evidence, however, is simply to reinforce the denial. We have seen this on this blog. As we have unravelled the story of quite how deep the European Union is involved in our financial affairs – with quite impeccable evidence - the groupescules shriek and run for cover. The more we shout, the faster they run.

Thus, while the daily hit rate of this blog has been increasing, the bulk comes from direct hits. The number of referrals from other blogs has declined sharply. We have been put firmly in quarantine. Part of this must be due do our (my) aggressive approach (itself born of frustration and despair) but, in the main, what we have to offer is too enormous, too scary for the collective to admit.

We also see the media retreating to its comfort zone, The Daily Telegraphprojecting the myth – without saying so explicitly – that the UK action was "unilateral" and contrasting this and other events unfavourably with "the shambles of last weekend's EU summit".

The Times, on the other hand, retails in turgid detail how "Alistair Darling and his team got ready for all-night negotiations to part-nationalise Britain's banks – with tandoori chicken."

This is the sort of detail the hacks can deal with. This is what they are comfortable with. Real journalism would have been to reveal precisely what happened in Paris and in Luxembourg. But to acknowledge the big, outside, scary world is too much. The hacks prefer to bury their heads in the sand and indulge in the politics of denial.

COMMENT THREADSomething smells

That huge stinking elephant is on the rampage again, and I'm not the only one who thinks so. Whichever way you look at it, the UK's bank rescue plan drives not so much a cart and horse through EU law as a fleet of 32-ton trucks with a supertanker in their wake.

The big question is, whether the UK acted unilaterally or whether the deal was stitched up at Ecofin, with probably the germ of the idea hatched at the "pre-meeting" – the so-called "summit" in Paris on Saturday.

My instinct is that Ecofin in Luxembourg was where the final deal was done. Most likely, there would only have been a small group in the know – the "Paris four" ... France, Germany, Italy and UK. Spain might have been brought into the deal, and perhaps a few more (possibly Ireland, Holland, Belgium and Luxembourg). And, of course, Barroso would have been in the loop.

The deal would have been sealed in the couloirs, with no witnesses. Nothing would have been said in plenary but all 27 member states would have agreedthe communiqué, written in advance by the [French] presidency, with the text written to cover the backs of the plotters.

Some others think that the UK might have acted unilaterally, with Barroso going along with the plan after the news had broken. But, while he might have been able to keep little Neelie in her box, it is significant that not one other member state protested. Compare and contrast with the howls after the Irish unilateral action.

Either way, as we see from the previous post, the “colleagues” are going along with it, with further confirmation from an AP report, which tells us that:Both France, acting as the current head of the 27 EU governments, and the European Commission said the plan to partly nationalize banks and guarantee bank loans met EU guidelines agreed Tuesday [Ecofin] on how far nations could go to save their financial systems.

The essence of this is repeated in the IHT and by Reuters. But, no matter how many times the story is repeated, it ain't true that the plan conforms with EU law. It just does not.

Of course, for the commission to have stepped in to condemn the plan, ex post facto would have been suicide. It would have precipitated a bust-up far bigger than the "Beef War" of 1997 and, this time, the EU would have been the loser.

But who is writing the script is not an academic question. If the UK did act unilaterally, then the EU is in trouble. But if this is a conspiracy of silence between the UK and the rest of the "colleagues", then it might suggest that the EU institutions are getting a grip and reasserting their authority. Upon that distinction rests the prospect of the EU emerging from this crisis much weakened, or stronger, more powerful and much more dangerous.

Someone who seems to think that the EU has been weakened by the UK plan is Bruno Waterfield, although his piece has been so heavily "Londonised" that it is hard to divine precisely what his line is.

However, he starts by telling us that a "Europe-wide funding plan" will be discussed at a Brussels summit next week, "despite the continuing failure of European Union leaders and institutions to pull together in the face of the global financial crisis." The "summit", of course, is not a summit. It is the autumn meeting of the European Council and there we expect the next stage of the "plot" to be hatched, if there is one.

But Bruno is writing that Gordon Brown's call for EU unity and funding may fall on deaf ears at the Council "as other national leaders scrabble to save their own political skins."

He makes a case, but it is pretty thin. Even so, he may be right – the EU may be on its uppers. I sense he is not but, frankly, I do not know. What is indisputable, though, is that there is a major drama being played out in thecouloirs of Brussels and Luxembourg, the outcome of which could shape our lives for decades to come, and even change history.

The other indisputable point is that, as far as the MSM goes, most of the hacks are blissfully unaware of what is going on, so profoundly ignorant of the nuances that the "elephant" could sit on them and they still would not notice. (The sentence reads better with a "h" inserted in the appropriate place.)

That aside, this is written in the early small hours. Whether the Brown/Darling plan (with or without EU prior assent) is working may become apparent later today. If the market calms down and, more particularly, if we see movement in inter-bank lending – some signs of which may already be apparent – then today could be a turning point.

If it is, then all of us will breathe a sign of relief, and we can go back to our normal hostilities, hunting down that "elephant" - and working out how to pay the bill for the "rescue".

COMMENT THREADWednesday, October 08, 2008

Now there's a thing

With the unlikely figure of Britain emerging as a shining example of how to rescue banks, writes Lionel Laurent for Forbes,

With the unlikely figure of Britain emerging as a shining example of how to rescue banks, writes Lionel Laurent for Forbes,… the real credit should go to the Ecofin meeting of Europe's finance ministers on Tuesday. It was there that the conditions were laid for measures such as partial nationalisation, which otherwise may have run into trouble from regulators because of limits to state aid.

