Gerald Celente: “COLLAPSE: IT’S COMING! ARE YOU READY?”

Trend forecaster Gerald Celente of the Trends Journal advises subscribers of his quarterly newsletter that the collapse is on it’s way and will become apparent to the population of the entire world in short order.

While pundits argue over whether or not a double dip recession is coming, many on the street have finally begun to realize that another recession is the least of our problems.

Via Gerald Celente’s June 13, 2011 Trend Alert

Everything is not all right. And things are going to get worse … much worse. The economy is on the threshold of calamity. Wars are spreading like wildfires. The world is on a razor’s edge.

Not so, say world leaders and mainstream media experts. Yes, there are problems, but the financiers and politicians are aware of them. Policies are already in place and measures are being taken to correct them.

Whether it’s failing economies, intractable old wars or raging new wars, the word from the top always maintains that steady progress is being made and comforts the populace with assurances that the brightest minds and the sharpest generals are in charge and on the case. On all fronts, success is certain and victory is at hand. Only “patience” is required … along with more men, more time and more money.

As far as these “leaders” and their media are concerned, the only opinions that count come from a stable of thoroughbred experts, official sources and political favorites. Only they have the credentials to speak with authority and provide trustworthy forecasts. That they are consistently, if not invariably, wrong apparently does nothing to diminish their credibility.

How can any thinking adult possibly imagine that the same central bankers, financiers and politicians responsible for creating the economic crisis are capable of resolving it?

…

Yet even in the face of their proven failures and gross incompetence, anyone daring to challenge the party line or the conventional wisdom is dismissed as an “alarmist,” “fear monger,” or “gloom-and-doomer.”

…

…with the Dow on a down trend and the economic data increasingly pointing in the direction of Depression, Washington and Wall Street remain in denial. The only debate among the “experts” is whether or not a “double dip” recession is likely.

However, for the man on the street – pummeled by falling wages, higher prices, intractable unemployment, rising taxes and punitive “austerity measures” – “Depression,” not “recession,” and certainly not “prosperity,” is just around the corner.

…

Trend Forecast: The wars will proliferate and civil unrest will intensify. As we forecast, the youth-inspired revolts that first erupted in North Africa and the Middle East are now breaking out in Europe (See “Off With Their Heads,” Trends Journal, Autumn 2010)

Given the trends in play and the people in power, economic collapse at some level is inevitable. Governments and central banks will be unrelenting in their determination to wring every last dollar, pound or euro from the people through taxes while confiscating public assets (a.k.a. privatization) in order to cover bad bets made by banks and financiers.

When the people have been bled dry financially and have nothing left to give, blood will flow on the streets.

We’ve been saying it for over two years, and we maintain our position today – this is a depression. No amount of government machination is going to fix the fundamental problems within the financial, economic, monetary and political systems of our country. Nature will force balance one way or the other. And nature, as we have come to learn in recent months, can be very brutal.

Make no mistake. We are in as serious a time today as any in the last century. While we may not be directly engaged in a World War, it is not that far off. Analysts often speak of the engagements in the middle east as four separate wars (Iraq, Afghanistan, Libya, and now Yemen). We may be engaged in conflict across four different borders, but there is only one war – and it will soon expand. It’s only a matter of time before China and Russia get involved. Look at the middle east and you’ll clearly see this is a battle for resources and regional dominance. Chinese state owned companies have had to withdraw 30,000 employees from the Libyan oil fields. Ownership, it seems, has now been granted to the “rebels.” Similar activities, though hidden from the view of the masses, are occuring all over the world. How long before the Chinese, the Russians and others take a real stand – a military stand?

Even if we were to avoid global war, which is doubtful in the long-term, the fact that the super majority of the world’s population is broke and going hungry means that rioting, revolution and bloody civil wars cannot be avoided. If you still believe that the powers that be, those politicians who are in bed with the very financiers and military industrial complex that is robbing us blind and pushing us towards war, have your interests at heart, then you need to have your head examined. It’s time to be blunt. You either get it, or you don’t.

The United States of America, as well as the world, will be unrecognizable as it exists today within the next decade.

