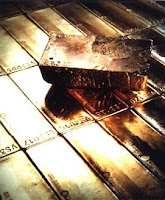

Gold Rising on Easing Fears of Global Recession

Breaking gold news....

Reuters reports gold rose about 2 percent on Monday (Tokyo time) on easing fears of a global recession after China's announcement of a huge spending plan.

A fall in the dollar against the euro after last week's weak U.S. jobs data was also supportive, analysts say.

*Spot gold stood at $750.35 an ounce as of 0033 GMT, up from a notional close in New York of $734.80 on Friday.

*A recovery in oil prices bolstered the yellow metal. U.S. crude oil futures rallied over $3 to above $64 a barrel as China's massive $600 billion stimulus package helped fuel optimism about the global economy.

*COMEX gold futures rallied in Asia after rising $2 in New York on Friday. The most active December contract GCZ8 was trading at $751.8 per ounce, up $17.6 or 2.4 percent from the New York settlement on Friday.

Writing in Forbes, Tom Gentile explains why it's a good time to be a gold bug:

*Drop in the Dollar - As the US continues to drop interest rates, it makes commodities like Gold more valuable. Yes, Oil could be included as well, but Oil has been closely tied to the stock market in terms of production, while Gold is not. As our Dollar diminishes in value, it will likely prop up Gold prices. Right now, the price of Gold in US dollar terms after inflation is around $2000 an ounce.

*Recession or Depression - Right now the total debt on the US economy is in the trillions and keeps climbing. As long as this continues, and there's almost certainty that it will, this will likely push Gold higher, as it did back in the 1930s. That's the last time we had huge debts on our country.

*Supply and Demand - according to many Gold producers, the amount of Gold that is mined from the ground has actually fallen by 5-10% this decade. If this trend continues, Gold should rise on its own despite the problems outlined above. As far as demand is concerned, India and China are the world's largest consumers of Gold. Unlike oil, which is used for production, Gold is seen by these countries as a form of savings, in both good times and bad.

*Correlation to the Stock Market - Gold in the long term is a great hedge against paper assets. Look at the last few decades, as the 1970s were great for gold. The 1980s were great for stocks. Now we see the trend for stocks as down as the trend for Gold up again.

UPDATE: Bloomberg reports:

Crude oil and gold rose for a second day after China announced a 4 trillion-yuan ($586 billion) stimulus package that may spur economic growth and demand for fuels.

China, the world's second-largest oil consumer, yesterday said it will spend the money through 2010 on housing and infrastructure, boosting demand for commodities including iron ore, crude oil and copper, which also gained. Saudi Aramco, the world's biggest state oil company, told South Korean and Japanese refiners it would cut December supplies.

"China's steps will stimulate investment and also spending by consumers, all of which drives oil demand,'' said Victor Shum, a senior principal at consultants Purvin & Gertz Inc. in Singapore. "The oil market has been waiting for a clear signal out of the Saudis that they'd cut and this is an indication that they are following through.''

Crude oil for December delivery gained as much as $3.26, or 5.3 percent, to $64.30 a barrel in after-hours electronic trading on the New York Mercantile Exchange. It was at $63.90 at 10:33 a.m. in Singapore.

Asian Investors Drawn to Canadian Companies Mining Gold in Mexico's Sierra Madre Mountains

Foreign Confidential....

Sophisticated Asian investors are hunting for gold on the Toronto Stock Exchange.

While their North American counterparts continue to sit on the sidelines, value-conscious Chinese, Japanese, and Korean investors are actively searching for listed Canadian gold mining companies that are selling at 52-week lows or below book value--with a clear preference for firms with the potential to significantly expand margins and earnings.

The Asian investors believe that there is opportunity in every great crisis; and the gold mining industry's dramatic downturn--a surprising result of the global financial meltdown--is no exception to the rule, in their view.

