Water: "moral questions" on profits

Tuesday 11 June 2013

Cox is an interesting man. Former chief executive of Yorkshire Water and Anglian Water, he is now poacher turned gamekeeper, having been appointed last October as chairman of the Water Services Regulation Authority (Ofwat). And now he is now accusing Ofwat of having turned a blind eye to excessive profits from the water companies utilities, which, according to critics, translates into customers' bills being too high. Some water utilities are taking out annual dividends of up to 24 percent of their regulatory equity. It has also been alleged that some companies use shareholder loans to avoid UK taxation. At the same time, hard-pressed customers have seen annual bills rise by 13.5 percent since 2010-11, while their incomes have fallen. These are normally regarded as business questions but Cox is arguing that they also raise regulatory and moral questions. Not least, the structure of the water industry, he writes, has changed markedly over the past six years, with private ownership largely replacing the listed companies created at privatisation, and thus requiring a review of how they are regulated. What's been happening at the Ofwat end, though, is that the regulator has been giving the water companies a free pass on loan costs. Since 2009, it has allowed then to charge 3.6 percent when, in practice, debt now costs no more than 1.25 percent. High RPI levels – to which revenues and the assets are indexed – have added unexpected gains. On top of this, a good number use high-coupon shareholder loans to improve their equity returns beyond the currently exceptional returns from the regulated entity. It appears that this reduces tax liability for the benefit of shareholders which, although legal and common in private equity companies, are sometimes morally questionable in vital public services. Cox seems to view this in terms of perception, arguing that companies need to maintain trust in the industry, a duty "we all owe to government and customers". Customers, he says, look at companies’ behaviour, management reward, trust, service and price. That shapes their attitude towards them and whether or not they trust them. To provide today's service and to build resilience, Ofwat must protect customers' willingness to pay for the under-investment of the past. Here, he refers to the damage inflicted on trusted consumer brands in recent months by alleged tax-avoidance structures. Water company licences require proper regard for the UK Corporate Governance Code, he adds, then revealing that there is not a single company that fully complies or satisfactorily explains why not. And while some investors have responded in an open manner, other have hidden behind "investment banker-speak", complaining that the "new" Ofwat is "piercing the corporate veil". But, says Cox, if a veil hides practices that do not stand the test of public interest, then it is our duty to lift that veil. It is regrettable if directors have not done so already.

However, Cox is not well-placed to complain. Ofwat's charging methodology is shrouded by its own veils of corporate-speak, rendering its "charges schemes" masters of complexity and obfuscation. No more is it possible to get a straightforward view of the basis for charging, that it is to discover precisely how water companies structure their charges.

