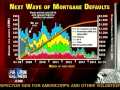

The second leg down Where it will come from and when Tilson predicts failures via Option Arms resets and Alt A's resets over next 1-3 years circa $1.5 trillion with a further 50%-70% default.Brasscheck TV Home More videos like this

Related Videos

Monday, 11 January 2010

part 2

Now the real "fun" begins

In a boxing match, a good referee will take a boxer out who's been hit so hard, he's staggering.

Why?

The potential damage from follow up blows to someone already in a weakened state is exponentially higher than from the first one.

Unfortunately for the credit market, there's no referee to call a time out.

A second blow in the form of a second major wave of real estate loan defaults is on its way - and nothing can stop it.

My guess is that the credit market is being propped up now during the lull so that the banks can sell off their holding to suckers (us) before the real carnage begins.

Imagine two trainers propping up a nearly unconscious fighter as his opponent warms up for one final blow and you've got a good idea of the situation we're in.

Here's how it looks from the trading floor - from the mouths of people who know what's going on and aren't afraid to say so.

Details in the video- followed by advice in text:

Posted by

Britannia Radio

at

10:55

![]()