The Daily Reckoning | Wednesday, September 22, 2010

-------------------------------------------------------

A.O.P. returns 18.5% a year

You've probably never heard of the A.O.P. It's a special asset class that has outperformed every investment on the market that we know of over the last decade...and has produced average, annualized returns of 18.5%. It even beat out gold!

That's why we've recently compiled everything we know about the A.O.P. in this exclusive video...

Click here to watch video.![]()

Bear Market Breakdown Why some analysts expect a short-term top...followed by a market drop

Reporting from Laguna Beach, California...

Eric Fry

The Fed spoke. The market rallied. The Fed stopped speaking. The market slumped. Clearly, what the market needs most is more Fed-speak.

At 2:15 Eastern Time, the Federal Open Market Committee (FOMC) announced that it would do more stuff, if necessary, and less stuff, if not. Initially, investors celebrated the FOMC's resolve to cure the economy's malaise, while ignoring the FOMC's dire assessment of current economic conditions.

Said the Fed:The pace of recovery in output and employment has slowed in recent months. Household spending is increasing gradually, but remains constrained by high unemployment, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software is rising, though less rapidly than earlier in the year, while investment in nonresidential structures continues to be weak. Employers remain reluctant to add to payrolls. Housing starts are at a depressed level. Bank lending has continued to contract, but at a reduced rate in recent months.

Maybe there's a silver lining in there somewhere, but a cloud is still a cloud. This realization seemed to dawn on investors shortly after the Fed's press release. Initially, the Dow Jones Industrial Average jumped nearly 100 points to a new 4-month high of 10,833. But the rally quickly fizzled, as the Dow ended the trading day with a slim 7-point gain.

Yesterday's failed rally attempt conveniently coincided with the bearish prognostications of Jay Shartsis, a seasoned and insightful options trader with R.F. Lafferty in New York. "I'm getting ready for short sales on Wednesday or Thursday of this week," Shartsis declared two days ago. "I'm looking at stocks that have been exhibiting highly priced puts (potentially bearish) and that have not been rallying along with the overall market. Three intriguing examples are Valassis Communications (NYSE:VCI $33.36), Rubicon Technology (NASDAQ:RBCN $23.9) and RINO International (NASDAQ:RINO $13.14)."

Shartsis' bearish call does not necessarily merit our attention, but it probably doesn't deserve our inattention. Yesterday's "breakdown" of RBCN - down 9% to a 5-month low - occurred almost exactly as Shartsis had warned...almost. The stock tanked Tuesday, instead of "Wednesday or Thursday."

Moving from specific stocks to the overall market, Shartsis has been expecting a short-term top to arrive in the middle of this week. "Further evidence for a coming market drop are presenting themselves now," Shartsis observed recently. "The Daily Sentiment Index has reached 83% bulls, which is the highest reading since last April 26, the day of the market's last short-term top."

Additionally, Shartsis noted a variety of short-term trading and sentiment indicators that reflect "a high degree of speculation... I am expecting a short-term market top very soon."

Robert Prechter, editor of The Elliot Wave Theorist, is matching Shartsis' bet and raising him 300! "We're on the verge of the biggest bear market in nearly 300 years," Prechter predicts. "Because the mania [the bull markets of 1982 to 1999 and 2003 to 2007] was so terrific, it will be followed by a negative trend in social mood that will lead to a complete retracement [to less than 1,000 on the Dow]."

"In a deflationary environment, the last thing you want is to own any financial asset," Prechter added. "If you stay out of stocks, real estate, gold and other commodities, which will all come down together, then you can preserve your purchasing power [in cash] for the next great buying opportunity."

Bear markets of this magnitude are "very rare," Prechter admitted. "I'm taking a big risk [making such a forecast]."

Your editors would not argue with Prechter, but neither would they begin preparing for Armageddon. Even if the US stock market is vulnerable to a major decline, the world is not without investment opportunity. Clearly, many, many US stocks will perform well, even if most of the market simply muddles along.

At the same time, various foreign markets offer the promise of much higher returns than American stocks will deliver. Therefore, the forward-looking investor might want to ask himself, "Where in the world can I receive the highest return for the risks I am assuming?"