We offer the same advice that Mr. Celente has offered:

…it has to be treated as if you are preparing for battle; expect the unexpected and prepare for the worst, which in these perilous times could be a declaration of economic martial law. Banks may close, currencies may be devalued and deposit withdrawals may be imposed. Remember Gerald Celente’s basic survival strategy, “GC’s Three G’s: Guns, Gold and a Getaway plan.”

We’re in the middle of an unprecedented global crisis. Make preparations or suffer the consequences.

More Cruxallaneous:

Top trend forecaster: A MAJOR war is coming

Top trend forecaster Celente: The crash of 2010 is starting now

Top trend forecaster: U.S. could be headed for the first "Great War" of the 21st century

Author: Mac Slavo

Date: June 13th, 2011

Copyright Information: Copyright SHTFplan and

-------------------------------------------------------------------------------------------------

Nouriel Roubini gets it. He writes in

today's FT:

The muddle-through approach to the eurozone crisis has failed to resolve the fundamental problems of economic and competitiveness divergence within the union. If this continues the euro will move towards disorderly debt workouts, and eventually a break-up of the monetary union itself, as some of the weaker members crash out...

A reckless lack of discipline in countries such as Greece and Portugal was matched only by the build-up of asset bubbles in others like Spain and Ireland...

All successful monetary unions have eventually been associated with a political and fiscal union. But European moves toward political union have stalled, while moves towards fiscal union would require significant federal central revenues, and also the widespread issuance of euro bonds — where the taxes of German (and other core) taxpayers are not backstopping only their country’s debt but also the debt of the members of the periphery. Core taxpayers are unlikely to accept this...

Here the options are limited. The euro could fall sharply in value towards – say – parity with the US dollar, to restore competitiveness to the periphery; but a sharp fall of the euro is unlikely given the trade strength of Germany and the hawkish policies of the European Central Bank...

The German route — reforms to increase productivity growth and keep a lid on wage growth — will not work either. In the short run such reforms actually tend to reduce growth and it took more than a decade for Germany to restore its competitiveness, a horizon that is way too long for periphery economies that need growth soon.

Deflation is a third option, but this is also associated with persistent recession. Argentina tried this route, but after three years of an ever deepening slump it gave up, and decided to default and exit its currency board peg. Even if deflation was achieved, the balance sheet effect would increase the real burden of private and public debts. All the talk by the ECB and the European Union of an internal depreciation is thus faulty, while the necessary fiscal austerity still has – in the short run – a negative effect on growth.

So given these three options are unlikely, there is really only one other way to restore competitiveness and growth on the periphery: leave the euro, go back to national currencies and achieve a massive nominal and real depreciation...

Yet, scenarios that are treated as inconceivable today may not be so far-fetched five years from now, especially if some of the periphery economies stagnate. The eurozone was glued together by the convergence of low real interest rates sustaining growth, the hope that reforms could maintain convergence; and the prospect of eventual fiscal and political union. But now convergence is gone, reform is stalled, while fiscal and political union is a distant dream.

Debt restructuring will happen. The question is when (sooner or later) and how (orderly or disorderly). But even debt reduction will not be sufficient to restore competitiveness and growth. Yet if this cannot be achieved, the option of exiting the monetary union will become dominant: the benefits of staying in will be lower than the benefits of exiting, however bumpy or disorderly that exit may end up being.

Roubini is something of an optimist by thinking the euro has even five years. One point that Roubini does not focus on is that the fiscal undisciplined countries such as the PIIGS are likely, when resorting to their old currencies, to be aggressive money printers, thus moving from a bad situation to one that is even worse, possibly moving to hyperinflation.

That said it will remove the burden from relatively prudent governments such as Germany from supporting the reckless and that in the end is what will result in the eventual end of the euro.

------------------------------------------------------

10 Reasons To Short China – Part One

by ADMIN on JUNE 13, 2011

I’m reminded of Thomas Friedman’s famous quote from his book, “The Lexus and the Olive Tree” – “Buy Taiwan, Hold Italy, Sell France.” Never one to accept conventional wisdom, I try to look in some less-than-obvious places for information that makes me challenge my own assumptions. And like some of you, I change my mind from time to time (becoming less “pro-free trade” as they say because of the obvious skewing of how trade rules apply to various goods produced by various countries) and so have titled this post accordingly. And being a person more interested in the social sciences vs. the hard sciences, I like to look beyond the numbers and speak to the proverbial man on the street to augment and/or challenge some of those assumptions.

