Obama's Gamble - The Ultimate And Final Bet By Obama’s Financial Handlers

by Matthias Chang |

Any responsible central banker would want to control a downturn, preferably by a gradual slide of the market as opposed to a sharp hard landing.

But events and data have revealed that these financial handlers are not responsible and are hard core gamblers in their very soul.

Their mindset is that of the ultimate gambler and nothing in this world will change their behaviour not even the thought that millions will starve and die and that national economies will be shattered. They are totally unconcerned as tbe devastating consequences of their actions. And anyone still having illusions about their altruistic aims will be disappointed.

The stock market and the derivative market is their ultimate casino. Fix this in your mind in the months to come. Then you will understand and agree with me and my conclusions in the next few paragraphs.

Global Financial Domination

The present global financial tsunami has given the 12 elite global gamblers and 2 maybe 3 central banks, the opportunity of a millennium to confiscate un-imaginable wealth and power and to reign supreme over the entire planet.

Since the massive injection of trillions into the major global banks by the FED, Bank of England and to a lesser degree the European Central Bank (ECB), many financial commentators and economists of all hues have been lamenting that the banks are not lending as per the aims of the “rescue package” but are instead hoarding the monies. Various reasons and excuses have been made to justify this massive hoarding, unheard in the history of banking.

I will now reveal the real and hidden reason for this hoarding.

It is this. Bernanke and Paulson have been directed by the controllers of the Shadow Money-Lenders that it is time to make the ultimate bet on the global casino – the playing of the $Trillion dollar chips.

This gambit is risky but they have been assured by the “financial models” created by economists, the Nobel Laureates such as Myron Scholes etc. that they will win hands down!

Should the bet misfire, be assured also that the world will enter the dark ages for years to come. But the 12 chosen elite gamblers have been primed and are ready for the ultimate gamble and they are not concerned about our welfare.

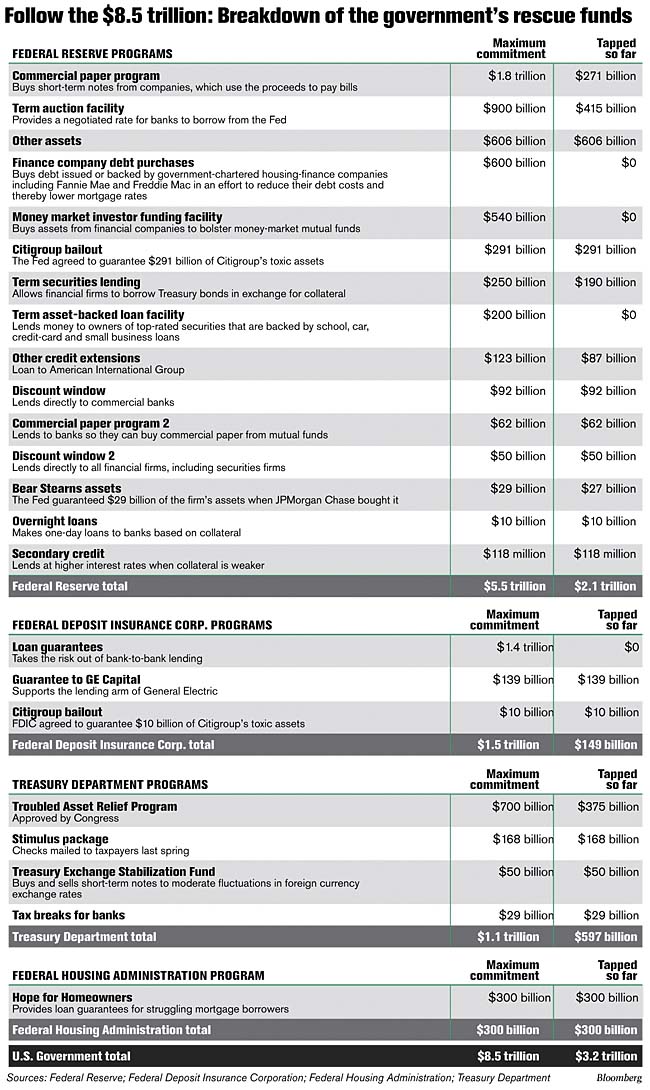

$8.5 Trillion no less is the pot of money that they can throw at the casino table, maybe more. This sum is over half the GDP of the US which has been estimated at US$13 Trillion. The global GDP is approximately US$60 Trillion.

There is no entity in the world that has the means and the control of the casino to match their betting power. So these elite gamblers are determined and more than confident that they will win and win big.

This is because their mindset is that of a gambler and that the world is a Casino.

They have completely in their calculations divorced their strategy from the dynamics of the real economy.

This will be their fatal mistake and their downfall. But my pleas will fall on deaf ears.

The Ultimate Bet

What is uncertain and unknown is the timing of this Trillion dollar bet. But my estimation is, just before the crowning of Obama on 20th January 2009.

The logic of these gamblers is that when they place the trillion dollar bet in the global casino, the markets will surge in one huge rally – the reversal of a tidal wave. When that happens, everything will be “sucked-up” and recede in the belly of the ocean (the gamblers financial pockets)

Those of us who have had the experience of the Tsunami will understand. The incoming Wave destroyed everything in its path. And when the force reversed, everything was sucked backed into the ocean, leaving the dead and damages on the beaches!

Therefore, I expect a huge rally soon.

The chosen elite global gamblers know that this is their one and only chance to total conquest and financial power. This is because should the Dow decline below the 7,000 mark and other stock indexes dive in tandem, no force will be able to trigger a reversal of the trend.

The hoarding of Trillions in the coffers of these chosen elite gamblers is the equivalent of giving extra fuel or ammunition to these financial terrorists to unleash their evil deed of devastation!

How high the rally, I cannot forecast. But I am confident that this gamble will fail. Had this bet being played in late 2007, there was an even chance of success. But it is too late now for this gambit.

The financial cancer has spread all over the body. Not even the immediate surgery and transplant of the organs will change the course.

Given the situation and the desperation of the Controllers of the Shadow Money-Lenders, this bet must be played. It is all or nothing. This is their mindset.

Just place yourself in their position, one with a warped mindset. You have $8.5 Trillion, maybe more. There is a chance for you to amass maybe US$100 Trillion or more on this one bet. If you fail, a slow but still a luxurious death awaits you. What would you do?

“To hell with the rest of the world, I will take my chances and even if I lose, I still have a couple of billions” will most probably be your frame of mind.

As I said earlier, they will fail. The Dow will surge, but will explode and dive with such ferocity that the world will suffer a massive heart attack from the shock of the collapse. THE DOW WILL SINK LIKE THE TITANIC!

If you are a gambler and want to take a chance and go in and buy then sell at the top, by all means do so, provided you have the inside intelligence possessed only by the chosen elites.

For the rest of us, start building bomb shelters!

You are all forewarned.

Stop these financial terrorists!

| |

Global Research, December 13, 2008 | |

FutureFastForward.com - 2008-12-12 | |

| |

Global Research Articles by Matthias Chang | |