On the other hand, information from the so-called "consumer watchdog", the Consumer Council for Water, is patronising, superficial and entirely unenlightening. The new Ofwat chairman says his highest priority is to deliver a forthcoming five-year price review in a way that benefits customers, while ensuring that the sector can efficiently raise funds. In this, he says he is committed to incentivising and rewarding capital fairly while firmly protecting customers and the industry's legitimacy. Cox, however, is being too optimistic about the industry's legitimacy, and his own capability to bring the industry to heel. Small things speak volumes to the public when they assess what are increasingly being regarded as the new generation of "fat cats". Thus does a commenter remark that the CEO of Yorkshire Water more than trebled his salary when Yorkshire Water Authority became Yorkshire Water PLC - Mr Cox himself being a beneficiary. And if Cox thinks the water companies are going to roll over and suddenly become consumer friendly, he looks set to be disappointed. Coming out fighting is Thames Water. Its finance director, Stuart Siddall, has declared its conscience "absolutely clear", parading a fall in pre-tax profits of nine percent to £550m, on a turnover of £1.8 billion. By contrast, the Cooperative Retail Group made £7.4 billion in food revenue for the year ending 5 January 2013, and an operating profit of £288.4 million. Thames puts this "downturn" - a profit level that any supermarket group would kill for - to bad weather, rising energy costs and, significantly, unpaid customer bills. As a result, the company booked a £5.1 million tax credit, paying no corporation tax at all, but hitting customers with a 6.7 percent increase. In an attempt at damage limitation, it says it has paid business rates and other taxes, such as the income tax on behalf of its employees, which amounted to about £150 million. This, though, is a company with a serious image problem. In 2001, it was bought by the German company RWE, who own nPower, which then sold it to Kemble Water Holdings in 2006, "following several years of criticism and failed leakage targets". Kemble is a consortium run by an investment fund managed by Macquarie Bank, an Australian bank which was founded in 1969 in Sydney as Hill Samuel Australia, a subsidiary of Hill Samuel, UK. That company, in turn, is owned by Lloyds TSB. With this labyrinthine ownership structure, the public is only too well aware that it is not so much paying for water services, as funding a segment of the financial services industry. Thames Water accounts show it paid £231.4 million in dividends to its parent company, with £279.5 million having gone that way the previous year.  The accounts also show it paid £328.2 million interest on "intercompany loans", paid via a Cayman Islands funding vehicle to its external bondholders such as pension funds. Since 2006 it has reported post-tax profits of £1.8 billion and handed £957 million to its shareholders. And with such much money being diverted offshore, the public have been "sold down the river", as the Independent puts it on its front page. The accounts also show it paid £328.2 million interest on "intercompany loans", paid via a Cayman Islands funding vehicle to its external bondholders such as pension funds. Since 2006 it has reported post-tax profits of £1.8 billion and handed £957 million to its shareholders. And with such much money being diverted offshore, the public have been "sold down the river", as the Independent puts it on its front page.Such is the corporate arrogance, though, that Siddall seems unaware of Cox admitting that Ofwat has been too lax in allowing the water companies excessive profits, defending the current profits on the basis that the 4.31 percent return was "below what was determined by Ofwat". By such means, Ofwat becomes the apologist for the industry rather than its regulator. Thames chief executive Martin Baggs, meanwhile, has been awarded a pay rise of 5.9 percent, taking his basic salary to £450,000. He has also scooped a bonus of £274,000 as part of a scheme to "reward significant improvement in the group's financial and corporate performance". Next month, he will pick up a further £366,000 in shares under the company's long-term incentive plan. Even then, this is relatively modest compared with Yorkshire Water, whose CEO Richard Flint takes home nearly £1 million in salary and bonuses. He has presided over a six percent rise in operating profits, up to £331.5 million last year, compared with £303.3 million in the previous period. Without adding to its customer base, the company managed to increase its turnover by four per cent to £936.2 million (up from £893.6 million), achieved almost entirely from increased charges and a fall in capital expenditure of four percent, to £385.7 million. This year, the average bill rose by 5.1 percent, well above the current inflation rate of 2.6 percent. Chairman Kevin Whiteman thinks this a "good overall business performance", as well be might for a company that is free to sting its customers with inflation-busting charges, irrespective of customers' willingness to pay. It is quite fitting, in a way, that these are companies which also own the sewers which transport domestic sewage. Dealing with the products of this enterprise, they must be so used to the stench that they no longer notice their own. COMMENT THREAD Richard North 11/06/2013 |

EU politics: Cameron – a "little European"