Then, EU commission president José Manuel Barroso is recorded by ForexTV, welcoming the UK banking sector proposals to supply the banking system with £200 billion in a speech before the EU parliament today. "I take this opportunity to welcome the measures announced by the UK, which are in line with the principles adopted yesterday at Ecofin," he says.

Yet the British media still haven't begun to understand what is going on, or even Ruth Lea, who is still writing about our local government having been "dithering".

With increasing clarity, though, it is emerging that Brown and Darling werewaiting for the go-ahead from the "colleagues" before acting. That is why they took no action on Monday – they could not until they had had their marching orders from the "colleagues".

Thus, overnight on Tuesday and into the early hours of this morning was the first time they could have acted, having been given the green light at Luxembourg to break the EU rules. No wonder Mr Barroso is looking quietly confident. This is the face of the man in charge.

COMMENT THREADA crisis of "enormous proportions"

Poor old Ambrose this morning was running out of hyperbole. Once you've proclaimed that the sky is falling in, there is not much left in the vocabulary to describe a situation that is getting even worse.

Poor old Ambrose this morning was running out of hyperbole. Once you've proclaimed that the sky is falling in, there is not much left in the vocabulary to describe a situation that is getting even worse.

Nevertheless, our brave correspondent rose to the occasion, lifting a quote from Miguel Angel Ordonez, Spain’s ECB governor. In testimony to the Spanish Cortes, Ordonez "acknowledged" that the world now faced a crisis of "enormous proportions."

Guy Quaden, Belgium's ECB member, also helped out. He declared that the violent storm ravaging Europe's banking system was far from over. "This is the worst financial crisis since the Thirties," he told the Belgian parliament.

This is the European Central Bank, dramatically changing its tune over the last twenty-four hours. It is getting to grips with reality and testing out its own disaster vocabulary.

The problem is, once the situation does get even worse, what is there left after Ordonez's "enormous"? Do we raid the dictionary or start inventing new words, like "gigahorrendous" perhaps?

But, squeezed into Ambrose's dictionary of disaster, is a more pedestrian word, but one which nevertheless retains its power. That word is "shock". The collapse of Germany's Hypo Real, writes Ambrose, "has come as a deep shock since the company's assets are mostly high quality." The crisis, he tells us, was triggered when Hypo was unable to roll over loans or issue bonds in the closed credit markets.

Although the point is not directly made, this takes head-on the current mantra that the market is being taken down by "toxic" debt. Much of the paper being written down now would be, in an orderly market, of high value with limited default risk. But, in today's febrile climate, even these are worthless.

That point – rarely made – is that even much of the "dodgy debt" still has a default value. Yet, while one banker commenting on a Wall Street Journalblog was writing that even foreclosed mortgages were fetching 40 cents on the dollar, he was being forced to write down securities at zero value.

This is actually the madness that is infecting the market and when banks like Hypo Real Estate go down, when in fact they were perfectly sound, "shock" is a good a word as any.

COMMENT THREADNot just the euro

Some of the comments are interesting as well – the EU does not have a lot of friends amongst Mail readers.

COMMENT THREAD

skip to main |

skip to sidebar

Treason From Within

The site provides sourced, named articles, reported in the world wide press and the alternative media, presenting an overview of global events.

Weekly News Review, Recordings, Interviews & Conversations.

Over 25,000 current and archive articles in our Search facilities.

You will not find the totality of information on any other UK site.

Our goal is to provide live interviews, news alerts and phone-in facilities but we need your help to make this happen!

So, please recommend this site to as many people as possible, submit research material and make donations.

10.4.2009

The Royal Family...Enjoy

11.4.2009

Fire Fighter Rescue!

22.4.2009

SO WHOSE STUPID ...REALLY? REMEMBER...SOME OF YOU MINORITIES, VOTED FOR THIS MOB! I'D DESCRIBE THEM DIFFERENTLY..BUT DONT WANT TO GET SUED. Brownies Budget EXPLAINED ...till the monies run out then we pay. Do you think Brownie cares?

12.5.2009

Is there any one left in the UK, that will vote for prudence brownie?

24.5.2009

SURGEONS:

28.5.2009

Cassette Boy versus the Bloody Apprentice

27.7.09

CARNATION MILK

21.5.2009

The Pineal Gland..Stairway to Heaven???????

Search This Blog.80,290 ARTICLES TO DATE

Stat Counter

monthly visitors to site

2013

Unique Visitors- Unique

Page - Page Views

Google - Google Page Views

Visitors

..........Unique.......Page........Google

Dec01...0,018.......0,016.........0,090

Nov30...0,935.......0,764.......08,325

Dec01...0,018.......0,016.........0,090

Nov30...0,935.......0,764.......08,325

Oct31....1,125.......0,947.......08,237

Sep30....1,086.......1,341.......10,259

Aug31....2,706.......3,957.......21,451

Jul31......2,463...... 3,894.......23,431

Jun30.....2,358.......3,631.......21,003

May31....2,567.......4,087.......23,062

Apr30.....2,538.......4,149.......21,845

Mar31.....2,930.......4,000.......22,930

----------------------------

..........Page Loa038ds''Unique Visits..First Time Visits.. Returning Visits

Total.. 549,444.......408,358........... 351,667..........56,691

Avge ...68,676..........51,045..........43,958............7,086

Year ...Page Loads.. Unique Visits.. First Time Visits.. Returning Visits

2013....

