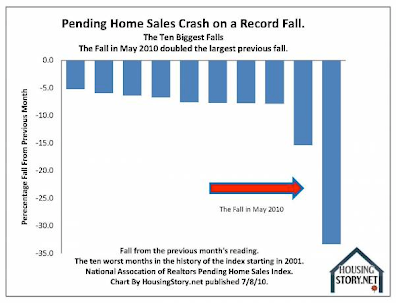

Stacy Summary: This is a great opinion piece from Martin Wolf in the FT, “Why we must halt the land cycle.” Wolf, despite having seen a 10 fold increase in his property value in the past decades, advocates drastic changes to our Western economies’ addiction to the cycle of property bubbles and the subsequent devastating collapses. The consequences of our property bubble as industrial policy: First, it makes it necessary for the state to fund itself by taxing effort, ingenuity and foresight. Taxation of labour and capital must lower their supply. Taxation of resources will not have the same result, because supply is given. Such taxes reduce the unearned rewards to owners. Second, this system creates calamitous political incentives. In a world in which people have borrowed heavily to own a location, they are desperate to enjoy land price rises and, still more, to prevent price falls.Thus we see a bizarre spectacle: newspapers hail upward moves in the price of a place to live – the most basic of all amenities. The beneficiaries are more than land speculators. They are also enthusiastic supporters of efforts to rig the market. Particularly in the UK, they welcome the creation of artificial scarcity of land, via a ludicrously restrictive regime of planning controls. This is the most important way in which wealth is transferred from the unpropertied young to the propertied old. In his new book, David Willetts, the universities minister, emphasises the unfairness of the distribution of wealth across generations.* The rigged land market is the biggest single cause of this calamity. Third and most important, the opportunity for speculation in land both fuels – and is fuelled by – the credit cycle, which has, yet again destabilised the economy. As you can see from this Economist article, however, housing bubbles continue to expand thanks to easy money, government policy (as in Australia) and continued ponzi euphoria. The Australian housing bubble, where the Economist reckons house prices are 61% overvalued, seems one destined for the history books. (I’m sure the Economist is being bombarded with hate mail from Canadians and Australians holding onto their fictional bubble gains for dear life). As those first into this ponzi scheme economics are the active voters of the baby boom generation each about to retire on their house price gains, however, it looks 100% unlikely that anything will change any time soon. And that’s no doubt why “Gold keeps rising as panicky investors look for security.” No less exciting, though rather more unsettling, is the real-life drama taking place on the world’s financial markets, where investors have piled into gold on fears that capitalism is about to crumble. If capitalism is what you call what we’ve got and if a perpetual ponzi scheme is as good as we’ve got gets, then let them eat capitalism crumble. For more download & listening options, visit Archive dot org Facebook is closing it’s virtual gift shop as a means to move closer to a cross-platform virtual currency system that will encourage users to work at an effective wage of less than $1 a day. As the US economy continues to shrink with jobs and wages disappearing fast, desperate FB users will come to rely more on the social networking site – giving the company many hours a week of ‘click time’ – in exchange for enough credits to buy food and other essentials (convertible at outlets like 7-11; a huge sponsor of the site’s Farmville). This is the beginning of indentured ‘click servitude.’ Stacy Summary: I found this video interview with Chris Whalen via Jesse’s Cafe Americain. And here is another article from his site with some great, if scary, charts (see one below) about the recent deterioration in the US housing market. Pending home sales: Stacy Summary: We look at the latest scandals of groveling monarchs, democratic politicians calling their taxpayers hobos and stray animals and BP and Goldman as targets of RICO. In the second half of the show, Max talks to journalist Teri Buhl about Timothy Geithner, RICO and more. As the world runs out out of credit and various forms of financial liquidity, the world is also running out of water. Global Warming and Climate Change are drying up the planet’s water supply and causing havoc with economies around the world. Monetary deflation is driving the price of gold to new highs. Ecological deflation is driving the price of water to new highs. My informal analysis of the climate change deniers points to a concentration in the countries that stand to lose the most money when climate debts are paid. Clearly, the USA is the number one climate indebted country on Earth as it is also the number one financially indebted country. No wonder then that US citizens seem to be oblivious about both their financial problems as well as their ecological problems. As predicted: The capitalism-socialism debate will fade as it becomes clear we’re sinking back into feudalism. The casino-gulag will be lorded over by new sovereignties like Google and Facebook. As bank balance sheets deteriorate, regulators are giving banks more room to lie about their capital provisions. When does free speech become hate speech? When does financial reporting become financial obscenity? Banks are hiding trillions in bad debts that are leeching interest out of society and killing jobs and income. Changing the wording on how you refer to this is an example of financial obscenity. Geithner should be held accountable. Stacy Summary: Here it is! Stacy Summary: We have an elaborate military/prison welfare system that has created a class of people well fed by the state and, obviously, in the US, this has resulted one of the highest incarceration rates for any society ever to occupy earth. In the UK, a watchdog has now mentioned the high costs of incarceration and whether a new model ought not to be considered – even for serious crimes. No doubt the Daily Mail will be baying for this watchdog’s blood by now, but, hopefully, an interesting (and honest) discussion will, nevertheless, be had. Re: the baying for Persian blood of the second story, it seems Americans are not ready to hear about the costs, financially and morally, of the many countries they occupy and the thousands upon thousands of people they kill annually in the name of transfer of wealth to the dogs of military welfare. Some reoffending — even if it involved “serious” new crimes — could be the price that society had to pay for trying to cut down on the huge cost of the country’s rising prison population, said Mr Bridges, the chief inspector of probation. While acknowledging that prison reduced crime, he described it as a “rather drastic form of crime prevention” and said it was time to consider dealing with more offenders in the community. He claimed that the public could never be perfectly protected and that the cost of a “small amount” of reoffending could be outweighed by the “benefit” of financial savings to the public purse made from having less prisoners locked up. At the end of the year, look for Google to start offering virtual currency to users to stay penned in their casino-gulag. Polanski behaved badly only during the time he lived in California. It’s America that needs to focus on its social sickness, not Polanski. Stacy Summary: Here is the full video for the Damon Vrabel interview from yesterday as half the episode was missing: Stacy Summary: Max and I are having a mini-break here in the Angers area; just outside it in the countryside, so internet is hard to find! Reading Ellen Brown’s latest How Brokers Became Bookies: The Insidious Transformation of Markets Into Casinos. Thanks for all the comments and conversation on the latest Keiser Report; we’re also reading those! Stacy Summary: We look at the latest scandals of downgrading America, investors seeking security in gold, bank profit abominations and federal ponzis. In the second half of the show, Max talks to Stefan Molyneux of Freedomain Radio about the Canadian economy and housing bubble, the oil spill in the Gulf of Mexico and how to fix the world. If moderation is a fault then indifference is a crime. [Read more →] Stacy Summary: Here is the Youtube version of yesterday’s interview for those who prefer to view while listening. Stacy Summary: Max interviewed on the Corbett Report about boycotts and activism. Stacy Summary: We look at the latest scandals of IMF forecasts and commercial banks pawning their nations’ gold reserves. In the second half of the show, Max has a most excellent interview with The Market Ticker’s Karl Denninger about market manipulation and flash crashes.

