Energy: the back-up bonanza

Monday 8 July 2013

With no apparent evidence of conventional back-up plants being built, little did we imagine that, under our very noses, the capacity was being provided in a form undreamed of. Standby diesel generators are being bought up on a colossal scale, by a growing band of companies set up to exploit what is turning out to be a huge "back-up bonanza". This is facilitated by the so-called Short-Term Operating Reserve (STOR) and one company quick to take advantage is Green Frog Power 214 Limited. It was originally set up to invest in and develop "new green technologies", collecting used cooking oil and turning it into "environmentally friendly biofuel" for generating electricity in their own green electricity generators. This electricity was "100 percent renewable" and supplied to Green Energy UK through the National Grid. Now, the company has been seduced by "the dark side", claiming to have "a pipeline" to build 500MW of power generation across the UK, using dirty diesel as a fuel. The National Grid, it explained by way of justification, "needs our power to alleviate stresses on the transmission systems, for example when other power stations shut down or when the wind stops blowing".

Until there is a breakthrough in non intermittent green energy or people are prepared to accept power cuts, the company said, it is essential to have back-up for wind power. The greenest and simplest back-up is provided by reciprocating engines, with 100 years of proven history. This enabling technology is low carbon and provides the flexibility to allow the proliferation of wind and other intermittent generation.

In October 2010, the Birmingham-based company was awarded a 15-year Short Term Operating Reserve (STOR) contract with National Grid to develop a series of twelve 20MW power plants. In conjunction with equity partners, InfraRed Capital, it then secured a £60m finance from the Royal Bank of Scotland (RBS), for a project with a value of £75 million. Already, it had identified as site in North Lincolnshire and was seeking other sites in the North East, Yorkshire, South Wales and Devon. In March 2010, it was telling the Yorkshire Evening Post that it planned to build 21 mini power stations at sites across Yorkshire. Known as "Embedded Generation Stations", the standard model was a 6MW unit, located adjacent to an existing sub station, operating for less than 150 hours a year. Then, in March 2012, the Company applied for planning permission for an embedded 20MW distributed standby power plant, comprising 52 diesel generators, within the Plymouth Main substation near Plymouth. The permission was granted in May 2012. A 20MW unit has also been completed at the Garnoch Site in Swansea, and a smaller 6MW units has been installed in Tregaron, Wales. The generating equipment has been manufactured by FG Wilson which claimed that, in November 2011, within hours of Green Frog opening its site in Somerden Road, Hull for service, a sudden surge in electricity demand had prompted the National Grid to call them for emergency back-up. An output of 20MW was produced continuously for seventy minutes without incident, proving the success of this STOR project. In June 2013, it was back to Plymouth, where another application was made for a similar 20MW unit, this time by a different company, Fulcrum Power Limited, working with Armstrong Energy. Another 20MW unit, the operator unknown, is located in Flatworth, Tynemouth, and is due for completion in the fourth quarter of 2013. The unit has been identified by UESL, but no client has been named. Then, specialist installer, Ocktcom boasts of having completing their customer's first four STOR power plants in 2011, Ocktcom are now well underway with supplying and installing SDMO generators and ancilliary equipment for the latest 20MW site. This may be SSE. Another firm, this one an aggregator, UK Power Reserve, offers aggregated STOR services to industry partners and participants who have an asset base but power generation is not their core business. It sought and obtained in July 2011 planning permission for a 20 diesel generator site inMelton Mobray. There are many much smaller operators, such as Renewable Energy Generation which operates 8MW STOR generators, using biodiesel, to augment its fleet of windmills. As of 30 June 2012, though, it had over 40MW of STOR projects available for construction. There is the publishing giant DC Thomson, which has had two STOR-compliant HV 2500-1 KVA diesel generator sets installed in its printing plant in Dundee, Scotland, and Wadswick Energy which has been operating a 1MW STOR diesel generator on-site for over a year. In addition, there are companies such as UPS Systems PLC, this one operating the "GENsmart STOR scheme", which allows operators to recover the complete costs of new generators through participation in their STOR scheme. Industry consultants, Generator Power Systems, on the other hand, offer to guide companies through the certification process, including the initial engineering and equipment surveys, upgrading existing equipment, new generator installations, ongoing maintenance and the final contract with National Grid. What we are seeing, therefore, is a major change from the original concept, where the system was originally devised to use spare capacity, though running unused standby generators. Now, it is dragging new capacity into the system, with dedicated generators installed solely to service the reserve market. Driving this change is money As Autonomous Mind points out, billions of pounds are on offer. We see that the energy company npower has estimated that the STOR price paid when stand-by generation capacity was called for was £180-280/MWh in 2010. There was also a payment of around £7-10/MWh. This was worth around £30,000-45,000/MW per annum to an owner of stand-by generation. That, already, was roughly eight times the industrial tariff for power. But, as the demand for operating reserve increases, the price is expected to rise and the incentive to participate will grow stronger. By 2015, National Grid estimates that the utilisation payment will have risen to £544/MWh, and by 2020 the figure is £685/MWh, all in real terms in 2010/11 money. That is an increase of 96 percent in ten years providing a strong incentive for new owners of generation to participate. Across the whole market, the total payments for being available and for generating could reach £945 million per annum by 2020, up from £205 million in 2010. That is an increase of 350 per cent in ten years. Compared with the cost of providing the same capacity through spinning reserve, this is actually cheaper but, effectively, it still represents a £1 billion premium for backing up windmills. The industry is thus complimenting itself on having found "the cheapest way to maintain an uninterrupted power supply" for the scenario the UK finds itself in, calling this massive extra cost "to the benefit of all consumers". When the National Grid is then prepared to offer long-term contracts to players who can then go to equity financiers to fund new generators, investors are rubbing their hands at the prospect of a guaranteed nine percent return on their capital, with no risk. Money might be driving the change, but greed is driving our energy policy, with the ultimate absurdity of having upwards of 2,000 diesel generators keeping the "low carbon" windmills in business - greed, compounded by utter insanity. COMMENT: "STOR" THREAD Richard North 08/07/2013 |