Your California editor addressed this exact question last week in Las Vegas. While addressing the attendees of the conference, your editor asked, "Am I getting paid adequately for the risks I'm taking?" In today's column, we present a slightly edited transcript of that presentation...![]()

Bulletin Board Elite Presents...

Urgent Retirement Wealth Alert, Don't Miss This Chance At...

Your "30-Day Retirement Plan"

It's happened before. It could happen again - starting as early as next week...

So will it happen to you...? Read Our Latest Report, Here.![]()

The Daily Reckoning Presents Buy Emerging Markets...Once Again With Feeling

Choir...meet your Preacher.

Eric Fry

I'm not here today to tell you anything new, but merely to reinforce what you already believe...to reinforce a good habit. The good habit is this: Investing in the Emerging Markets. It's like flossing...or exercising; we all know we're supposed to do it, but most of us don't do it enough.

This discussion about Emerging Markets is essentially one of analyzing the risks you wish to take and the ones you don't. If you were a young, heterosexual male, for example, you might be willing to risk missing a new episode of The Simpsons to risk going on a date with Megan Fox. On the other hand, you might not be willing to tightrope across the Grand Canyon to have lunch with the cast of Cats.

In the same way, there are rewards you want and ones you don't. For example, you probably wouldn't be too thrilled to receive a trophy for bushiest eyebrows, shiniest bald spot, most exotic melanoma or most obnoxious in-laws. By winning an award like that you have already lost. In fact, you've lost just by virtue of being a contender!

Choose your risks, and be sure that the potential rewards are commensurate with those risks.

Any wheat farmers in the room?...No one?

Okay, well then imagine that you are a wheat farmer. Would you rather be the best wheat farmer in Antarctica...or the worst one in Kansas? Investing in the Developed World often feels like trying to grow wheat on an iceberg, while investing in the Emerging Markets more often feels like growing wheat on a fertile prairie. So I'm suggesting that you try to grow the wheat where it will grow.

The question comes down to choosing your risks...really choosing them, not simply accepting them.

You should be asking yourself continuously, "Am I getting paid adequately for the risks I am taking?" This seems like an obvious question. But often, it is not.

Another way to frame this question is to ask: Who's getting paid better? The guy who's flipping hamburgers at $10 an hour? Or the guy who's flipping hamburgers at $12 an hour...with a grizzly bear in the kitchen?

In the Developed World, the Welfare State is ascendant. Meanwhile, capitalistic elements - the things that made this country great - are having a hard time. In many parts of the Developing World we have the inverse situation, where many of the impediments to capitalistic enterprise are falling away.

In a recent edition of The Daily Reckoning, Bill Bonner addressed this phenomenon. He's been talking a lot about "Zombie Nation"...and how the United Stats is becoming a Zombie Nation.

"The trouble with zombies is that they're expensive to maintain," Bill observed. "Which is to say, the welfare state works fine as long as there's enough money to keep the zombies happy. But when you get too many zombies...and not enough money to feed them properly...you're in danger. Well, the welfare state itself is in danger.

"We're not saying that everyone who loses his job becomes a zombie. But that's what makes this Great Correction actually worse than the Great Depression of the '30s. There were fewer zombie support systems back then. So people HAD to work. And they did. They worked on farms. And then, when the war started, they worked in factories.

"The point is, they couldn't become zombies because - even with all Roosevelt's efforts to create a zombie economy - there just wasn't enough money to support them.

"This is, of course, why there are so few zombies in the emerging markets too. Not that there aren't a lot of people who would like to be zombies... But right now, the emerging markets are still too poor to be able to afford a large class of leeches."

Hence, we have this dichotomy opening up. In the US we are trying to work through the legacy of accumulating lots of debt. Consider this lamentable fact: 14% of all residential mortgages are either in delinquency or foreclosure.

That's just one part of the problem. Commercial real estate loans are in a similar state of distress.