[KR58] Keiser Report – Markets! Finance! Monarchy!

Stacy Summary: We look at the latest scandals of groveling monarchs, democratic politicians calling their taxpayers hobos and stray animals and BP and Goldman as targets of RICO. In the second half of the show, Max talks to journalist Teri Buhl about Timothy Geithner, RICO and more.

Land Cycle and Capitalism Crumble

July 11th, 2010 by

Respond[1147] The Truth About Markets London – 10 July 2010

July 10th, 2010 by

RespondFacebook moves closer to virtual currency for its Casino-Gulag

July 9th, 2010 by

RespondDouble Dips and Currency Wars

July 9th, 2010 by

Respond[KR58] Keiser Report – Markets! Finance! Monarchy!

July 9th, 2010 by

RespondFear Index

Rises to 16-Year High

July 13th, 2010 by

RespondThe ‘Other’ Deflation: First Half of 2010 Breaks All Heat Records

July 13th, 2010 by

RespondPushing the Bankrupt Country into a Form of Feudal Vassal State-Cum-Reparations Subservience

July 13th, 2010 by

RespondBasel Allows More Financial Obscenity

July 13th, 2010 by

Respond[1148] The Truth About Markets USA – 10 July 2010

July 12th, 2010 by

RespondBaying for blood economics

July 12th, 2010 by

RespondGoogle Invests Big Time in Casino-Gulag and Virtual Currencies

July 12th, 2010 by

RespondSwiss Won’t Extradite Polanski

July 12th, 2010 by

RespondOn the Edge with Damon Vrabel – Reuploaded

July 11th, 2010 by

RespondBookie Jibber Jabber

July 16th, 2010 by

RespondGuest Post: The Dangers of a Failed Presidency

July 15th, 2010

Friday, 16 July 2010

Posted by

Britannia Radio

at

20:06

![]()