2013.....31,070...........20,013..............15,543..........4,470

2012.....88,626...........59,633..............29,100........10,342..

2011....115,210..........71,692...............57,967........13,725..

2010..146,221...114,099..........98,575..15,524

2009..150,566...124,132.........111,349..12,783

2008....32,000.....27,000.........25,002..2,620..............

Current Events and Weekly Recordings, Interviews, Conversations

Aug08-2012

Committee of 300

Feb27

2011

Nov26

John Loeffler-Steel on Steel-Critical Thinking in an Age of Deceit..political power always follows a shift in monetary power.

Nov22

Tamar Yonah and Walid Shoebat Interview 3-Mid East Iran-Israel-Egypt-Turkey

Nov20

WHY ARE YOU ALL SO SILENT !!!!Tamar Yonah discusses The Palestinian Issue with Iraqi I.Q. Al Rassooli

KYLE BASS on BBC Hard Talk

Nov19

John Loeffler Steel on Steel-transforming Crisis into Transnational Technocracies-John Fonte Sovereignty or Submission:-Carl Teichrib explains Europe

Nov13

Tamar Yonah talks with

IQ.Rassooli-Arab Scholar=ref claim on Jerusalem a misconstruction at best

Nov12

John Loeffler Steel on Steel- Gun walking, the Middle East and Health Privacy

Nov08

Mosab Hassan Yousef

2. Deutscher Israelkongress - Mosab Hassan Yousef

Walid Shoebat with Tamar Yonah-2 UP DATE Iran-Israel-USA-Middle East

A REMINDER

Albert Burgess-A CASE FOR TREASON---PROPAGANDA THAT LED TO COMMON MARKET----HOW MI6 PUSHED BRITAIN TO JOIN EUROPE

Nov06

James Delingpole with guests Brit bloggers Christopher Booker and Richard North.EU-EURO IS A FOUR LETTER WORD!

Nov05

John Loeffler Steel on Steel- The Vatican’s Middle East Flip Flop..Israel.Jews-Christians-Islam-Europe...Politicos 'double standards.

Nov 04

Walid Shoebat with Tamar Yonah..

Committee of 300

There is a download issue on current recording with our ftp host

server ..access to previous recordings seem to be alright.

we are awaiting resolution. APOLOGIES

"The world is a dangerous place to live not because of the people who are evil, but because of the people who don't do anything about it." -

Albert Einstein

TO LATE ! NOW BLOOD SWEAT AND TEARS?

Feb27

Global Government Confirmed!

Nigel Farage Returns to Alex Jones TV: Mr. Farage Puts Van Rompuy in His Place.GLOBAL WARMING-

CLIMATE CHANGE-

ALL SCAMS -FOLLOW THE MONEY - TAX IS THE METHOD

SERFDOM THE OBJECTIVE-

UP-DATED 30-04-10- More exposee on whose behind -Crime inc.USA style-Glenn Beck exposes Chicago Climate Exchange..its ownership ..its SCAM.The scam of Global Warming and whats really going on!

Jul31

John Loeffler-Steel on Steel- Agenda 21 Plus 20 with Henry Lamb (www.freedom21.org), Carl Teichrib (www.forcingchange.org),

Pat Wood (www.augustreview.com) and Mitch Wright join us for a spirited conversation.

CAROLINE GLICK-Israel and Iran after the Bomb

Pat Wood (www.augustreview.com) and Mitch Wright join us for a spirited conversation.

CAROLINE GLICK-Israel and Iran after the Bomb

Apr30

John Loeffler Steel on Steel; Joint Survival in the Middle East: Israel and Christianity; Christians in Islamic countries tied to Israel survival.

Porter Stansberry: My worst predictions are now coming true

"End of America" predictions, including his take on the dollar's recent plunge, the huge rallies in gold and silver, and what will happen next... when the Federal Reserve begins a third round of quantitative easing. He also explains what Americans must do now to protect themselves.

John Loeffler Steel on Steel; Joint Survival in the Middle East: Israel and Christianity; Christians in Islamic countries tied to Israel survival.

Porter Stansberry: My worst predictions are now coming true

"End of America" predictions, including his take on the dollar's recent plunge, the huge rallies in gold and silver, and what will happen next... when the Federal Reserve begins a third round of quantitative easing. He also explains what Americans must do now to protect themselves.

2011

November

Nov26

John Loeffler-Steel on Steel-Critical Thinking in an Age of Deceit..political power always follows a shift in monetary power.