They see a physical gold shortage, which, coupled with recent actions by governments and central banks that are inherently inflationary, should lead to higher gold (and silver) prices. Asian analysts and investors assert (a) that China, despite mounting economic slowdown concerns, still maintains near double-digit annual growth rates, and (b) that demand for precious metals as a store of value and base metals for the production of goods and infrastructure is likely to remain strong.

More Treasure in the Sierra Madre

All of which explains why Asian institutional and institutional-class individual investors are said to be specifically interested in Mexico, a country with a mining history that spans almost 500 years. Mexico is not only one of the world’s largest metal producers; it is a major mineral exploration area.

Mexico's vast mineral riches extend from Sonora to Oaxaca, principally in the rugged Sierra Madre mountains--the Mother Range--a region immortalized in B. Traven’s 1927 novel, The Treasure of the Sierra Madre and John Huston's classic, 1948 feature film adaptation of the book, which starred Humphrey Bogart (one of the first films ever to be shot on location).

Mexico's vast mineral riches extend from Sonora to Oaxaca, principally in the rugged Sierra Madre mountains--the Mother Range--a region immortalized in B. Traven’s 1927 novel, The Treasure of the Sierra Madre and John Huston's classic, 1948 feature film adaptation of the book, which starred Humphrey Bogart (one of the first films ever to be shot on location).The Sierra Madres are a magnet for miners, including several Canadian startups and juniors who have acquired and reopened existing mines and quickly generated cash flow for developmental drilling to expand reserves. Applying modern engineering, geological modeling, and drilling techniques, the Canadians have shown that the best place to find gold is at a gold mine.

Dual-listed Gammon Gold (TSX: GAM, NYSE: GRS) is a case study. In eight years, the company went from initial discovery to Mexico's largest gold producer. The company's once high-flying stock has been badly battered; but Gammon's Mexican focus and proven and potential gold reserves differentiate it from other mid-tier mining companies.

Interestingly, two former Gammon executives--Colin Sutherland, who, as CFO, was instrumental in growing the company's market capitalization from $300 million to more than $2 billion, and Bradley Langille, who co-founded the company with its chairman, Fred George--have joined forces to build a junior mining company, Nayarit Gold (TSXV: NYG). Sutherland is CEO of Nayarit Gold (named for the state of Nayarit, home of the company's concessions). Langille is the company's strategic adviser.

Nayarit Gold controls more than 102,000-hectares of mining concessions--collectively called the Orion Project--in the Sierra Madre Occidental, the range that extends from Arizona in the United States down into western Mexico (west of the Sierra MadreOriental). The Orion Project includes a series of old high-grade silver and gold mines, all of which lie in an east-west vein system.

The company believes the vein system may be an unrecognized silver-gold districtbonanza, similar to other silver-gold bonanza epithermal vein districts of western Mexico, such as the Tayoltita District. Such systems can extend for considerable distances and up to 1,000 meters in depth.

Bonanza is a key word. Though somewhat subjective, it is a term used to describe deposits from which large quantities of precious metals have been recovered from relatively small, high-grade ore bodies. Gold prospectors have sought and mined bonanzas throughout history.

Early results from Nayarit Gold's Phase I drilling program are pointing to bonanza potential; and Phase II drilling has begun, following a $10 million financing led by Bank of Montreal.

Saturday, November 08, 2008

Venezuela Offering Canadian Gold Deal to Russians

Foreign Confidential....

More gold mining news.

Brian Ellsworth reports Venezuela is about to offer a Russian company a big gold mining project:

Venezuela said it will offer a joint venture to Russian-owned miner Rusoro to operate the Las Cristinas and Brisas gold projects, currently under contract to two Canadian companies, Mining minister Rodolfo Sanz on Thursday.

He told a Russian delegation that a memorandum of understanding would soon be signed with Rusoro.

It appeared that Sanz intends to replace the Canadian companies who operate the projects that contain some of Latin America's largest gold deposits, with Rusoro, but he did not mention their names.

Click here to continue.

