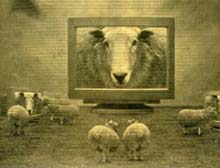

The Swimming Naked Prophecy

It's only when the tide goes out that you learn who's been swimming naked - Warren Buffet(2007)

It surely kind of prophetic to hear a market guru, like Buffett, embracing such a philosophical approach two years ago as the Berkshire profits plunged 96% in early March amid the dysfunctional world economy. It is even more baffling to hear him blame the derivatives after admitting that the firm' s equity holdings had lost 44% because of them. One has to wonder exactly which game is he playing. In 2003, he was among the very first experts to warn about CDOs calling derivatives *financial weapons of mass destruction* and *time bombs*. This grabbed the media's attention and put on a red alert a myriad of intrigued journalists who directly began to investigate the opacity surrounding these innovative products, all of which led them to the conclusions that Buffett would eventually be proven right. Yes, this was the ultimate CDOs horror story that circulated for many months on the Net. Talk about complacency! But even more troubling: how does it come to be that he was unable to take action in order to prevent his shareholders from dealing with this nasty surprise? And one might ask too: how does it come that Buffett' shareholders didn't do anything to reduce Berkshire's exposure to those exotic financial deals... Of course everybody reaped highly satisfying returns for a while. But that was then, and this is now. As of October 2008, the Size of Derivatives Monster was coming down to $190K per personon the planet! It is not a matter of 'if' but 'when' and when this derivative bubble explodes, we will see who was swimming naked. What a clever man, Buffett, whose private wealth won't most likely suffer too much from the Greatest Depression.