Products of the Past Working For Profit to Prop Up the Economy Evidence the China Bubble is Edging Closer to a Pop Joel Bowman The Mogambo Guru Rocky Vega![]() The Daily Reckoning U.S. Edition

The Daily Reckoning U.S. EditionHome . Archives . Unsubscribe

The Daily Reckoning | Tuesday, January 18, 2011

-------------------------------------------------------

Don't be a Zombie!

Millions of clueless Americans are completely oblivious to the fact that Washington and Wall Street are robbing them blind.

Don't be a zombie!

Chris Mayer explains in a breaking new presentation exactly what this den of thieves is up to and how you could protect, even grow your wealth because of their scam.

Click here to watch your FREE presentation now.![]()

Long-Term Trends vs. Short-Term Corrections What to make of the volatility in the commodity markets

Reporting from Laguna Beach, California...

Eric Fry

"The dollar, yen and euro are all headed to zero...eventually," Chris Mayer predicts in today's edition of The Daily Reckoning. "But there is a journey of some length between here and there. In the between, you'll be glad you own real assets like oil, natural gas and gold."

But in the between, you'll also be sorry you own real assets like oil, natural gas and gold. That's simply the nature of financial markets. Even in bull markets, misery pays a visit periodically.

The recent history of natural gas prices makes the point. If you invested in natural gas at the beginning of 1999, you're sitting on a plump 150% gain - or more than five times what the S&P 500 Index gained over the same time frame.

But if you happened to establish your long-term, inflation-hedging position in natural gas in late 2005, just after Hurricane Katrina caused nat gas prices to spike above $15/mcf, you're nursing a painful 69% loss...five years later!

More recently, misery paid a visit to the oil market. After topping out at $145/barrel on Bastille Day 2008, the oil price plummeted more than $100 to $34/barrel. And the oil price still remains nearly 40% below its all-time high. But this monstrous collapse occurred in the context of an equally monstrous bull market. If instead of investing in oil in the summer of 2008 you had invested in oil in the summer of 1998, you would have watched your investment increase 8-fold!

So what's the point?

Simply that large, long-term trends sometimes succumb to large, short- term corrections. As the gold price soared, for example, from $253 an ounce in 1999 to $1,367 today, it suffered a number of large, short- term corrections. Twelve times during this long bull market, the gold price retreated 10% or more. Twice, the gold price tumbled more than 20%.

In a bull market, such setbacks are buying opportunities. In bear markets, every price is a selling opportunity.

So what should we make of the current volatility in the commodity markets. Grain prices are soaring, as is the oil price. But at the same time, the gold price is languishing and the silver price is tanking.

Is the commodity bull market ending because gold and silver are going nowhere, or is the commodity bull market simply fanning out and/or taking a breather?

Let the reader decide. But before deciding, let the reader consider that each piece of paper currency that falls off a printing press costs the issuing government about one cent each to produce. By contrast, bushels of wheat and ounces of platinum demand much larger investments...and also require the cooperation of weather or geology.

If all goes well, massive investment combined with favorable conditions yields a bit of grain or a speck of precious metal. If not, not. That's why precious metals are precious...and why generations of mankind have begged the Lord above to "give us our daily bread."

In short, hard assets are precious because they are either rare or essential...or both. And hard assets become all the more essential to the extent that central bankers debase the currencies they purport to protect.

In the column below, Chris Mayer, editor of Mayer's Special Situations, offers a few insights on three of his favorite hard assets...![]()

Did You See The Video About The American Nuke Bomb LOST Under Ancient Ice Fields?

Way back in 1968, an American B-52 crashed in northwest Greenland...

Unfortunately, the nuclear bombs on board got forever swallowed by an ancient ice sheet...

But there's an unknown penny stock set to rise 2,000% from this sorry situation.

Sound unbelievable? Watch this presentation for proof...![]()

The Daily Reckoning Presents Better than Zero

Monetary worries are the order of the day. The dollar, the euro, the yen... Where are they all headed?

Chris Mayer

Eventually, to zero.

But there is a journey of some length between here and there. In the between, you'll be glad you own real assets like oil, natural gas and gold.

These three are the subject of today's missive.

We view them through the fog of currencies. You cannot say, for example, that since the price of oil rose in 2010 that means demand is strong and supply is tight. It may also mean the US dollar is weaker.

Nonetheless, on oil, it seems as if the market tightened in the second half of 2010. But the key thing to watch is the marginal cost to produce a barrel of oil. This is an important analysis that many people overlook. What we want to know is how much it costs to produce the most expensive barrel.

If the world's demand for oil is 85 million barrels a day, then what did it cost to produce the last barrels? This is the marginal cost. The reason it is important is that it gives you insight into how the market ought to behave. If the price of oil is $90 a barrel and the cost to produce is only $40, then that would imply there is a lot of room for the price of oil to fall.