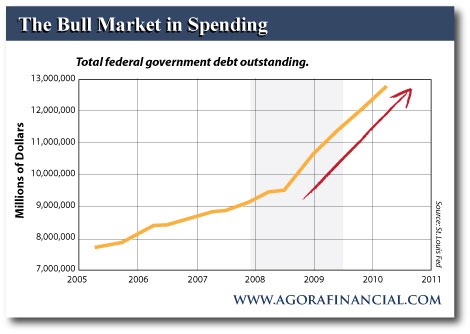

At the same time, US government spending is going up and up. Not the trend you want to see.

So let's play a little game...

I will hand out $5 for every right answer. But anyone who gives the wrong answer will owe me a drink. So we're going to find out at the end of this game whether I'm going to be drunk tonight...or just a little bit poorer.

I'm going to show you budget and economic growth data for five different countries. For each country I'm going to show you the most recent government deficit, total GDP and annualized GDP growth for the last three years.

The floor is open.

"E is the US," one attendee blurts out.

"You are correct," you editor replies. "Here's five bucks."

"B is Germany," another attendee yells out.

"Nope," your editor replied. "You owe me a drink.... Anyone else?... C'mon, drinks aren't that expensive... Okay, well, since no one else wants to hazard a guess, I'll tell you the answers... 'A' is Brazil, 'B' is Norway, 'C' is Chile, and 'D' is Spain...horrible, horrible Spain. See how bad Spain is? But guess what? 'E' is worse."

When you consider data like these, the distinction between "Emerging" and "Developed" blurs...or becomes completely irrelevant. So we investors are left to decide whether we should stick with the familiar "safe" risk or the unfamiliar "risky" risk.

Charlie Munger, the Vice-Chairman of Berkshire Hathaway says, "One thing about accounting, the liabilities are always 100% good."

And this observation will be true here in the Western world as well. We will have to deal with our massive liabilities, somehow, some way... They won't go away.

Maybe we deal with them by printing our way out of it, but they're going to stick around for a while; they're going to be a burden; they're going to be a tax on national productivity.

To be continued tomorrow...

Eric J. Fry,

for The Daily Reckoning![]()

Video Presentation: Check Out This Canadian Penny Stock!

This Canadian penny stock play just won the rights to an estimated $172.5 billion oil bonanza... The profit potential could be enormous for investors who get in early. Resident geologist Byron King has all of the details in this exclusive video presentation. There's still time to get in...

Click here to watch the presentation immediately. (Turn your speakers on.)![]()

Bill Bonner Government Spending Even the Tea Party Can Get Behind

Reckoning from Delray Beach, Florida...

Bill Bonner

Are you ready for this, dear reader?

You remember that recovery? Well, forget it. There ain't no recovery. But at least we're not in recession anymore. Yes, now it's official. Here's the report from The New York Times:The recession officially ended in June 2009, according to the Business Cycle Dating Committee of the National Bureau of Economic Research, the official arbiter of such dates.

Okay, so now we're out of the woods, right? Well, maybe not. Here's another item from yesterday's AP news:

As many economists had expected, this official end date makes the most recent downturn the longest since World War II. This recent recession, having begun in December 2007, lasted 18 months. Until now the longest postwar recessions were those of 1973-5 and 1981-2, which each lasted 16 months.

The newly-declared end-date to the recession also confirms what many had suspected: The 2007-9 recession was the deepest on record since the Great Depression, at least in terms of job losses.

From December 2007 to June 2009, the American economy shed more than 5 percent of its nonfarm payroll jobs; through December 2009, the month that employment bottomed, the economy had shed more than 6 percent of these jobs.

Additionally, a broader measure of unemployment, which also includes people who are reluctantly working part time when they wish to be working full time and those who have given up on looking for work altogether, also shows that unemployment this time around was far worse than in any previous postwar recession.Unemployment grew in more than half of US states in August, the largest number in six months, as private employers aren't hiring enough to offset the loss of census jobs.

This unemployment thing is getting to be a bummer. As we reported yesterday, it pinches both young and old particularly hard. The young are traumatized for life, says a report in the Telegraph. They "lose faith in institutions," it says. Which is not surprising. They never get in the habit of working. They become permanently unemployed...and unemployable.

