EU regulation: Hannan discovers the "top table"

Thursday 4 July 2013

Something that has struck Mr Hannan in the years that he has been doing his job as an MEP, he claims, is how many EU directives and regulations are there to give effect to guidelines or rules that come from an even higher, more international level.

Referring to an OECD agreement (which could just as well be an ILO agreement or a UN Convention), he tells us that what happens in practice is that the EU has one seat at the table and then Norway and Switzerland and the other independent countries have their own seats. So in fact, says Hannan, far from getting a seat at the table, the member states are surrendering their seat at the table where the law is actually made in exchange for a voice over how to implement it when it has come down. One can only applaud Mr Hananan for his insight. But would it be too churlish if we wondered why, if Mr Hannan has been aware of this dynamic for all these years, he has never mentioned it once in all his copious writings and many speeches? Only now that we have written about it in detail, including making a reference to the OECD and to ILO agreements and UN Conventions (alongside Booker), and produced our own film, does Mr Hannan discover that he has known all about this for years. Of course, Mr Hannan would never use anyone else's work without full acknowledgement, so this must be a complete coincidence. COMMENT THREAD Richard North 04/07/2013 |

Eurozone: euro doomed to second place

Wednesday 3 July 2013

Amazingly, this continued through to as late as last year when there were still some arguing that the euro would be the next global reserve currency.

But the dreams are now officially dead, with the mighty ECB is admitting the game is over – for the time being, at least. Via Handelsblatt, we are told that, since the debt crisis, the euro has lost importance and is nowhere near challenging the dollar. According to the ECB, based on an analysis of 2012 figures, the dollar has retained its traditional poll position, with 61.9 percent of global reserves invested in the currency. The euro accounted for a mere 23.9 percent, while sterling took four percent, behind the yen at 3.9 percent. All other currencies together accounted for slightly more than six percent - which is still comparatively little, but at the same time more than ever before. The share of the euro has fallen steadily in recent years. In 2010, 25.8 percent of global reserves were held in euros. Effectively, since the debt crisis, the euro has fallen back to its 2000 level. With that, Ulrich Leuchtmann, chief foreign exchange analyst for Commerzbank, has put the boot in. "The euro is and will remain the number two," he says. That it could one day challenge the dollar is not an issue. "The euro", he says, "is no longer a safe haven currency, but is viewed as currency risk. This has been reflected in the international foreign exchange reserves". However, not everything is going the dollar's way. In 2000, it took 64.6 percent of total reserves. Today, this figure is nearly three percentage points down, while China looms as an emerging contender. At the moment, the yuan plays no role as a reserve currency but there are moves to change that. With the three other major emerging economies - Brazil, India and Russia - the Chinese have agreed to trade in national currencies. Since the end of 2011, there is has been a similar agreement with Japan. Thus, the banking giant HSBC estimates that in three years, about half China's trade will be in its own currency. Jürgen Fitschen, head of Deutsche Bank, believes that China's yuan will become the third reserve currency alongside the dollar and euro. "That may take ten to fifteen years", he says, "But it cannot be prevented". Whether the euro then survives is a different question. But, as it stands, there is no question of the euro being number one in the foreseeable future. COMMENT THREAD Richard North 03/07/2013 |

Energy: the hypocrite speaks again

Wednesday 3 July 2013

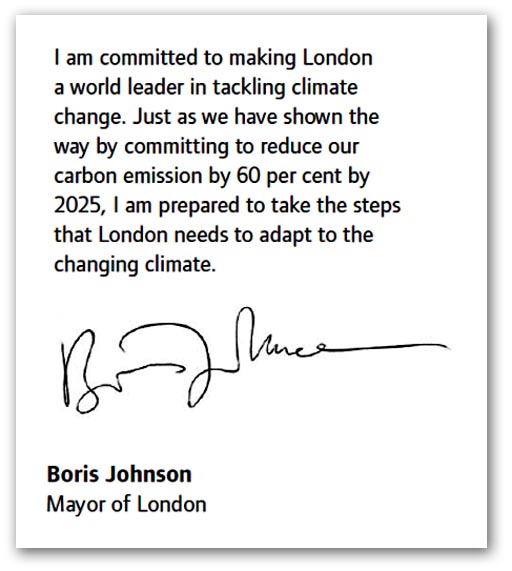

Speaking on his new LBC 97.3 Ask Boris radio show, Johnson said shale gas was the best answer to the problem of Britain's looming energy shortages. He dismissed the Government's efforts to replace closing coal stations with wind power and nuclear, arguing shale gas offers the best opportunity for a secure supply. "Labour put in a load of wind farms that failed to pull the skin off a rice pudding", he said. "We now have the opportunity to get shale gas - let's look at it. It is part of the 2020 vision we have for this city - power generation is vital". Yet this is the very same Boris who in August 2008 introduced London's first Climate Adaptation Strategy. In his foreword (above), he declared: Our climate is changing. This strategy starts the process of planning in detail for how our great city must adapt to these changes. If we don't make the necessary changes then many Londoners' quality of life will gradually deteriorate, we may fail to capitalise on some of the benefits that the changing climate will bring and we will be poorly prepared for the more extreme and damaging weather that science says we must expect in future.Then said Boris:

Among those steps was to convene a forum of "key stakeholders" in London responsible for green spaces to develop an "urban greening programme" for London. And amongst the things that was going to do was to "identify opportunities for green spaces to provide renewable energy (biomass and wind) ".

Climate change, said Boris, gave "opportunities for renewable energy" and, he said, the "longer growing seasons, more cloud-free days and potentially windier winters may benefit the generation of renewable energy through biomass, wind turbines, photovoltaic and solar thermal arrays". Thus we were told, "the Mayor's commitment to reducing carbon emission by 60 percent by 2025 through increased energy efficiency, use of decentralised energy and renewable energy will improve London's energy security". And yes, this is the same Boris Kohnson who in February 2006 was dissing the "the fear of climate change", declaring it to be "a growing world religion". With the London mayoral election two years ahead, pitting himself against warmist Ken Livingston, our Boris took on the fears of "green prophet James Lovelock", airily telling his readers that, if Lovelock was "completely right" in his fears, "there is not a lot we can do, and we might as well enjoy our beautiful planet while we can". And now, having giving up making London a "world leader in tackling climate change", Boris has climbed back on the climate sceptic bandwagon. He has abandoned his quest to cover London with windmills and is now dismissing the Government's efforts to replace closing coal stations with wind power and nuclear.

Shale gas offers the best opportunity for a secure supply, says the born-again sceptic. It really is quite amazing what a difference a few years can do for an opportunistic politician - and how short public memories are.

COMMENT THREAD |

Thursday, 4 July 2013

EU regulation: Hannan discovers the "top table" .....Eurozone: euro doomed to second place

Posted by

Britannia Radio

at

09:35

![]()