Today, that is not the case. The marginal cost is probably right at $90. I say "probably" because it's not a figure you can look up so easily. It requires some estimates.

Macquarie Research recently released an estimate of $90 a barrel. At this price, oil sands projects earn after-tax returns in the low teens for big mining projects. By Macquarie's reckoning, the oil sands projects are the marginal producers. They are the "last barrels."

Now, this analysis is not perfect. For one thing, supply constraints can drive the price higher. Even though the marginal cost might be $90 today for 85 million barrels, it might be $100 for 90 million barrels. Second, if lower-cost sources of oil expand, you can actually push the marginal cost down.

But even after all this, it's comforting to know, as an oil investor, that the market price is right where it seemingly ought to be. If global demand sits at 85 million barrels, then $90 is a fair price, given all that we know today.

Conclusion: Oil is not cheap, but neither is it expensive. Stay long oil and oil-related stocks.

Let's turn to natural gas.

I got natural gas wrong two years ago. I couldn't see it going below $5/mcf. When I saw the rig count drop off severely, I thought for sure the production of natural gas would also topple over. Then, the price of natural gas would have to rise. But I was wrong. The natural gas price easily broke below $5/mcf and then languished below that level.

I thought the natural gas industry could operate profitably at sub-$5 natural gas. But I got wrong. For one thing, the productivity of rigs has climbed. We produce a lot more gas with a lot fewer rigs. Secondly, the drilling technologies that have "unlocked" shale gas deposits have lowered the marginal cost of natural gas production. But even so, very few natural gas projects are economic below $5/mcf...and many projects require even higher gas prices to operate profitably.

So I think the pressure on natural gas prices going forward will be to the upside. But since natural gas is very difficult to transport around the globe, gas prices vary dramatically from place to place. So here is how I would play it. Invest in gas plays that are overseas, where you get paid more than twice what you do in the US for the same resource.

To bridge these markets, there is the LNG trade. This is the trade for liquefied natural gas, which is put on tankers. There is plenty of money going toward LNG terminals. Longer term, I think the US emerges as a big exporter of natural gas.

Conclusion: Eventually, natural gas prices will turn up. In the meantime, in North America, I'd own producers with proven low costs, such as Contango Oil & Gas (AMEX:MCF).

Finally, let's turn to gold.

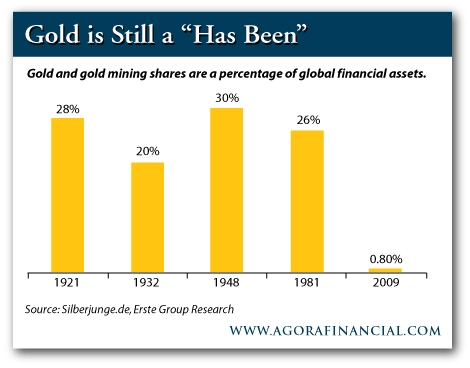

Over the weekend, Barron's had its first installment of its annual round table. Two panelists made intriguing points on gold. Fred Hickey pointed out that "institutional ownership of gold is ridiculously low. It is less than 1%." And Felix Zulauf said that at its last peak in 1980, gold was 3% of the market capitalization of global stocks, bonds and money market assets. Today it is 0.6%.

Here is a chart I found on gold and gold mining shares as a percentage of global assets:

Despite a big run-up in the price of gold, it is still vastly under- owned. As inflation starts to get more and more headlines, I think more and more attention will focus on to gold. We still have a long way to go. In inflation-adjusted terms, gold doesn't hit a new high until it breaks $2,000 an ounce.

On the way, gold stocks look attractive. In particular, I'd stay with the juniors and mid-tier producers. With them, you have the added prospect of getting a buyout. I think we'll see consolidation among the gold producers.

In the end, it's simply easier to buy a gold mining company with proven reserves than to build a new mine. You get a 100,000-ounce producer in a safe jurisdiction and it trades for only 5 times cash flow. Either the market will take the price of that stock higher or somebody is going to take them out.

Conclusion: Stay long those junior and mid-tier gold stocks.

Regards,

Chris Mayer,

for The Daily Reckoning

P.S. Just this morning (Tuesday, the 18th) I released a Special Research Presentation in which I detail the biggest threat to your wealth...and precisely what you can do to protect it. Daily Reckoning Readers Can Access The Presentation Here.![]()

Byron King's Energy & Scarcity Investor Uncovers...

Video Presentation: Check Out This Canadian Penny Stock!

This Canadian penny stock play just won the rights to an estimated $172.5 billion oil bonanza... The profit potential could be enormous for investors who get in early.

Resident geologist Byron King has all of the details in this exclusive video presentation. There's still time to get in...