The Labor Department says the jobless rate increased in 27 states last month. It fell in 13 and was unchanged in 10 states and Washington, DC. That's worse than the previous month, when the rate increased in only 14 states and fell in 18. It's also the most states to see an increase since February.

Much of the decline was due to the ending of 114,000 temporary census jobs nationwide. Overall, the economy lost a net total of 54,000 positions last month and the unemployment rate ticked up to 9.6 percent from 9.5 percent. Private employers added a net total of only 67,000 jobs.

The old have their crosses to bear too. Here's The New York Times on the story:...a growing number of people in their 50s and 60s...desperately want or need to work to pay for retirement and... are starting to worry that they may be discarded from the work force - forever.

And more thoughts...

Since the economic collapse, there are not enough jobs being created for the population as a whole, much less for those in the twilight of their careers.

Of the 14.9 million unemployed, more than 2.2 million are 55 or older. Nearly half of them have been unemployed six months or longer, according to the Labor Department. The unemployment rate in the group - 7.3 percent - is at a record, more than double what it was at the beginning of the latest recession.

Being unemployed at any age can be crushing. But older workers suspect their résumés often get shoved aside in favor of those from younger workers. Others discover that their job-seeking skills - as well as some technical skills sought by employers - are rusty after years of working for the same company.

Many had in fact anticipated working past conventional retirement ages to gird themselves financially for longer life spans, expensive health care and reduced pension guarantees.

Older people who lose their jobs take longer to find work. In August, the average time unemployed for those 55 and older was slightly more than 39 weeks, according to the Labor Department, the longest of any age group. That is much worse than in August 1983, also after a deep recession, when someone unemployed in that age group spent an average of 27.5 weeks finding work.

At this year's pace of an average of 82,000 new jobs a month, it will take at least eight more years to create the 8 million positions lost during the recession. And that does not even allow for population growth.

Oh...the market update:

Yesterday, the Dow rose 7 points. Gold dropped back $6.

Nothing important, in other words. We still don't have a clear picture of what this market will do...

..Is it "risk on" with a spree of higher inflation? A lower dollar? And a rally on Wall Street? Commodities seem to be anticipating it. They're at their highest levels in two years.

..or "risk off"...with a sucker punch to investors - whacking commodities, knocking the dollar higher, while pummeling stocks...and even gold?

We don't know. We wait. We watch. We wonder what will happen next...

..and we keep our money in gold and cash until Mr. Market declares his intentions.

*** On a lighter note, here's deep thinking Thomas L. Friedman writing in The International Herald Tribune:In recent years, I have often said to European friends: So, you didn't like a world of too much American power? See how you like a world of too little American power - because it is coming to a geopolitical theater near you. Yes, America has gone from being the supreme victor of World War II, with guns and butter for all, to one of two superpowers during the cold war, to the indispensable nation after winning the cold war, to "The Frugal Superpower" of today. Get used to it. That's our new nickname. American pacifists need not worry any more about "wars of choice." We're not doing that again. We can't afford to invade Grenada today.

Is there anything the Sage of The New York Times doesn't not know?

"Frugal Superpower?" Huh? The US is running a $1 trillion-plus deficit!

Can't afford to invade Grenada? Is he kidding? We may not be able to afford NOT to invade Grenada. The US is running out of time and money. And the Tea Party activists are making themselves felt on American politics. They're calling for "fiscal restraint."

But government can't deliver fiscal restraint. Not in this economy. Cutbacks to spending would probably produce even greater deficits, since economic activity would shrink up.

Besides there are too many zombie voters and lobbyists. And we have a printing press, for Pete's sake. Serious cutbacks are out of the question.

But what kind of spending would get the support of the Tea Party activists...and all the other activists, chiselers, malcontents, Keynesians and blowhards? You guessed it. Military spending. Unfurl the flag, print up the money and bring out the cannons. Who objects?

What did Mussolini do when he found himself at the head of a bankrupt nation? He invaded Abyssinia.

Regards,

Bill Bonner,

for The Daily Reckoning

Wednesday, 22 September 2010

Posted by

Britannia Radio

at

22:16

![]()