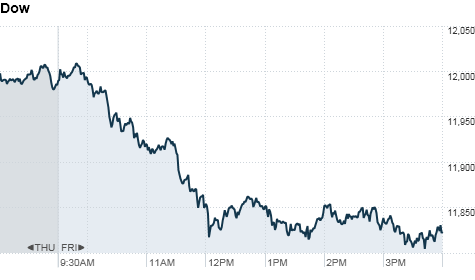

NEW YORK (CNNMoney) -- U.S. stocks plunged Friday, with the three major indices logging the worst daily drops in months, as investors grew nervous about political unrest in Egypt. The Dow Jones industrial average (INDU) lost 166 points, or 1.4%, the biggest daily drop since Nov. 16, 2010. A 3.9% drop in Microsoft's (MSFT,Fortune 500) stock led the blue chips lower despite the company postingrecord sales of $20 billion. The deep losses also ended the Dow's eight-week winning streak. The index slipped 0.4% during the week. The S&P 500 (SPX) slipped 23 points, or 1.8%, dragged down by Monster Worldwide (MWW), which issued a weak outlook, and Ford (F, Fortune 500), which postedlower-than-expected earnings. The tech-heavy Nasdaq dropped 68 points, or 2.5%, with shares of Amazon (AMZN, Fortune 500)sinking more than 7%. Those were the biggest drops since August for the S&P 500 and Nasdaq. Investors are worried that the situation in Egypt could intensify over the weekend, and took some money off the table ahead of that possibility. The CBOE volatility index (VIX), which is known as the VIX and is used to gauge fear in the market, jumped more than 24% Friday. "Political turmoil is not good for the stability of the market, and Egypt is a populous country that borders one of the busiest shipping routes in the world, so that's getting investors nervous," said Peter Tuz, president at Chase Investment Counsel. The Market Vectors Egypt Index ETF (EGPT) slipped 3.4%. The ETF tracks the performance of companies that are either listed on an exchange in Egypt or that generate the majority of their revenues in Egypt. Oil also rallied on concerns about crude shipments through the Suez Canal, which is controlled by Egypt. About 8% of global sea trade travels through the canal, making it one of the world's busiest waterways. Crude for March delivery rallied 4.3% to settle at $89.34 a barrel. Investors are also taking in quarterly financial results and the latest reading on U.S. economic growth. Stocks managed to log modest gains Thursday, pushing the Dow and S&P to their highest levels since the summer of 2008. The Dow ended 4 points higher at 11,989.83 -- just shy of the 12,000 mark, while the S&P ticked up 3 points to end just below 1,300. U.S. markets have been steadily rising, with the Dow briefly eclipsing the 12,000 benchmark earlier this week. Economy: The U.S. economy grew at a 3.2% annual rate in the fourth quarter, according to an advance reading on gross domestic product released Friday morning. That's up from a 2.6% rate in the third quarter. Though the figure missed economists' expectations for a slightly higher 3.5% rate, personal consumption, a measure of consumer spending, jumped by 4.4% in the fourth quarter -- the strongest increase in that reading in at least four years. The University of Michigan's consumer sentiment index rose to 74.2 in January, slightly better than the 73.2 expected by economists. World markets: European stocks ended lower. Britain's FTSE 100 and France's CAC 40 dropped 1.4%, while the DAX in Germany fell 0.7%. Asian markets ended the session mostly lower. The Shanghai Composite edged up 0.13, while the Hang Seng in Hong Kong slumped 0.7% and Japan's Nikkei tumbled 1.13%. Losses in Japan came as investors had a chance to react to Thursday's news, that Standard & Poor's downgraded Japan's sovereign credit rating to AA- from AA on concerns of mounting debt. Currencies and commodities: The dollar fell almost 1% against the Japanese yen, but rallied 1% versus the euro and 0.4% the British pound. Gold futures for February delivery climbed $22.30, or $1.7%, to settle at $1,340.70 an ounce Bonds: The uncertainty over Egypt also boosted demand for the safety of U.S. government debt. The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 3.33% from 3.39% late ThursdayStocks plunge amid Egypt unrest

Click chart for more market data.

Click chart for more market data.

Saturday, 29 January 2011

Posted by

Britannia Radio

at

08:06

![]()