Click here to watch the presentation immediately. (Turn your speakers on.)![]()

Bill Bonner A Word of Advice to Financial Authorities

Reckoning from Paris, France...

Bill Bonner

Markets were closed in the USA yesterday. But the world didn't stop turning. And we didn't stop reckoning with it.

What we are reckoning with is the breakdown so big hardly anyone notices it. The model of a political economy set up in response to the industrial revolution is now worn out. Exhausted. Headed for the trash heap of history.

We're not in the habit of giving advice here in The Daily Reckoning. Sure, we warned readers about the biggest threats to their finances in 30 years - the bubbles in tech stocks and then in housing. And sure, we urged them to buy what turned out to be the best investment they could have made - gold.

And yes, we criticized governments for doing all the wrong things. But urging them to do the right things would be both futile and earnest. Futility doesn't bother us. But we can't stand earnestness. Left unchecked it leads right to world improvement...and thence to Hell.

Still, in the spirit of civic betterment, today exceptionally, we offer a bit of advice to financial authorities all over the world. In a word:

Default!

When you have more debt than you can pay, it is always best to own up...default...hang your head...say you're sorry...promise not to do it again...

..and go about your business. And do it as soon as possible.

Whence cometh this august advice? From the pages of history - recent...and not so recent.

In the second half of the 19th century, the Arab states borrowed heavily from Europeans. The Ottoman Empire was an anachronism. The modern state had already been developed by Napoleon and Bismarck. Meanwhile, in America, the War Between the States sealed the fate of the founding fathers' republic. The limited government of Jefferson became the runaway military government of Lincoln...and later the all- powerful social welfare state of Franklin Roosevelt.

Back in the Old World, in the 19th century, modern technology gave Europeans a huge advantage over their neighbors. The Ottomans - who governed from the Balkans to Morocco - were being left behind. Their economies were less productive, so they lacked the tax base needed to sustain modern armies. So, they brought in European entrepreneurs and European capital to build railroads, canals and other improvements.

Then, as now, declining economies were supported by more dynamic ones.

"China's lending hits new heights," says a headline at The Financial Times today.

China has the most dynamic economy in the world...with $2.8 trillion in reserves, most of it in dollars. It is lending money all over the world. It is America's biggest creditor. And now it is helping wobbly European nations go deeper into debt too.

Foreign money comes at a cost. When the Ottomans couldn't pay, they tried austerity...and then borrowed more. The natives grew restless under the austerity measures. The debt grew larger too...as more and more money was needed to support previous borrowing.

Soon, there was no way out. Backed by better armies, the Europeans foreclosed. France's general Bugeaud laid waste to Algeria's fertile plains. Later, France found a pretext to invade Tunisia. Italy took Libya. Britain invaded Egypt. Soon, Europeans were in control of all of North Africa...and much of the Levant.

Lesson # 1 - don't borrow from foreigners.

Lesson #2 - if you get into trouble, don't borrow more from the foreigners. Default.

And we return to our theme...

Next, it was the Europeans' turn to be the borrowers. They got into a nasty, pointless war in 1914. The French borrowed from the English. The English borrowed from the Americans. The Germans couldn't borrow, so they printed money.

Then, when the war was over...everybody waited to get paid. The Americans waited for the English to pay. The English waited for the French. And the French waited for the Germans. The Huns were supposed to pay reparations, but they were broke...so they printed more money. In the end, after many disasters, no one got paid...neither the Americans, nor the English, nor the French. Instead, they all suffered a worldwide depression and then another worldwide war.

Same lessons: if you can't pay; don't try; don't pretend. Default.

And now the European states are in debt again. Not because of war, because of the social welfare system...aging populations...and bank debt. They cannot pay. So they try austerity measures and borrow more. The Chinese and Japanese are the latest benefactors.

In the US...the problem is similar. The government runs at a loss. Debt mounts up. The states implement austerity efforts; they have no choice. The central government, like Germany, prints money.

Now, both America and Europe are the Old World. Their social welfare model is failing. It was developed as a response to the needs of the nation state in the early days of the industrial revolution. It was suited to an era with expanding populations, fast-growing wealth, large pools of factory labor and almost unlimited resources. Governments needed to keep the urban masses under control. It was no good to provide them with security, insist that they obey the laws, and let it go at that. The politician that promised only a dollar's worth of benefit for a dollar's worth of taxes was soon replaced by one who promised to give back $1.20...or $1.50. In theory, this made perfect sense. Once government became recognized as the servant of the people, rather than their master, the people had a right to get their moneys' worth. And then, why would anyone willingly submit to the authority of a government if it delivered no more than the citizen could get on his own? Why allow yourself to be forced to pay into the government's social security program, for example, if it paid out no better than a private plan? Or, if the government's health care system delivers no more or better service than you can get from private plans, what's the point?

