WEDNESDAY, MAY 26, 2010

OECD Tells George To Brace Up

PS The more we hear and see of young Mr Laws, the more impressed we are. We thought he was pretty good under fire in the Commons today, and in matters fiscal, he seems a whole lot drier than many a Tory front bencher. Hopefully he'll provide some much needed resolve when the shooting starts for real. We like him.

Friday, 28 May 2010

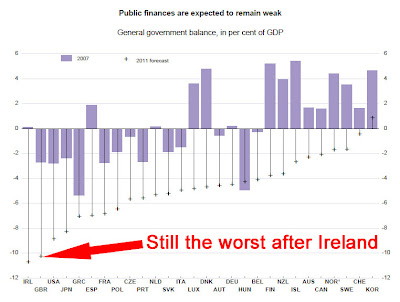

That's where 13 years of Labour leaves you

The OECD published its six-monthly World Economic Outlook today. And you know what? It's not all bad news.

They say that world growth is picking up faster than they expected last time, and it's been driven by China and the other emerging economies, rather than by yet more fiscal blow-outs here in the West.

So world trade is picking up again, and basket economies like the UK have a real chance of earning their way back to solvency.

Right, that's the good news over with.

The bad news is that when it comes to government borrowing we are still theworst economy in the whole of the OECD, bar Ireland (see chart above). The OECD forecasts that HM Government will borrow 11.5% of GDP this calendar year, and a further 10.3% next. Which compares with the laughably optimistic figure of 8.5% forecast by Darling for 2011-12.

The OECD's assessment?

"A weak fiscal position and the risk of significant increases in bond yields make further fiscal consolidation essential. The fragile state of the economy should be weighed against the need to maintain credibility when deciding the initial pace of consolidation, but a concrete and far–reaching consolidation plan needs to be announced upfront. While monetary policy should remain expansionary over the forecast period to support activity against the background of low levels of resource utilisation, the process of normalisation of interest rates needs to start soon in response to the expected gradual rise in underlying inflation."

Translation: public sector borrowing needs to be gripped soonest; George needs to announce a quantified plan for getting the public finances back in the black and keeping them there (aka a new set of explicit fiscal rules); the Bank of England needs to increase interest rates now before inflation balloons completely out of control.

Oh, and George will also need one of these:

Posted by

Britannia Radio

at

08:50

![]()