Nov22

Tamar Yonah and Walid Shoebat Interview 3-Mid East Iran-Israel-Egypt-Turkey

Nov20

WHY ARE YOU ALL SO SILENT !!!!Tamar Yonah discusses The Palestinian Issue with Iraqi I.Q. Al Rassooli

KYLE BASS on BBC Hard Talk

Nov19

John Loeffler Steel on Steel-transforming Crisis into Transnational Technocracies-John Fonte Sovereignty or Submission:-Carl Teichrib explains Europe

Nov13

Tamar Yonah talks with

IQ.Rassooli-Arab Scholar=ref claim on Jerusalem a misconstruction at best

Nov12

John Loeffler Steel on Steel- Gun walking, the Middle East and Health Privacy

Nov08

Mosab Hassan Yousef

2. Deutscher Israelkongress - Mosab Hassan Yousef

Walid Shoebat with Tamar Yonah-2 UP DATE Iran-Israel-USA-Middle East

A REMINDER

Albert Burgess-A CASE FOR TREASON---PROPAGANDA THAT LED TO COMMON MARKET----HOW MI6 PUSHED BRITAIN TO JOIN EUROPE

Nov06

James Delingpole with guests Brit bloggers Christopher Booker and Richard North.EU-EURO IS A FOUR LETTER WORD!

Nov05

John Loeffler Steel on Steel- The Vatican’s Middle East Flip Flop..Israel.Jews-Christians-Islam-Europe...Politicos 'double standards.

Nov 04

Walid Shoebat with Tamar Yonah..

Egypt, Turkey, Iran, Israel.

Connecting the Dots...E.U RULES, REGULATIONS, DIRECTIVES and Comments.

WITHDRAWAL FROM LISBON TREATY!!!

TO LATE! NOW BLOOD SWEAT AND TEARS?

Yet again, the truther MEP, Nigel Farage, speaks some hard truths at the EU. He warns of the collapse of the Euro. He also points out the Communist backgrounds of the main players in the so called democratic union.

December

EU -Current Regulations, Directives, Laws & comments.

Global Government Confirmed!

Nigel Farage Returns to Alex Jones TV: Mr. Farage Puts Van Rompuy in His Place.Yet again, the truther MEP, Nigel Farage, speaks some hard truths at the EU. He warns of the collapse of the Euro. He also points out the Communist backgrounds of the main players in the so called democratic union.

Apr01

THE ERA OF MADNESS. Occupied territory of the UK.THE PEOPLE WILL BE AT WAR WITH THE GOVERNMENT.

|

Marcus Tullius Cicero

we want our referendum

Oppression of Christians World Wide.

2010

November

Antisemitism-Incidences World Wide.

In memory of the six million Jews, 20 million Russians, 10 million Christians and 1,900 Catholic priests who were murdered, massacred, raped, burned, starved and humiliated with the German and Russian peoples looking the other way!

'American training will be utilized to kill Jews' Muslim gunmen issue dire warning in sit-down interview with WND By Aaron Klein

FROM WND'S JERUSALEM BUREAU - WorldNetDaily Exclusive

'American training will be utilized to kill Jews' Muslim gunmen issue dire warning in sit-down interview with WND By Aaron Klein

FROM WND'S JERUSALEM BUREAU - WorldNetDaily Exclusive

swine flu alerts and updates

Announcement on the future of Britannia Radio

To all visitors of Britannia Radio and the Britannia Radio Blog Spot.

If you would like to have Britannia Radio continue and expand, please start to make your contributions as soon as possible via the ‘Make a Donation’ tab ,above, contact us to offer your help at info@britanniaradio.co.uk and recommend the site to increase our visitors.

To date we have approx £290.00 donated.

Thank you,

Harold Hoffman

About Britannia Radio

Welcome to our site. We bring you an alternative early warning service, joining the dots of Geo Politics - alerting you to what is in store for us all if we do not wake up and unite.

The site provides sourced, named articles, reported in the world wide press and the alternative media, presenting an overview of global events.

We bring you:

Weekly News Review, Recordings, Interviews & Conversations.

We have sections for:

Videos to Watch from the UK and across the world.

Also available:

Access to Links and Daily Newspapers.

Over 25,000 current and archive articles in our Search facilities.

We have added new pages which include:

Ecological Matters, Chinese Blog, Religion, Health Watch, Larf out Loud and the seperate britanniaradio.blogspot.com

You will not find the totality of information on any other UK site.

We combine articles of local, regional and global significance; offering an independent, objective view explaining the current events in the UK, EU, USA, NAU, MID EAST, ISRAEL, CHINA & ASIA; thus providing indisputable evidence from which to draw your own conclusions.

The fact that we are ahead of the pack does not make us 'wackos'!

NB. The site is not aligned to any political party.

We are in the process of setting up a live internet radio station to come on line, when your demand -demands it.

Our goal is to provide live interviews, news alerts and phone-in facilities but we need your help to make this happen!

To go live, we must attract 4000-5000 visitors per day.

So, please recommend this site to as many people as possible, submit research material and make donations.

Make it grow and make a difference!

Contact us by email at info@britanniaradio.co.uk

Archive

Links

- Asia Times

- Atlas Shrugs

- BBC

- Blog Activ. EU

- britanniaradio

- China Confidential

- China Post

- Daily Express

- Daily Mail

- E U R Democracy

- EU Referendum.

- Evening Standard

- Financial Times

- grumpyoldsod

- Guardian

- I.Q. al Rassooli

- Independant

- International Herald Tribune

- Islamic Republic News Agency

- Isra Pundit

- Jerusalem Post

- Los Angeles Times

- Melanie Phillips

- New York Times

- Professor Gil White

- Schuman.

- Sydney Morning Herald

- Telegraph

- The Sun

- Times

- U.K.I.P

- Washington Post

- Washington Times

- World Net Daily

- Xinhaunet China

Videos to view

Current Health Watch

Current Ecological Matters

Current Larf Out Loud

10.4.2009

The Royal Family...Enjoy

11.4.2009

Fire Fighter Rescue!