Booker: high prices in STOR

Sunday 7 July 2013

This is, as explained by Booker in his column today, because of the emergence of a "secret weapon", known by the acronym STOR (Short Term Operating Reserve). Thanks to smart computer management, this will enable the National Grid to call on a vast network of standby diesel generators – amongst other measures - to keep the electricity supply running. Because of the complexity of the issue and its novelty to most readers, I have agreed to publish this longer post alongside the Booker column, explaining the issues more fully than space allows in the column, including the referencing links which are absent from his online piece and the print version. Our assertion that power cuts are no longer an issue does, of course, represent something of a change of heart for both of us. Separately and together, we have both been warning of possible power cuts, myself since the first days of this blog, and consistently thereafter. In those early days, though, the expectation was of increasing demand which, with the need to provide back-up plants for the growing wind estate, meant that we could in the future be looking at anoverall requirement of as much as 120GW by 2020 and very substantial shortfalls. However, the lending crisis triggered a recession that brought with it a substantial fall in demand, which now peaks at about 60GW and shows no signs of immediate increase. Thus, by September 2009, I was cooling the rhetoric, and cautiously predicting that there was little real risk of power outages. Rather, as supplies grew even tighter, there was to be rationing by price. However, with the earlier than expected retirement of so many coal-fired power stations and the delay in replacing the nuclear estate, that prediction was beginning to look a bit optimistic, and this yearothers were beginning to trigger media concerns about power cuts. Having followed the politics of energy for so long, though, we were starting to pick up the growing body of evidence, indicating that novel measures being considered to address the coming shortfall, and in particular to deal with intermittency issues associated with wind-generated electricity. As we looked further, we found considerable sophistication in what was the expanding field ofdemand management and demand-side response (DSR), along with the use of smart meters andsmart appliances. The complexity of some of the measures was alluded to during the debate on the Energy Bill, where we saw the concept of "negawatts" aired in Parliament, together with the concept of "electricity demand reduction" (EDR) and "route to market". Just as we were beginning to get to grips with this, however, up popped the Ofgem Electricity Capacity Assessment Report 2013 which purported to tell us that were in greater danger than ever before of suffering blackouts, as early as 2015. This, predictably, had newspapers such as the Daily Mail predicting imminent rationing and even worse. These dire predictions were repeated by broadcasters, numerous bloggers, facebook commenters and forum pundits. But what was painfully evident was that few had taken the trouble to read the original Ofgem report. Had they done so, they would have realised that the regulator had been carrying out predictive modelling, and the media had picked up a worst-case scenario based on assumptions which were hardly likely to materialise. Nevertheless, after neglecting the subject for so long, numerous media pundits suddenly seemed to acquire an expertise on energy policy that was belied only by the superficiality of their writing. Meanwhile, the bandwagons started rolling, as interest groups sought to exploit the issues for their own purposes. Meanwhile, a particularly egregious report in The Guardian had the antennae twitching. This had the paper's "energy editor", Terry Macalister, writing about hospitals "being asked to cut their power demand from the National Grid as part of a government attempt to stave off power blackouts.

