china confidential

Monday, December 15, 2008

OPEC Cutting Oil Output at Worst Time for US

Dateline USA....

Crude oil prices rose today, touching $50 in New York, in anticipation of further OPEC production cuts.

The cartel's move could be considered a form of financial warfare against the United States and other oil importing nations.

Depressed crude prices constitute a major form of relief for depressed economies, including the U.S., which is trying to prevent a recession from deepening into a full-blown remake of the Great Depression of the 1930s. Continued price hikes would threaten millions of unemployed, partially employed and hard-pressed working Americans with pauperization.

President-elect Obama owes it to the nation to ignore the rants and raves of elitist, environmental extremists and charlatans like former Vice President Al Gore and give serious consideration to establishing a national oil company. Limited by law to domestic production and exploration, it would develop resources that are profitable but perhaps not profitable enough for the multinationals and large independents, including onshore and offshore light and heavy crude oils and oil that can be lifted out of old fields using enhanced recovery methods (some of which are similar to heavy crude production methods). A national oil company could also develop and explore for domestic natural gas and extend the nation's natural gas infrastructure.

A U.S. national oil company would put legions of people to work, stimulate the economy, and do more for energy independence than all the alternative energy projects that could conceivably be built, although the government should also follow through on that front despite widespread agreement among serious energy experts (that excludes the windbag Gore) that the world will continue to run on oil and gas for the next two decades.

- Andre PachterUS Left Out of Left-Leaning Latin-Caribbean Summit

Foreign Confidential....

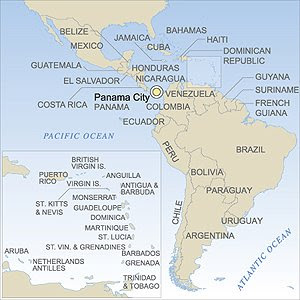

Joshua Goodman reports from Rio de Janeiro on an event that signifies Latin America's anti-American drift: Latin American and Caribbean leaders gathering in Brazil tomorrow will mark a historic occasion: a region-wide summit that excludes the United States.

Almost two centuries after President James Monroe declared Latin America a U.S. sphere of influence, it is breaking away. From socialist-leaning Venezuela to market-friendly Brazil, governments are expanding military, economic and diplomatic ties with potential U.S. adversaries such as China, Russia and Iran.

“Monroe certainly would be rolling over in his grave,” says Julia Sweig, director of the Latin America program at the Council of Foreign Relations in Washington and author of the 2006 book “Friendly Fire: Losing Friends and Making Enemies in the Anti-American Century.”

The U.S., she says, “is no longer the exclusive go-to power in the region, especially in South America, where U.S. economic ties are much less important.”

Since November, Russian warships have engaged in joint naval exercises with Venezuela, the first in the Caribbean since the Cold War; Chinese President Hu Jintao signed a free-trade agreement with Peru; and Brazil invited Iranian President Mahmoud Ahmadinejad for a state visit.

Click here to continue reading.Sunday, December 14, 2008

Mumbai Victims Reportedly Included Two US Spies

Two senior intelligence officers were reportedly among the eight Americans killed in the Mumbai terror attacks.

The two spies, a man and a woman, were in a meting at Taj hotel when it was raided by heavily armed terrorists of the Pakistan-based Lashkar- e-Taiba.

Ironically, they had come to Mumbai to analyze the threat of a possible, sea-borne terrorist attack.OPEC Desperate to Cut Output, Raise Prices

OPEC, the producer of 42 percent of the world’s oil, may make the biggest supply cut in a decade to halt the plunge in crude prices as demand drops for the first time since 1983.

The Organization of Petroleum Exporting Countries will probably lower output targets by at least 2 million barrels a day, or 7.3 percent, when its members meet Dec. 17, according to 18 of 33 analysts surveyed by Bloomberg. While Saudi Arabia’s King Abdullah said last month that his country needs oil priced at $75 a barrel to spur development, Goldman Sachs Group Inc. predicts crude may slide to $30 from $46.28 today.

Click here to continue reading.Macquarie Signs MOU with Hengtai Securities

Macquarie Group Ltd., Australia’s biggest investment bank, plans a venture with Hengtai Securities Co. to gain access to China’s $70 billion equity and bond underwriting market, two people familiar with the matter said.

The Sydney-based bank last week signed a memorandum of understanding with Hengtai to form a joint venture company, the people said, asking not to be identified because no announcement has been made. Macquarie would take a 33 percent stake in the venture, they said.

Macquarie is the third foreign investment bank to sign an agreement or win approval in the past six months for a venture in China, which has 103.6 million active securities accounts. The nation’s CSI 300 Index has advanced 19 percent since reaching a two-year low on Nov. 4, after the government cut borrowing costs and pledged an economic stimulus package.

Click here to continue.Gold Bullion and Equities Expected to Keep on Rising

Dateline USA....

Savvy U.S. investors are touting a new mantra: gold, cash, concrete.

Concrete stands for construction--i.e. immediate federal government spending on ready-to-go, approved and engineered infrastructure projects, such as road and bridge repairs, in order to stimulate an apparently rapidly worsening economy.

Cash is king: it can be used to snap up undervalued properties and companies at fire-sale prices.

And gold is ... gold. Considered "real money" by gold bugs and believers, the precious metal is in a class by itself. They contend it is bound to rise in price when inflation eventually returns as a result of too much money printing.

Also bound to rise, according to many investors: the share prices of well managed mining companies, including listed juniors with reserves-- gold in the ground--which are proven but presently valued at only zero to $30 an ounce.

Even at today's physical gold prices, those assets will prove to be extremely valuable, many experts assert. Should gold prices rise significantly, however the share prices will skyrocket.

Stock Prices Moving Up

Some stocks are already moving up. On Dec. 1, this reporter (who does not and did not then own a single share of any mining stock) suggested that investors who can afford the risk of investing in equities keep an eye on the following firms active in Mexico's mining-friendly Sierra Madre region, the stock market valuations (market capitalizations) of which have all since increased: Agnico-Eagle Mines, Ltd. (NYSE: AEM), Alamos Gold, Inc. (TSE:AGI)), Gammon Gold, Inc. (NYSE: GRS), Minefinders Corp. Ltd., (TSE: MFL), and Nayarit Gold Inc. (CVE: NYG).

Turning again to physical gold. Pham-Duy Nguyen says it "may rise for the second straight week on speculation the Federal Reserve will cut its benchmark bank-lending rate, weakening the dollar and boosting the appeal of the precious metal."

The Bloomberg correspondent reports:Twenty-one of 27 traders, investors and analysts surveyed from Mumbai to Chicago on Dec. 11 and Dec. 12 advised buying gold, which rose 9.1 percent last week to $820.50 an ounce in New York. Three said to sell, and three were neutral.

Last week’s gain was the biggest since Sept. 19. Gold reached a record $1,033.90 in March as Fed rate cuts sent the dollar to an all-time low against the euro in July.

Gold’s gains last week surprised most analysts surveyed on Dec. 4 and Dec. 5. The survey has forecast prices accurately in 142 of 241 weeks, or 59 percent of the time.

Click here to read how the U.S. central bank could soon send gold prices soaring.

Monday, 15 December 2008

Bloomberg reports:

Bloomberg's Cathy Chan reports:

Posted by

Britannia Radio

at

17:05

![]()