The Best Insurance You Can Buy In Advance of a Crisis

By Dr. David Eifrig, editor, Retirement Millionaire

Saturday, August 20, 2011

Over the past four days, I've shown you how to earn high rates of tax-free income… what safe and cheap stocks to buy… how to "juice" those stocks for 15% annual income payments… and how to make money no matter what the market does.

This is the fun stuff… the "rewards" of investing. These ideas can produce great income streams and capital gains for investors. I encourage you to get started on them now.

But sophisticated investors know focusing solely on "rewards" like income and capital gains is a huge mistake. It's not the key to making an investment fortune. Great investors don't focus on rewards…

----------Advertisement----------

A Stunning Power Shift – Back to the USA

If this video is any indication, we're about to see one of the greatest power shifts in geopolitical history.

A move that would have been simply unimaginable a decade ago.

And for investors on the right side of this trend, it could mean a windfall.

Click here for the full story.

---------------------------------

They focus on risk.

Great investors consider all the bad things that can happen to a company, commodity, bond, or a piece of real estate that they're buying. Only after they deem the risk/reward situation is appropriate do they put their money to work. Huge returns happen as a result.

Regular readers of my Retirement Millionaire advisory know I believe the current "doom and gloom" rhetoric – the idea that the world is headed for a huge debt crisis – is off the mark. Most of the doom-and-gloom analysts would have you put all your money in gold and canned goods, then move to a bomb shelter in Belize. I've studied the same numbers they have, and I'm comfortable owning stocks and bonds right now.

But no matter how confident I am in a glass-half-full world… I always want to keep a portion of my wealth in assets that will do well in case I am wrong. I want to join the "doom and gloomers" in owning precious metals like gold and silver. These assets could skyrocket in value if the gloom-and-doom crowd is right. I think of owning gold and silver the way I would home insurance… something I'm glad to have, but hope to never have to use.

Here's an example of how owning my favorite chaos hedges, gold and silver, can turn out to be a fantastic idea…

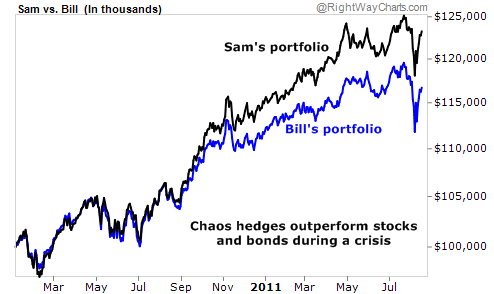

Let's use a couple of hypothetical investors – Bill and Sam – as examples.

Let's imagine that a year ago, Bill took $100,000 and invested it in a 50%/50% mix of stocks and bonds. That was a great decision. Since then, the stock market (as measured by the exchange-traded fund IVV) has risen nearly 6%. Bonds (as measured by symbol IEF) are up 23%. As a result, his portfolio is up nearly 17% and now worth almost $117,000.

However, in the last month, Bill has gotten nervous. His portfolio has dropped 2.5%, from a high of around $120,000 to $117,000. It even hit as low as $112,000. Like many investors, he's probably panicked.

Sam, on the other hand, invested 45% of his $100,000 portfolio in stocks, 45% in bonds, and 10% in silver and gold. The stock and bond side of his portfolio has performed like Bill's.

However, the $10,000 he invested in our gold and silver chaos hedges is now worth $19,315. As a result, his total portfolio is worth $123,000.

Even better, Sam is sleeping well at night. His total portfolio, buoyed by his chaos hedges, has only declined 1.5% since July's selloff.

You can see from the chart below how much better Sam's portfolio has done compared to Bill's.

The reason is, in times of chaos, investors drive up the price of gold and silver. As they become nervous about bad economic news… debt crises in Europe… and the specter of runaway inflation in the United States… investors have begun stockpiling gold and silver. And the prices have skyrocketed… In the past year, gold has run up from $1,100 an ounce to $1,800 an ounce. And silver is up to $40 from $15.

You should know, I'm not the kind of guy who lives in a concrete bunker. I don't think the world is about to end. I'm not anyone's idea of a "gold bug." Like I said, I view "chaos hedges" as a kind of portfolio insurance.

Here's to our health, wealth, and a great retirement,

Doc Eifrig

P.S. While panicked investors rush to gold, we have a great opportunity to buy into my favorite chaos hedge… silver.

I've showed my Retirement Millionaire subscribers one of the world's cheapest and safest ways to buy silver. It doesn't require any risky leverage or buying of mining companies that may or may not be around this time next year. Instead, it's a unique opportunity to own real, hold-in-your-hand silver for as little as $3. And even better, it's backed by the U.S. government.Click here to learn more.

Saturday, 20 August 2011

Posted by

Britannia Radio

at

16:19

![]()