"As 2009 opened, three weeks before Barack Obama took office, the Dow Jones Industrial Average closed at 9034 on January 2, its highest level since the autumn panic. Yesterday the Dow fell another 4.24% to 6763, for an overall decline of 25% in two months and to its lowest level since 1997. The dismaying message here is that President Obama's policies have become part of the economy's problem... The market has notably plunged since Mr. Obama introduced his budget last week, and that should be no surprise. The document was a declaration of hostility toward capitalists across the economy. Health-care stocks have dived on fears of new government mandates and price controls. Private lenders to students have been told they're no longer wanted. Anyone who uses carbon energy has been warned to expect a huge tax increase from cap and trade. And every risk-taker and investor now knows that another tax increase will slam the economy in 2011, unless Mr. Obama lets Speaker Nancy Pelosi impose one even earlier. ... The result has been a capital strike, and the return of the fear from last year that we could face a far deeper downturn. This is no way to nurture a wounded economy back to health." Like history will soon be saying, Dubya was the worst President imaginable. Except for the one who came after, that is. Labels: inflationTUESDAY, MARCH 03, 2009

Baling Out Of Money

With the Bank of England about to start Quantitative Easing (on some definitions, it has already started), the printing presses will soon be roaring. The money supply is already growing at nearly 20% pa so God knows how high it will go.

And inflation?

The official line is presented by those old troupers Rosy and Tina:

Rosy: we'll tighten policy again at precisely the right moment once the green shoots get going (aka R Scenario); and

Tina: even if we don't manage that - and let's be frank, the entire history of the world says we won't - we don't know what else to do, and inflation later is surely better than depression now (aka T Isnoalternative).

Here in the real world, anyone with savings needs to take evasive action pronto. As the legendary Buffett put it this week:“Economic medicine that was previously meted out by the cupful has recently been dispensed by the barrel. These once unthinkable dosages will almost certainly bring on unwelcome after-effects. Their precise nature is anyone's guess, though one likely consequence is an onslaught of inflation.”

So faced with an onslaught of debauchery at the hands of Rosy and Tina, who in their right mind wants to hold paper money?

Gold, that's what we need. And even those who'd previously thought we'd moved beyond such primitive necessities, are scrabbling to find ways of investing.

But what do you do exactly?

Sure, you can buy gold in any high street - you could pop down to H Samuel and buy some right now.

But ounce for ounce, you'd be paying through the nose - including VAT - and when you got it home you might find the gold had been made up into prawn sandwich earrings. Plus, you've then got to keep it safe - remembering that in post-Apocalypse Britain marauding gangs of gold thieves could gallop into town at any time. And then, when you finally come to use it in exchange for some bread to feed your starving family, you've somehow got to prove to the baker it's real gold rather than a decayed prawn sandwich.

How much easier it would be if you could buy the gold from somebody unimpeachable, who would not only vouch for the gold's authenticity, but also keep it safely locked up for you. In exchange, you could be given, say, a certificate of ownership, issued and signed by this unimpeachable somebody.

And the good news is that you can now do precisely that.

All over the place little independent operators are springing up to meet the demand for just this service. Two we've come across recently are GoldMoney andBullionVault (PLEASE NOTE: WE KNOW NOTHING ABOUT THESE COMPANIES OTHER THAN WHAT WE'VE READ ON THEIR WEBSITES, AND WE ARE CERTAINLY NOT ENDORSING EITHER).

Both use internet technology to offer punters the ability to buy and sell bullion quality gold (guaranteed 99.5% pure - no prawns) online, at more or less fair bullion market prices, with the gold being held in secure bullion market vaults so it's always immediately tradeable - an excellent store of value.

GoldMoney also offers what it calls a goldgram, which is a means of making payments in gold via an electronic transfer - a spendid medium of exchange.

Brilliant.

In fact, so brilliant you wonder why nobody thought of it before.

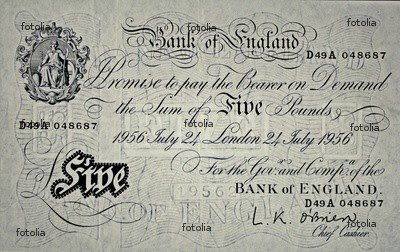

Although... now you come to mention it, the whole deal does ring a vague bell. Didn't there used to be some British bank that offered the same sort of facilities? Surely there did - a bank that would hold your bullion in its vaults and issue you with certificates of ownership? Yes, and if you went along with your certificate, they promised to pay the bearer on demand in gold.

Hmm.

It's many years since the Bank of England stopped tying its currency issuance to gold. On 20 September 1931 the last Great Depression forced us off the Gold Standard and we never went back.

And do you know how much prices have risen since then?

Go on - have a guess.

The answer is 50 times. 50 friggin' times. The I-no-longer-promise-to-pay-the-Bearer-on-demand Pound coin from March 2009 has the same buying power as fourpence ha'penny in 1931 (ie about 2 new pence). Or to put it the other way round, one pound in 1931 was the equivalent of £50 today.

Our money has already been debauched on a colossal scale. And for the future, there is certainly no prospect of HMG reinstating sterling's link to gold - indeed, a few years back some financial genius flogged off most of our remaining gold for a song (the Brown Bottom - see this post).

Even worse, the much vaunted independence of the Bank of England, supposedly designed to safeguard us against runaway inflation, has now effectively been ditched.

So what is the rational punter to do?

When it comes to savings, abandoning paper money for gold looks increasingly attractive. Sure, there are risks, and the price of your investment can go down as well as up. But there are also risks with paper money.

As we will soon be reminded.

PS The scariest thing about the current slump is not that Brown is screwing things up here, but that the Saintly One across the Atlantic is screwing things up for the world. The Wall St Journal is tearing its hair out:

PPS Well before we got the Bank of England, we had the goldsmiths. They offered services very similar to GoldMoney and BullionVault, not only buying and selling gold, but also for a fee, storing it. They would issue a promissory note to prove your entitlement. And people came to use the notes issued by respected goldsmiths to settle debts and make purchases directly, without the gold ever leaving the goldsmith's vault. It was paper money, good for value without anyone having to touch the gold itself. And then the goldsmiths realised that, since most of the gold never left their vaults, so long as they kept enough back to act as a float, they could make even more money by lending the rest out. Which is what they did. It was a critical step in the development of banking, but it was also the step that ultimately led to the world of printing press currency and giant credit bubbles.

Wednesday, 4 March 2009

Posted by

Britannia Radio

at

08:28

![]()