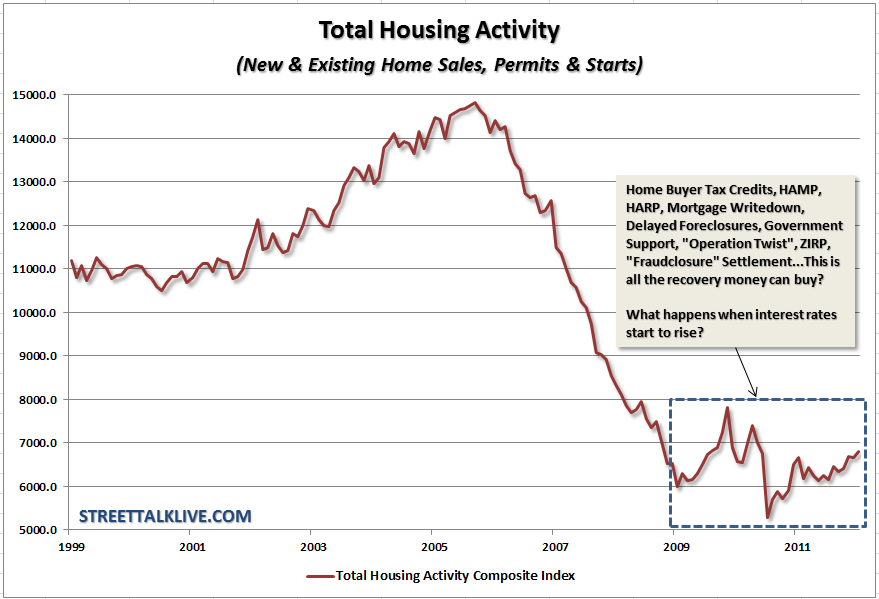

By Lance Roberts, CEO, StreetTalk Advisors There have been numerous media stories out over the last couple of weeks about the recovery in housing at long last. Of course, this is the same housing bottom call that we heard in 2009, 2010 and 2011 – so why not drag it out again for 2012. Eventually, the call will be right and they will be anointed with oils and proclaimed to be the gurus that called the bottom. In the financial world you only have to be right once. However, back on earth, where things really matter, housing is a major contributing component to long term economic recovery. Each dollar sunk into new housing construction has a large multiplier effect back on the overall economy. No economic recovery in history has started without housing leading the way. So, yes, housing is really just that important and we should all want it to recover and soon. The calls for a bottom in housing now, however, may be a bit premature as I will explain. The Total Housing Activity Index shown here is a composite of the sales of new and existing homes, new construction permits for single family homes and new single family home starts. As you can see we are still near the same lows that we were in 2009 at the end of the recession. Furthermore, and what is really worse, is that the “recovery” was built on the bank of a whole slew of tax payer funded bailouts, tax credits and incentives from HAMP to HARP to the Home Buyer Tax Credit. Not quite the recovery the government was hoping for. The recent bumps in housing have been due to the warmest winter on record in the last 5 years which is skewing the seasonal adjustments. With 1 in 4 home owners under some form of duress with their mortgage it is only a function of time until a further erosion in price resumes particularly as banks start to deal with the backlog of foreclosures and delinquencies that are on their books. The bottom line here is that while we have witnessed a very mild recovery in housing from the depths of the abyss; it is important to not forget that it has been with the help of a large amount of artificial support including the zero interest rate policy by the Fed and “Operation Twist” which has suppressed interest rates on mortgages to historic lows. That won’t last forever and as we wrote in our article on “Why Home Prices Have Much Further To Fall” people buy payments not home prices. The shear magnitude of the TOTAL inventory that must be cleared, the potential for rising interest rates, a weak employment market (no job=no house), declining real incomes and rising inflationary pressures will likely keep the housing market suppressed and disappointing for quite a while in the future. This is just a function of economics. Maybe we have seen the low point in housing? Maybe the bottom truly has been put in? A bottom, however, doesn’t mean that a sharp rise in prices or activity is just around the corner. This particular patient could very well remain comatose for much longer than people expect."Dr. Doom" Marc Faber:Government money printing

will create "economic Armageddon"The real state of the housing market in one simple chart

Monday, February 27, 2012

There have been numerous media stories out over the last couple of weeks about the recovery in housing at long last. Of course, this is the same housing bottom call that we heard in 2009, 2010, and 2011 – so why not drag it out again for 2012? Eventually, the call will be right and they will be anointed with oils and proclaimed to be the gurus that called the bottom. In the financial world, you only have to be right once.

However, back on Earth, where things really matter, housing is a major contributing component to long-term economic recovery. Each dollar sunk into new housing construction has a large multiplier effect back on the overall economy. No economic recovery in history has started without housing leading the way. So, yes, housing is really just that important and we should all want it to recover and soon...

Read full article (with chart)...

More on housing:

Top housing blogger is calling a bottom in the U.S. housing market

What the dramatic declines in housing inventories could be signaling now

Unbelievable: The big banks are becoming desperate to avoid foreclosuresTHE HOUSING RECOVERY IN ONE INDEX

Monday, 27 February 2012

Monday, February 27, 2012

From Newsmax:

Economist Marc Faber, publisher of The Gloom Boom & Doom report, says the Western standard of living won't recover, let alone rise.

"Government debt is rising everywhere," Faber tells Yahoo Finance. "We have stimulus packages, we have central banks that will print money (because) there is no other option to keep the system going," he said.

"The stimulus today is a fiscal deficit of around $2 trillion. It will go up..."

More from Marc Faber:

From Pragmatic Capitalism:

27 FEBRUARY 2012 BY LANCE ROBERTS 2 COMMENTS

Posted by

Britannia Radio

at

15:10

![]()