One assumption I have begun to challenge (reminiscent of Mark Twain’s quote, “The reports of my death have been greatly exaggerated”) suggests to me that the notion of China taking the lead over the US in terms of (fill in the blank) power appear premature.

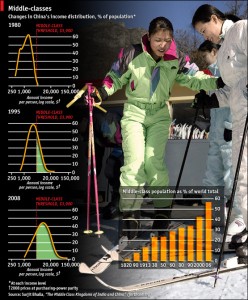

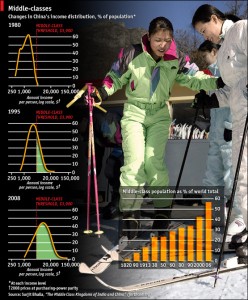

In short, I have begun to rethink my position on China vis-à-vis one assumption that all commodity markets, nearly all media and just about every economic pundit have made. The assumption that the Chinese middle class is growing and will continue to grow has given me pause to rethink that view. Because we don’t have the space or the time to properly define the middle class, we refer to this chart published in February, 2009, defining China’s middle class:

Source: The Economist

Further still, we borrow this definition of the middle class, also from the Economist: “The new middle consists of people with about a third of their income left for discretionary spending after providing basic food and shelter.” The article discusses China’s middle class and suggested back in 2009 that economic conditions can turn both ways. “Those at the bottom of the ladder do not have far to fall. But what happens if you have clambered up a few rungs, joined the new middle class and now face the prospect of slipping back into poverty?”

The anecdotal evidence we have gathered suggests it is possible that this may now be happening.

Here are 10 Reasons Why We Doubt China’s Ascendancy:

- The rise of “Maternity Tourism” – For reference, the other country that practices Maternity Tourism is Mexico. A baby born on US soil becomes a US citizen at 21 if his/her parents are not US citizens. It’s why places like El Paso, and other US border cities have such as high number of non-resident births. Why would well-to-do Chinese mothers be coming to the US to give birth, then?

- Gas prices in China are more expensive than gas prices in the US and that is not on a PPP (purchase price parity) basis, but on an actual dollars per gallon basis. Consider this: Shanghai gas prices as of Friday June 10 were: 8.5 RMB/liter = $1.31 per liter (3.785 liters to the gallon) = $4.96 per gallon.

- The real estate bubble may be popping and will harm not only the consumer market in China, but countries that export to China. The WSJ coverage includes discussion of plunging excavator sales within China as an example (we can write an entire post on the potential impact of popping the China housing bubble)

- Rising taxes have harmed Chinese small businesses and factories. Two months ago truckers in Shanghai went on strike protesting taxes and fees

- Many factories geared for exports have closed and will never come back

- Rising inflation has caused serious problems and this pundit also shorts China

- Chinese citizens have taken to micro-blogging where some political content can only be accessed through an ID and password, though one of our contacts confirmed the government routinely edits content it doesn’t like

- Follow the money. We asked another contact where the wealthy have parked their dollars. The reply we received, “outside of China,” followed by “Yes, I want to leave and take my kids to learn in another country if I can afford to” (this from someone who clearly falls into China’s ‘middle class’)

- After 30 years of China’s one-child policy, the birthrate now stands at 120 boys for every 100 girls. “When there are more men than women, social instability and crime increases in society,” said Valerie Hudson of BYU.

- We won’t even touch the issues of environment, government corruption,falling water levels on key trade routes, water shortages or China’s currency peg (those have been touched on by my colleagues already).

We’ll share our thoughts on what a “Short China” scenario might mean for global metals markets in a follow-up post.

–Lisa Reisman

More on China:

Must-see: These stocks could be starting a MASSIVE move

SocGen: China is about to set off a global inflationary nightmare

CRASH alert: New development could send commodity prices down 50% in a hurry

![]()