22.4.2009

SO WHOSE STUPID ...REALLY? REMEMBER...SOME OF YOU MINORITIES, VOTED FOR THIS MOB! I'D DESCRIBE THEM DIFFERENTLY..BUT DONT WANT TO GET SUED. Brownies Budget EXPLAINED ...till the monies run out then we pay. Do you think Brownie cares?

12.5.2009

Is there any one left in the UK, that will vote for prudence brownie?

24.5.2009

SURGEONS:

28.5.2009

Cassette Boy versus the Bloody Apprentice

27.7.09

CARNATION MILK

Current Religion

No comments are accepted on any of these recordings.

No comments are accepted on any of these recordings.

Harold Hoffman presents alternative understandings from his personal archives - recorded 35 years ago.

====================

20.8.2008

Preservation and Humility, what they mean, for real.

click to listen circa 22.00 Sunday 20.8.2008

====================

27.7.2008

The Line of Life. "I WANT... I AM... WHERE AM I?"

This discussion will loose most of you but don't worry, love the struggle!

The natural laws and some further world history.

====================

22.7.2008

Extra: Explains the soul and spirit.

An updating of the Human Condition.

click to listen

This is different... not heard before in open lectures. Challenging and you may think confrontational - but Harold has made the decision to release it anyway! Accept the information or reject it... that's your choice!

====================

No comments are accepted on any these recordings.

Harold Hoffman presents alternative understandings of Religion in three 90 minute lectures. Covering briefly, but not in our chronological order, so be patient - some challenging goodies are contained herein.

PART 1

PART 2 18.7.2008

click to listen

PART 3 18.7.2008

click to listen

These lectures are from Harold's personal archives - dating back 35 years ago.

Covering 'World History' from pre sands Egypt to current times and 'Esoteric Understandings'. History, Esoteric and Occult keys, the different types of religions, from whence they came and what this portends for the future - including how it all fits into the current times, of economics, geo-politics, law, judiciary, religious practices, moral philosophies, ceremony, magic and rituals; all in brief.

Before listening to these recordings it may be useful to have also listened to film director, Chris Everard, in conversation with Harold Hoffman.

The Pig Barn Meeting: Sheer delight, 3 hours of pure esoteric and occult delight. For those that have the Ears to SEE!

21.5.2009

The Pineal Gland..Stairway to Heaven???????

Conversations to remember

Ashley Mote: Independant Member of European Parliament

Weekly Letter from Brussels.

Starting in next few days:

Letter from the Asylum

ashley mote

......................................

WE ARE PLEASED TO ANNOUNCE THE FIRST OF MANY INTERVIEWS WITH ASHLEY MOTE.

website http://www.ashleymote.co.uk/

Britain is committing collective suicide”

Sensational new pamphlet J’Accuse…!

calls on British “to re-install own standards”

Most of the elderly in Britain are indigenous. Most of the young are the children of migrants.

The British nation and its way of life are in serious danger of disappearing within one lifetime, certainly within two.

“We are committing collective suicide.”

That is the conclusion of a new pamphlet J’Accuse…! by Ashley Mote MEP, vice-president of the Alliance of Independent Democrats in Europe.

'J’Accuse!' accuses the European Union and the British government of the “deliberate destruction of British identity”.

The pamphlet points the finger at uncontrolled immigration, the failure of the British to produce enough children to sustain their own future, the utterly inadequate education of tens of thousands of young people, and the exploitation of so-called ‘terrorism’ to impose a regime of oppression.

Together these factors have eroded fundamental British values. Britain is becoming a third-world country – a western version of a banana republic.

“Much of this change has been imported. It is our fault. We have allowed it to happen and we are now allowing other ideas and ways of life to replace our own.”

'J’Accuse!' goes on…“The whole point about the British way of life is our absolute right to enjoy our country and freedoms in peace. They are not the product of the law. Instead, the law and our government are there to protect that right and those freedoms – not destroy them.

“Yet it is our own government that is today the greatest single source of terrorism. Theirs is the terrorism of state control.”

The number of criminal offences on the statute book has doubled since 1997 – one more for every day Labour has been in power. Britain has become a self-imposed police state.

'J’Accuse!' concludes : “Our British way of life is at terrible risk. We British need to go back to our roots, and re-install our own standards.”

Copies of 'J’Accuse!' are available via the website http://www.ashleymote.co.uk/ or by writing to PO Box 216, Alton, Hants, GU34 4WY.

---------------------------------

MEP, vice-president of the Alliance of Independent Democrats in Europe.

'J’Accuse!' accuses the European Union and the British government of the “deliberate destruction of British identity”.

Harold Hoffman interviews Ashley Mote M.E.P

They discuss: Europe... the UK.. and what the future holds for the sceptred isle... this jewel this "new jerusalem"?

click to listen

Access full details of Ashley Mote site a:

http://www.ashleymote.co.uk/

See below for his home page.

Journalist turned businessman turned author. Now a regular columnist, broadcaster and political campaigner. Special interest in British constitutional history.

In 1972 he started his own international marketing business, helping major industrial companies to increase their export business. At one time the company had offices in Houston and Atlanta, USA, Geneva and London. The Tory government's foolhardy attempt to shadow the Exchange Rate Mechanism (ERM) in the late 1980s and early 1990s ultimately forced interest rates to 15% and destroyed Ashley Mote's business, along with over 100,000 others.