Monday 10 June 2013

The prime minister is arguing that the national interest requires the UK to be represented at the highest level in a multiplicity of international organisations, i.e., at the "top table". And to that effect he asserts that part of his international ambitions for the UK "is our place at the top table. At the UN. The Commonwealth. NATO. The WTO. The G8. The G20 and yes - the EU". Now, from that, there can be only one of two conclusions. Either the prime minister is colossally ignorant of the way the world works, or – a more cynical interpretation – he believes that we are totally ignorant and he can hoodwink us with deliberate untruths - aka lies. For the prime minister to assert that the UK can be at the "top table" of both the EU and the WTO, for instance, is to say that one or other of those conclusions must be the case. For even the meanest of us knows that, within the EU, trade policy is an exclusive competence of the commission. When it comes to dealing with the WTO, the framework for negotiations is decided at EU level by consensus, and we are then represented at the WTO "top table" by the European Commission. It is thus the case that membership of the EU gives us access to the "top tables" of EU institutions, but the very fact of our membership excludes us from the WTO top table. We can sit at one, or the other, but not both. Furthermore, this is repeated across the board. When it comes to the UN – and its many subsidiary bodies – even where the EU is not directly represented as of right (and in an increasing number of cases it is), we agree to be bound by a pre-agreed "common position" and do not represent our own national interests. But increasingly, we are not even represented on international bodies. For instance, as we pointed out earlier, when it comes to the World Forum for Harmonization of Vehicle Regulations, we have no direct membership and our interests are represented exclusively by the European Commission. Similarly, on the vital North East Atlantic Fisheries Commission, which jointly manages the fisheries in the region, the UK interest is represented by the European Commission, and we are not even parties to the enabling treaty, the EU having taken over our seat. Thus, Mr Cameron simply should be asserting that we can hold "top table" positions in a range of international organisations – in many instances, it is a question of "either or". If he is doing so out of ignorance, then it is a terrifying prospect to have a prime minister who does not know such things. If he is seeking to hoodwink us, that is deeply insulting. But that makes him either a fool or a liar, and I don't know which is more objectionable. Of course, a case could be made that, by assuming the "top table" position in the EU is worth the sacrifice of reduced direct representation in other organisations, such as the WTO. This is not one with which I would agree, but the case can be made. But Mr Cameron is not making that case. He is advancing an argument which is deeply flawed and, if advanced knowingly, would be fundamentally dishonest. Upon this, though, Mr Cameron builds his case further, stating: My argument – and the argument of this government – is that to succeed, it's no use just hiding away from the world; we've got to roll our sleeves up and compete in it. And it's no use just giving in to the world – we've got to be unashamedly bold and hard-headed about pursuing our national interests.With that, he rejects the "Little Englander" approach, arguing that he is "ambitious about pursuing our national interest and standing up for our values". But, in seeking the claustrophobic embrace of the EU, he is in fact demonstrating that he is something far worse – a narrow "little European". COMMENT THREAD Richard North 10/06/2013 |