Unwittingly, the author was describing an aspect of the (STOR) programme, which was then hinted at on the BBC TV Sunday Politics show last week. The pieces were starting to fall into place.

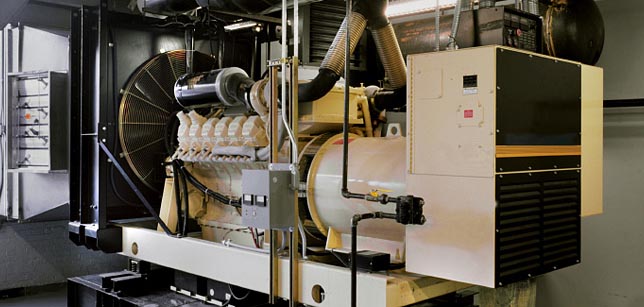

On the programme, Andrew Neil interviewed energy minister, Michael Fallon on "the latest on fears of power blackouts" (extracts published here). Under strong attack from Neil, who is determined to get an admission that the lights are about to go out, the minister should have been on the back foot. But Fallon was untroubled, calmly assuring Neil that: "We're organising new reserve capacity to come on-stream in a few year's time". When charged directly to estimate the chance of blackouts, Fallon told Neil that they were low. "We're going to make sure they don't happen. I can absolutely tell you", he said. Asked to guarantee that there would not be blackouts, Fallon goes on to say: We're not going to have industrial blackouts, factories shut at lunchtime and people sent home, or anything like that. We have Ofgem, the regulator, and the National Grid who are charged with making sure that in two to three year's time that doesn't happen and they have plenty of tools at their disposal to make sure it doesn't …Then, towards the end of the intgerview, when challenged that he was presiding over "a mess of an energy policy", Fallon reiterated his position. Among other things, Ofgem, he said, was "ensuring that companies manage their demand where they're able to use private generators if there's an unexpected peak". This relaxed performance, plus the reference to "operating reserve" and "private generators" gave the final clues as to the existence of the "secret weapon". Fallon was alluding to STOR. He could only have been so confident in the security of the electricity supply if he had known that this is going to keep the lights on – which indeed it is. As it stands, therefore, although we are running down our conventional power sources, and the gap between our electricity supplies and the 60GW required at times of peak demand seems to have become dangerously narrow, this is not the case. There is this hidden reserve that does not show up on the typical presentations – as was seen during the Sunday Politics show. There, Fallon was confronted with a chart (above) showing the percentages of power provided by coal, gas, nuclear, wind, and hydro. Not shown is this hidden reserve, which potentially offers more capacity than either coal or gas can currently supply. In most discussions, it does not exist. And, contrary to Fallon's claims, the system has not existed for "twenty years". Previously, there had been a form of standing reserve but, as a system, STOR was formally launched by the National Grid on 1 April 2007 and even then over the last three years has been further developed to accommodate more easily what are known as "aggregators", of which British Gas is but one example. Illustrated above, taken from an aggregator's brochure, is a stylised network, using a "smart grid" which feeds power into the National Grid from a variety of sources, and also manages power reductions in a process known as "demand reduction", this itself known as Frequency Control by Demand Management (FCDM). Shown are these two broad components of the system – the power suppliers taking the form of standby generators, usually diesel powered (illustrated below), of the type installed in thousands of hospitals and commercial and industrial concerns, such as banks, data centres and water companies. All of these can be linked to aggregators via theor own "smart" networks (the smart grids), whence they can be centrally controlled by the aggregators' control systems. Units able to provide more than 3MW can link directly to the Grid, whence they are managed by National Grid control centres. In addition to the standby generators, though, there are also the Combined Heat and Power (CHP) units, equipment which is most often optimised to supply heating for office blocks and the like, but which also generate electricity. Both the standby generators and the CHP units can contribute in different ways. They can either send power to the grid, directly or via an aggregator, they can supply electricity to their operators, thereby reducing the demand on the grid, or they can be used to reduce demand, with