Having had such bitter first-hand experience of the damage the ERM could do, he started researching the European Union. This led to his book Vigilance - A Defence of British Liberty. Vigilance is one of the fastest-selling books about the EU ever published. His second political book, OverCrowded Britain is about the UK's immigration crisis, and was published in 2003.

In 2000, Ashley drafted a Petition to Her Majesty under Article 61 of Magna Carta, which was later signed by 28 peers and taken to Buckingham Palace by the Duke of Rutland and others. The petition asked Her Majesty not to grant the Royal Assent to the Bill to ratify the EU's Treaty of Nice - an appeal which reports suggest came close to success.

A founder member of the SANITY group (Subjects Against the Nice Treaty), Ashley worked closely with Trevor Colman to produce three videos about the EU. The launch of Shockwaves resulted in sales of over 1000 a day. Since then he has written and directed two others - Better Off Out and Who Governs Britain?

Briefly active in the Liberal Party of Joe Grimond and Jeremy Thorpe, Ashley left when the party was taken over by left-wingers. He joined the UK Independence Party just before the 2001 general election as the only political home for people wanting Britain to leave the EU altogether. At the 2004 European parliamentary elections he won the second seat for UKIP in the south-east of England.

He now sits as the UK's only independent member of the European Parliament, free to fight for the early withdrawal of the UK from the European Union and the restoration of government of the British by the British for the British.

Married with two adult children. Ashley Mote is the author of several other books, including The Glory Days of Cricket, which won the Cricket Society Literary Award in 1997.

He is a member of the Hambledon Club and a Freeman of the City of London. His other interests include music, the theatre, good company and rugby.

---------------------------------

Gerard Batten UKIP MEP

Interview and possible weekly fortnight

Review from Brussels

Interview with Gerard Batten (U.K.I.P- M E P member of the european parliament) Click to Listen

his website, Gerard Batten

24.7.2007

---------------------------------

Experts in their Fields

Dr Richard North

weekly/fortnightly review on EU - THE EU SCEPTIC MOVEMENT AND EXIT STARATEGY FOR UK.

E U Referendum

Dr Richard North explains the The Reform Treaty and Why the people MUST have a vote! with Harold Hoffman

Click to Listen

27.7.2007 (7993)

--------------------------------

Prof Dennis Cuddy

10/27/2007

Modeling the Modern Middle East

LISTEN

PLEASE NOTE: ACCESS OUR THREE INTERVIEWS WITH PROF DENNIS CUDDY IN 'INTERVIEWS' AND ALSO IN 'LISTEN AGAIN'.

http://britanniaradio.co.uk/?q=node/2

The U.S. waved its light saber at Iran again this week, amid will- they or won't-they speculation about attacking that country, Russian President Putin's admonitions notwithstanding.

The world didn't arrive at today's Middle East in a vacuum. It's largely a product of century-old streams of globalist political thought, coupled with interventions by western counties such as France, Great Britain and the United States, topped off with Shiite Islamic expectations for the re-emergence of the Twelfth Imam. Dr. Dennis Cuddy, Ph.D, author of "The Globalists," is our sole guest for today's perspective-oriented program.27.10.2007

Prof Dennis L Cuddy fortnightly letter from the East Coast

via News with Views

Click to Listen 28.7.2007 (8057)

Dr Dennis Cuddy-A brief dissertation on whats really happening-The Revelations of the WORLD GOVERNMENT-BACKED BY HIS DOCUMENTATION-A MUST LISTEN-A WARNING TO WAKE UP-NOW !!!

THE EU-THE USA-THE MIDDLE EAST-ISRAEL-PAKISTAN-WW2-NAZISM-MONNETT-FABIANS-DIALECTS AND DELPHIC TECHNIQUES- A NEW RELIGION-GLOBALISTS-SOLANA-A WORLD SOCIALIST GOVT IN THE MAKING NOW!!!!!

IF YOU HAVE QUESTIONS WE SHALL BE HAPPY TO TAKE THEM ON OUR NEXT INTERVIEW

2ND INTERVIEW WITH DR DENNIS CUDDY

Click to Listen

Prof Dennis Cuddy with Harold Hoffman

An interview harold hoffman-world view and global implications

16.1.2007

-------------------------------

Prof Eugene Narrett a series of commencing beginning August

weekly 1 hour interviews on:-

Israel End Times

Israel End Times

Reminder of First Lecture by Prof Eugene Narrett

Click to Listen

2.8.2007 (8179)

To include:

Broad strokes. With illustrative details and examples of the situation in Israel and how it clarifies the drive toward a world state. Then in the subsequent shows, the topics on the list below:

Machiavelli and the Counter-Revolution of Paganism, 1500-1815

Western fragmentation, progress and regression, 1500-1900

Sympathy for the Devil: Romanticism and 'Darwin' 1790-1930

British Hysterics: Gothicism, Feminism and the New Empire

Working for the Three Bloc World: Betrayal, Eugenics, and Control

There's no Success like Failure... 1920 - 1966, Wars, cults and Vietnam

The pivotal year of the endtimes: 1967 and the Great Betrayal, Eras in Conflict

Land for Peace, the borderless world and War Eternal

--------------------

Prof. Eugene Narrett lecture-part 2

Machiavelli-and paganism-1500-1815

Click to Listen 8.8.2007 (8353)Link

his current book World War threeBooks by Dr. Narrett

3rd Lecture Machiavelli-Shakespeare

Click to Listen

4th Lecture Shakespeare

Click to Listen

Part 5 William Blake- click to listen

Part 6 Symapthy with the Devil

Prof Narrett part 6 shelley-hegel-marx-Dialectic-new theology in the west-a new social order-auguste comte-darwin-galton-huxley-conflict to religious thought-Romanticism-ROMAN TICISM

click to listen

Prof Eugene Narrett lecture 7-Mary Shelley and Frankenstein -click to listen

unausa.org-COMMON PURPOSE-social physchological social control-prohibition-sympathy-despair and horror-Illuminati in Engelstadt & Percy Shelley & Rosicruscianism

Prof Eugene Narrett-leture 8 Shelley-Frankenstein Dialectics-intellectualism gone mad click to listen

Prof Eugene Narrett in conversation with Harold Hoffman

leture 9 Frankenstein or the Modern Prometheus-the monsters education and the authors blind spot: the failure of romantic teaching

click to listen

apologies for bad background hiss

Professor Eugene Narrett in conversation with Harold Hoffman lecture 10 Gothicism Terror Awe Majik or Madness into the Culture of the West

click to listen

NOTHING NEW ITS OVER 5000 PLUS YEARS-EUGENICS-EUGENICS-EUGENICS-FROM CORRUPTION -DECEIT THROUGH ROMAN-TICISM-GOTHIC GLOBAL TERROR TO HUMAN ELIMINATION

PROF EUGENE NARRETT IN CLASS 11 WITH HAROLD HOFFMAN

CLICK TO LISTEN

Prof Eugene Narrett and Harold Hoffman discuss the span of history involving the EUGENICS MOVEMEMNT-FROM 1850's to the 1950's lecture 12

The deeper understandings of how this PROCESS AND PHILOSOPHY applies to destruction of Nation States and the furthering of the Global Agenda with such notaries as Machiavelli-Malthaus-Darwin-Galton-Huxleys's-Carnigie-Rockefeller-Sanger-Blavatsky-H G Wells-

click to listen

PROF EUGENE NARRETT AND HAROLD HOFFMAN DISCUSS LECTURE 13-THE EUGENICS PROCESS AND THE IMPORTANCE OF 1967 LECT 13 -WHEN ALL WAS POSSIBLE BUT FAILURE HAPPENED-VERY IN DEPTH OF HISTRY TO ALMOST CURRENT TIMES SETTING THE CURRENT SCENE

click to listen

Professor Eugene Narrett and Harold Hoffman discuss 1967 Turning Point in the Mid East-Israel

lecture14 GLOBALISATION-IN SPORT ACROSS RUSSIA-EUROPE AND N.AMERICA -DESTRUCTION OF HISTORY FORGETTING NOT REMEMBRANCE-ATTEMPT TO DESTROY RELIGION FOR A NEW RELIGION FRAGMENTATION-FEDERATION-INTERNATIONALIZE-IMMIGRATION AQUARIAN AGE FEMINISM SWINGING 60's BIRTH CONTROL FAMILY UNIT DESTRUCTION-MOVING TO AN AGE OF HI TECH FEUDALISM-ALICE BAILEY

click to listen

---------

CLICK TO LISTEN

Prof Eugene Narrett with Harold Hoffman ANNAPOLIS -ISRAEL-THE END TIMES -VITAL TO LISTEN

Israel as the control group for human kind and a template for whats already done in Europe and being done in USA-FROM 1967 TO 1973 -2007-The True state of Israel- Israeli Politics-Whats happening now The Future Problems !!!!!

Prof Eugene Narrett with Harold Hoffman discuss Annapolis-N Intelligence Iran Holocaust

click to listen

18.12.2007 16

Prof Eugene Narret in converstaion with Harold Hoffman-Israel's Destruction-Global Security State-what it all means-part 7

click to listen

Professor Narrett analyzes the dark side of the War on Terror and exposes its true and startling target. You will read the news with new and opened eyes after examining this study. With his characteristic breadth of relevant sources, he examines Western culture from ancient works to post-Modernism.

=============================

The Policy to Destroy Israel

and timely for Annapolis)with the shifting comments on

geopolitics and religion

click to listen

Please note our 10 plus 4 more

interviews to come on britanniaradio

Interviews

In this show, Dr. Eugene Narrett describes the interlocking strands between

British policy from 1920s through 1940s (and timely for Annapolis)

with the shifting comments on

geopolitics and religion of Aquarian guru Alice Bailey.

These facts give a new meaning to "land for peace" and

"internationalizing Jerusalem".

This show exposes the diabolical plans the British

and the wider International Community have,

planned for Israel.

--------------------

HIR

Prof Francisco Gil White

History of the 20th Century

14 hourly lecturesd

(Nazi Ideaology and infiltration into terrorist movements

How it effects the Mid East and Israel perhaps future prophetic interpretations?