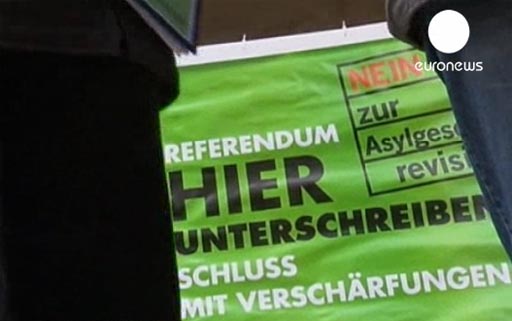

Immigration: Swiss vote for tougher rules

Monday 10 June 2013

This we flagged up on 1 June and the results are now being widely reported, in the German mediaand elsewhere - everywhere except the British press. As it stands, the Swiss people have approved a toughening up of the law, with 78.4 percent of those who voted accepting the proposition. This a regarded as a "sharp defeat" for NGOs and political left who have said it the new rules are too restrictive, and have been campaigning hard against "exclusion and xenophobia". Despite that, the changes are fairly modest. As well as stripping benefit rights from asylum-seekers convicted of criminal behaviour, they remove from the grounds on which asylum can be claimed, refusal of military service. Asylum seekers will also have to present themselves at the Swiss border instead of, as at present, being able to request asylum from Swiss embassies in other countries. There is also provision for national centres for processing asylum-seekers, as well as for sites housing those considered to be troublemakers. Asylum-seeking has been on the increase since 1999, since the Kosovo war, but as numbers have increased, the majority of applicants are coming from from Eritrea, Nigeria, Tunisia, Serbia and Afghanistan. More than 28,000 applications were recorded last year, a record since 2002, and the total awaiting processing stands at about 48,000. However, it has to be said that the issue has not sparked a string debate and the turnout is recorded at a mere 38.9 percent, giving a mandate for the proposition of only about 30 percent. One assumes that the non-voters were content to see the widely expected positive result to prevail. The most recent poll in late May showed 57 percent in favour of tougher asylum rules. Given the concern expressed about immigration throughout Europe, though, the Swiss result is a startling demonstration of people power, and contrasts sharply with the apparent inability of EU member state governments to determine their own immigration policies. One might have thought, therefore, that the British – supposedly eurosceptic – media might want to highlight an example if what happens when people are free to make their own rules. But, in this case, even the BBC – which did recently highlight tightened controls on EU migrants to Switzerland – has been silent. In fact, the BBC and others are devoting their resources to retailing complaints about "new visa rules" which, says the All-Party Parliamentary Group on Migration in a new report, are "tearing British families apart". The Labour MP Virendra Sharma, who was born in India, said: "The Government has set the bar for family migration too high, in pursuit of lower net migration levels. These new rules are keeping hard-working, ordinary families apart. I, and others like me, would not have been able to come to the UK to join my family if these rules had been in place then. Today we are calling on the Government to think again". This is the MP for Southall, where immigrant camps are being set up in abject squalor, and Mr Sharma thinks that rules that would have kept him and many like him out of the country are a bad thing? Nevertheless, the report's findings were also welcomed by the Migrants' Rights Network, giving Ruth Grove-White, its policy director, a platform to emote about foreigners being excluded from the UK. But of settled people's rights, on the basis of the Swiss model, comment there is none. COMMENT THREAD Richard North 10/06/2013 |

EU politics: the Single European Sky fails to deliver

Monday 10 June 2013

Achieving performance targets to increase European airspace capacity and cut costs go to the heart of the Single European Sky (SES), says the Commission. They are vital for its entire success, and the success of the performance scheme will depend on the level of ambition of EU-wide targets for the second reference period which will run from 2015 until 2019. Overall, the Commission has a point. The inefficiencies caused by Europe's fragmented airspace bring extra costs of close to €5 billion each year. They adds 25 miles to the distance of an average flight, forcing aircraft to burn more fuel. And be comparison, the United States controls the same amount of airspace, with more traffic, at almost half the cost. But, while this is the very sort of thing that Mr Cameron might laud as a perfect example of why we need this wondrous construct called the European Union, French unions are very far from impressed. Having leaned of the new performance targets, they have decided to stage a three-day strike for this week. The union action will coincide with the next phase of the European Commission plans, scheduled for Tuesday, when the Single European Sky (SES) II+ package of measures is announced. The European Transport Workers' Federation (ETF) had already announced that that air traffic management employees will mobilise for a European Action Day on 12 June to demand the establishment of a fair, cooperative and social SES and to "stop a never-ending process of liberalisation, deregulation and cost-cutting in the ATM industry". And there we have the dagger poised at the heart of the European experiment. In October last yearvice-president Siim Kallas, European Commissioner for transport was complaining that, after ten years, the SES was still "not delivering". The core problems, he said, remained the same: too little capacity generating the potential for a negative impact on safety at too high a price. "There are some signs of change", he added, "but overall progress is too slow and too limited. We need to think of other solutions and apply them quickly. There is too much national fragmentation. Promised improvements have not materialised". Yet, whenever it comes to delivering on its plans, the EU always fails. It is great at bullying Britain, and forcing member states to comply with whatever comes out of Brussels, but whenever the shoe is on the other foot, and Brussels has to deliver, nothing serious ever gets done. But then, trying to get the liberal "free-market" British to cosy up with the dirigiste French and the rule-bound Germans, together with the anarchic Belgians, all with the corrupt Greeks, the Italian jokers and the rest, always was a crazy idea. At least though, there is some small comfort for any eurosceptics trying to fly to or over France in the next few days. They can blame the delays and disruption on the EU and ruminate that this is how it is always going to be when the EU tries to run the show. COMMENT THREAD Richard North 10/06/2013 |

Tuesday, 11 June 2013

Posted by

Britannia Radio

at

08:26

![]()