Will Gold Stocks Come Back?

Foreign Confidential....

Gold companies, like other miners, have felt the effects of the recent financial market turmoil, seeing their stock prices plummet.

Last month, the price of gold, traditionally a safe haven in times of economic uncertainty, fell below $700 per ounce for the first time in more than a year. It was selling for about $735 on Friday and the S&P gold stock index was at a 52-week low of 61.52, down from a high of 135.23 last January.

Shares of Barrick Gold Corp, Newmont Mining Corp and Goldcorp Inc are all selling at about half their price of nine months ago. Freeport McMoRan Copper & Gold Inc, at $26.04, is far off its 52-week high of $127.23 in May. Will the stocks rebound and are they a good bargain?

Jay Taylor, publisher of the industry newsletter, Gold, Energy & Tech Stocks: "With an increase in the price of gold, I expect an improvement going into the fourth quarter." "The higher leveraged they (companies) are to the gold price, the more the share price will bounce back.

"It's the larger-cap companies where institutional buying will go. The gold price should be moving up again if we get global growth again."

Robert Lutts, president and chief investment officer at Cabot Money Management, which oversees $400 million of client assets: "I think the (gold) equities are extraordinarily, reasonably priced today. And I think that's a reflection of the recent drop of $200 of gold bullion."

"It (the lower gold price) is weighing on equities like Barrick and Goldcorp, and those are priced at a very modest level. I think they are very inexpensive today." "I have always stated 5 to 10 percent of an investor's portfolio should be in gold, and we still believe that."

-Reuters

India and Qatar Signing Security, Defense Pacts

Foreign Confidential....

India and Qatar will sign two agreements on defence and security during Prime Minister Manmohan Singh’s visit to the Gulf nation beginning Sunday evening--the first by an Indian head of government.

Apart from the two pacts, the two sides will also discuss a number of other issues ranging from energy security to bilateral trade.

“The visit by the prime minister of India has been long overdue. Qatar’s Amir (Sheikh Hamad Bin Khalifa Al-Thani) visited India twice,” an Indian embassy official said from Doha.

“Qatar is the only country (in the Gulf) with which India has had long-term security co-operation. During the course of the visit of the prime minister, two key agreements will be signed--one on defence co-operation and another on security and law enforcement,” he said.

According to the Indian official, the defence agreement will also include the issue of maritime security. “The agreement on security and law enforcement will cover issues like common threat perceptions and sharing of data,” he said.

Upgrading Energy Deal

As for energy security, India will seek to significantly upgrade its current deal with gas-rich Qatar. Qatar has the world’s third largest gas reserves, comprising 15% of the world’s total.

Apart from defence and energy security, bilateral trade will also come up for discussion. India is Qatar’s third largest export partner after Japan and Singapore.

“Bilateral trade between India and Qatar now stands at $3.3 billion and is significantly tilted in favour of Qatar because much of it is accounted for by gas exports,” he said.

Qatar’s exports to India stand at $2.6 billion while India’s share is $700 million. India’s exports to Qatar mainly comprise consumer items, foodstuff and industrial equipment.

Increasing Exports

With consumers in that country becoming highly quality conscious, there is scope for significantly increasing Indian exports.

According to the official, delegation level talks will be held between the two sides soon after the prime minister’s arrival on Sunday evening. The next day, Manmohan Singh will have a meeting with Qatar’s amir. Petroleum minister Murli Deora, minister for overseas Indian affairs Vayalar Ravi and minister of state for foreign affairs E Ahamed will be accompanying Dr Singh.

National security adviser M K Narayanan and deputy chairman of Planning Commission Montek Singh Ahluwalia will also be part of the entourage.

Apart from his parleys with the Qatari leadership, Singh will also meet representatives of the large Indian community. Qatar is home to around 420,000 expatriate Indians. India has one of the oldest labour welfare agreements with Qatar dating back to 1975, an additional protocol to which was signed last year.