any surplus electricity sent to the grid. Then there is the "demand reduction" (FCDM). By way of examples, on a signal from the grid, scheduled production processes in a factory can be switched off or delayed, non-essential air conditioning in offices or retail centres can be turned off, or refrigeration in commercial cold storage units can be shut down for a short period. What will stagger most people though is the scale of the operations. A recent report for Ofgemindicated that the 2011 requirement for STOR was 3.5GW and, by 2020, the demand could rise to 8GW, equivalent to five large nuclear power stations. Technically-compliant capacity, currently available to the grid if the price is right, is in the order of 6GW. Not included in the STOR system is the bulk of the CHP capacity. This stands at approximately 6GW, (2011) rising to 18GW by 2020. It serves to reduce overall demand on the grid. And, in the period of a year or so, about 4GW is available through reactivating mothballed gas plants, while at 1GW or more may be available from under-used assets such as the Peterhead gas plant. Collectively, these assets and systems add the equivalent of 18-19GW or more to grid capacity, This effectively matches the power provided by all our remaining major coal-fired power stations, and amounts to a massive hidden reserve amounting to nearly 30 percent of current peak demand. It is this reserve which can be relied on to keep Britain's lights on. Nor does it stop there. Although no firm figures are available, it is estimated that the total capacity of diesel generation installed in the UK is around 20GW – although it may be 30GW or higher. Much of that, through the activities of the aggregators, could become available to the grid. However, all this comes at a price. The average contracted utilisation payment for STOR paid by National Grid in 2011 was around £225/MWh, in addition to an availability payment of around £22,000 per MW of firm reserve. A hospital offering its standby generators to the grid can make as much as £100,000 profit before even supplying any electricity. The prices compare with a typical price seen by commercial consumers of around £100/MWh (10p/kWh). The National Grid will pay around £50/MWh for conventionally generated electricity, £100 for onshore wind generated power and £155 for offshore. Yet bids submitted to the Grid on the annual STOR tender have reached £400/MWh. While these have been rejected, a sellers' market could force the Grid to pay that much and more. Under normal circumstances using this back-up capacity is not an economically competitive form of generation; it is generally only called upon in emergencies when price rises can cover the costs of generation. But as we lose power stations from the system, there will be no option but to use it as replacement capacity and, in particular, as back-up when the wind is not blowing. So lucrative is this option that diesel generators are being installed specifically to service the reserve market. It is being regarded as a major investment opportunity, "anticipated to experience significant growth due to increased reliance on reserve sources of power to meet fluctuations in electricity. Investors are told that the "significant upward trend in the requirement for reserve services" is due to "decreased power supply following from the decommissioning of ageing nuclear power plants" and "increased volatility of power supply caused by increased reliance on renewables (due to the high proportion of wind power, renewables are not a consistent source of power) ". One company alone recently gained planning permission to install 52 diesel generators supplying 20 MW, in a factory unit in Plymouth. (news report above). In 2010, the company, Green Frog was looking for £75 million to fund 200MW of standby power, which it has subsequently upped to 500MW. The 52 generators in Plymouth would consume more than 1.1 million litres of diesel a year, or about one tanker a week, producing emissions at a similar level to that of coal, yet their primary purpose is to provide back-up for "green" wind energy. Thus, as Booker observes, not only will we be bankrupted by this idiocy. It won't even help to save the planet either. COMMENT THREAD Richard North 07/07/2013 |

Monday, 8 July 2013

Posted by

Britannia Radio

at

07:30

![]()