History of the 20th Century

14 chapters-14 interviews(listed as per his book chapters)

Click to Listen

to his site HIR

part1-as promised

Dissertation by Prof Francisco Gil White

His Background

The Importance of History

The Creation of the Eugenics Movement

Oh -Its those Jews Again

Dr Francisco Gil White-part 2 History of the 20th Century- The Name -Palestine-and Hadjamini al Husseini-in converstaion with Harold Hoffman

Click to Listen

30.7.2007 (8113)

Prof Gil White(-chapter 4-) our part 3- The Rise of the Eugenics Movement in Germany-History-Aristocracy-and the rise of Hitler-the role of the USA/UK ELITE-

Click to Listen

The role of the Vatican -pope pius 12th -chapter 5 part our part 4-Click to Listen

--------------------

Who is Robert Gaylon Ross, Sr.?

First Interview with Gaylon Ross Snr.

CLICK TO LISTEN

PLEASE NOTE: TELEPHONE CONNECTION TO USA NOT GOOD - SO YOU WILL HAVE TO INCREASE VOLUME WHEN GAYLON IS SPEAKING.

http://www.4rie.com/

Born in Big Lake, Texas, he holds a BS degree in Industrial Engineering from Texas A & M University. While active in engineering, he was a licensed Professional Engineer in the State of Texas, and a National Certified Manufacturing Engineer. After graduation, he accepted a commission as a 2nd Lieutenant (later promoted to 1st Lt.) in the Army Security Agency (ASA), a branch of the National Security Agency (NSA), which is a big brother to the Central Intelligence Agency (CIA). Military training was in the field of cryptoanalysis (the breaking of codes), and served as a Company Commander with an Intelligence Unit on the Demilitarized Zone (DMZ) in the Chorwan valley of South Korea, from 1956 to 1957 (after the fighting had ceased).

Upon leaving active duty, began his professional career in the petroleum industry. Served as an Industrial Engineer for ten years until being promoted into management, and was a manufacturing Plant Manager for over ten years.The past seventeen years he served as an International Management Consultant, working in the US, Japan, Mexico, Canada, England, and Iran.

After completing the manuscript to the first book, Who's Who of the Elite, he contacted a number of publishers to ascertain their interest in this material. They all declined because of the subject matter, so he formed his own publishing company, RIE, and published this first of fourteen books in progress. The author has devoted the rest of his life to exposing the real truth about those evil ones in this world who would like to make us all their slaves

27.1.2008

===

March 23, 2008

Back to the future

By Ted Belman Israpundit, for regular update of news from Toronto, London and Israel.

We discuss Obama Barak and his background. Real revelations! The battle with the Clintons and McCain's position. Finally, Ted Belman's view of Israel's state. Optimistic.

========

Dr Sean Gabb director of Libertarian Alliance monthly review of one to two topical news items and their relevance to current issues and the Libertarian Alliance philosophy Libertarian Alliance

Interview with Dr Sean Gabb of the Libertarian Alliance by Harold Hoffman Click to Listen We are pleased to announce the discussion with Dr Sean Gabb-

--------------------------------

John Galt on a fortnightly basis and his views on the current state of Nations and the lack off a Spiritual -Religious Dimension in the West.

The Cassandra File click to listen Be a fly on the wall and listen to John Galt and Cassandra and myself discuss: The failure of the UK and its population.

====================

1.7.2008

Harold Hoffman interviewed by Tamar Yonah, Israel National Radio. PARADIGM SHIFT: the Financial Tsunami WE ARE IN NOW... Tuesday morning interview on site click to listen

Harold Hoffman interviewed by Tamar Yonah, Israel National Radio. PARADIGM SHIFT: the Financial Tsunami WE ARE IN NOW... Tuesday morning interview on site click to listen

THE PARADIGM SHIFT WE ARE EXPERIENCING.

=========

Chris Everard. Controversial? Yes Definitely. Thought Provoking? Undoubtedly!

Four weekly interviews

1a: Secret Societies; Illuminati.

click to listen

1b: Spirit Worlds; Illuminati.

click to listen

2: Royalty,

EU,

Space Programmes.

Very Revealing!

click to listen

3:Magic

click to listen

www.enigmatv.com

Filmography -

http://www.illuminatiDVD.com/

http://www.antichristDVD.com/

http://www.SecretSpaceDVD.com/

http://www.SpiritWorldDVD.com/

http://www.LadyDieDVD.com/

He is Britain’s most successful documentary film-maker. He is the only British director making feature-length documentaries for cinema audiences and the only British director to have late show slots every weekend at cinemas in Los Angeles, New York, Paris and Rome simultaneously. His is called the ‘Enfant Terrible!’ (which means the terrible child) of British Cinema by Paris Match magazine.

In 2007, he made no less than 4 x 2 hour feature-length documentaries, which were all subsequently released on DVD, each with 2 hour bonus discs. That means in 2007 he almost single-handedly matched the entire cinema output of the combined British Film Industry. Since 2004, he has made no less than 7 feature-length documentaries which have all been on independent cinema release and then sold to DVD worldwide.

===========

Previous interviews on site under Listen Again and Listen Now.

Nigel Farage with Adrian Lithgow.

Nigel Farage leader of UKIP

28.10.2006

Daniel Hannan with Martin Jay.

Interview on the EU and its various implications for the UK - Daniel Hannan noted Journalist and MEP FOR S.E. ENGLAND.

Click to Listen

Tamar Yonah with Harold Hoffman.

Harold Hoffman with Tamar Yonah on aspects of the EU.

24.10.2006

John Loeffler: Steel on Steel with Harold Hoffman.

Part 2 of 2 on the EU.

18.11.2006

Part 1 of 2 on the EU.

14.11.2006