The promise of government's social welfare projects was that they would take money from the few rich and the many as yet unborn in order to give it to poor and middle class voters. That is, voters thought they could get something for nothing. And, for a very long time, governments could deliver. They simply relied on the next wealthier, larger generation to make good on promises made to the previous one. It worked for 150 years. But now the next generations are often smaller. And maybe poorer. The old live longer. And there are more of them. The rich are too few to pay the bills. The rate of growth has slowed down. The return on additional inputs of debt have turned negative, while trillions in unpaid debt and commitments comes due.

Again, governments in the Old World have borrowed and promised too much. But rather than default honestly and openly, (forcing the people who lent imprudently to take the losses) they try to put the burden of the losses onto the innocent citizen...and the unenlightened investor.

He will pay higher taxes. He will get less in services. His money...his savings...his pension - all will be devalued by inflation. If he has stocks...they too will likely be sold off in the financial crises to come.

But let's look at another, more recent example. Iceland.

You may remember, two years ago Iceland was a mess. Its banks had borrowed, lent, and speculated recklessly. Iceland's feds squirmed and winced. At first, the government decided it would do what Ireland was doing. It would rescue the banks...that is, it would bail out the banks' lenders with public funds.

But when the public caught on to what was going on, a referendum was held. Voters rejected the bailout as if they were voting against sin itself. More than 90% of voters cast ballots against a taxpayer bailout. We were impressed. We wrote about it. The "Patsy Revolt of 2009" we called it.

Unable to stick the voters with the losses, the government left the banks to default.

Was this the end of the world? Did Iceland slip below the North Atlantic waves...joining the Titanic on the chilly, dark bottom of the sea? Did commerce break down? Did the Icelandic money become worthless? Was this the "end of time"...the apocalypse forecast in the Bible?

Nope.

"Iceland is doing better than anyone could have hoped," reports Bloomberg.

Inflation fell from 18% down to 5% last year. The cost of insuring Icelandic debt fell to less than a third of the price in early 2009. Unemployment is barely 6%.

"Thanks to its rescue plan," says the IMF, "the recession in Iceland has been less deep than expected and not worse than in the other countries deeply affected."

How did they achieve this? Are the Icelanders smarter than the Europeans?

Not exactly. They tried the typical dead-end solution. The trouble was, no one would lend Iceland more money. And once the public revolted, after realizing that it would be left holding the bag, the Icelandic feds had no choice. They had exhausted all the bad ideas. They were forced to go with a good one.

The foreign debt was consolidated into a few banks...which then went broke. The remaining banks were left intact, ready to keep the country's financial machinery in business.

Lesson learned: got too much debt? Default quickly. Make it clean. Make it fast. Make it work.

There. That's all the advice we're going to give today. Any European or American government that would like more details could contact us on our mobile phone...if we had one.

Regards,

Bill Bonner

for The Daily Reckoning

-------------------------------------------------------

Here at The Daily Reckoning, we value your questions and comments. If you would like to send us a few thoughts of your own, please address them to your managing editor atjoel@dailyreckoning.com![]()

A look back over the last 100 years finds trends that go way beyond republican or democratic administrations. Almost every year, the reach of the federal government expanded. More people were covered by more programs...with more debt and spending obligations pushed farther into the foggy future.

The US Deficit Recovery Program and Other Fallacies

Why Gold Is Still a Good Investment

Everybody seems to be complaining about the unemployment rate, mostly (I suspect) those who are unemployed. Being but a heartbeat away from that dismal fate myself, due to my crippling handicap of Lazy Bum Syndrome (LBS), I empathize with their plight.

Inflation and the Damage Done

Economic Ruination from Money Creation to Price Inflation

Round and round China goes, and where she stops, no one knows... but, at least a few hedge funds are wagering that China’s economy is in a bubble likely to pop soon. Fund managers, including Hugh Hendry at Eclectica Asset Management and Mark Hart of Corriente Advisors, are shorting the China boom.

China Disses the Dollar

Working For Profit to Prop Up the Economy![]()

The Daily Reckoning: Now in its 11th year, The Daily Reckoning is the flagship e-letter of Baltimore-based financial research firm and publishing group Agora Financial, a subsidiary of Agora Inc. The Daily Reckoning provides over half a million subscribers with literary economic perspective, global market analysis, and contrarian investment ideas. Published daily in six countries and three languages, each issue delivers a feature-length article by a senior member of our team and a guest essay from one of many leading thinkers and nationally acclaimed columnists. Cast of Characters: Bill Bonner

FounderAddison Wiggin

PublisherEric Fry

Editorial Director

Managing Editor

Editor

Editor

Tuesday, 18 January 2011

Posted by

Britannia Radio

at

21:36

![]()