China Confidential

Tuesday, November 11, 2008

Newmont VP: Climate of Fear Hits Peru Gold Output

Foreign Confidential....

Bad news for the operator of Peru's biggest gold mine: political risk is rising.

Dow Jones Newswire reports that gold production from Minera Yanacocha SRL, which runs the country's largest gold mine, could decline in coming years if new deposits aren't developed, Newmont Mining Corp. (NYSE:NEM) Senior Vice President Carlos Santa Cruz said Tuesday.

Santa Cruz said that the main obstacle to developing new deposits at the mine in northern Peru is opposition from what he called "minority groups who have created a climate of conflict that has stopped or delayed investments in new mining projects."

He said the company needs to sharply increase exploration in order to sustain current production levels.

Santa Cruz said that production of gold is forecast at 1,761,229 ounces this year, following output of 1,563,669 ounces in 2007. In 2005 the company produced 3,333,088 ounces.

The forecast is disappointing news because the company previously predicted increased gold output this year from the previous year mainly due to the coming into operation of a gold mill.

Santa Cruz said the company expects to invest $216.04 million this year, following an investment of $277.96 million in 2007.

Yanacocha is run by Newmont Mining, with a 51.35% stake, while Compania de Minas Buenaventura SAA (NYSE: BVN) holds a 43.65% share. The International Finance Corp. holds a 5.0% stake.

Newmont also announced Tuesday that it will delay a development decision on its Minas Conga copper-gold project in Peru until the first quarter of 2009 because of the global financial crisis. The company had originally said it would announce a decision by the end of this year.

Newmont previously said the Conga project could start operating at the end of 2011 or the start of 2012.

Buenaventura recently said it is moving ahead with plans to develop its La Zanja gold project in northern Peru despite the global economic crisis. The La Zanja mine, which is slated to start production in 2010, is expected to produce 100,000 ounces of gold annually.

"We are going ahead with La Zanja," Roque Benavides, CEO of Buenaventura, said told analysts and reporters.

In 2004, Buenaventura put the project on hold after angry locals set the miners' camp on fire.

The company has since won support from the community and just needs environmental approval from the mining ministry to start construction, which the company expects to begin in 2009.

Peru is the world's fifth largest gold producer.IDF Deploying Remote-Controlled Guns on Gaza Line

Foreign Confidential....

Foreign Confidential....

Israeli defence officials say the military has deployed remote-controlled machine-guns along its border with the Gaza Strip. The system allows soldiers watching television screens in control rooms in the rear to spot targets and open fire.

In the past, lookouts had to call in ground forces to intercept militants.

Israel's military is shifting to more unmanned weaponry along the Gaza border in an attempt to protect soldiers.

Israel is currently observing a shaky truce with the Palestinian terrorist group Hamas, which rules Gaza.Guess Who's Coming to Dinner?

U.N. Secretary-General Ban Ki-moon is hosting the dinner for leaders attending a two-day U.N. conference to promote a global dialogue about religions, cultures and common values that starts Wednesday. King Abdullah of Saudi Arabia asked the General Assembly to hold the conference as a follow-up to an interfaith meeting he organized with King Juan Carlos of Spain in July in Madrid.

"It's quite unique when you expect President (Shimon) Peres of Israel ... and many kings and leaders from the Arab world ... (sitting) down together and having dinner," Ban told reporters.

The secretary-general told reporters he was not going to organize any meeting between the Saudi king and the Israeli president. Public meetings between Israeli and Saudi officials are extremely rare, and many Muslim countries, including Saudi Arabia, do not have diplomatic ties to Israel.

Ban refused to disclose seating arrangements for the dinner, though he said all guests would be eating the same food.

"But sitting in the same room and engaging in (the) same functions — normally in the past they have not been sitting in the same place like this. That is again very important," Ban said. "I sincerely hope that through their participation in the meetings, and through this social-diplomatic gathering, they will be able to promote further understandings."

Click here to continue.Foreign Outlook: US Debt Threatens Gulf Economies

By Wayne Arnold,

The National

Faced already with evaporating credit and export demand, cash-rich economies in Asia and the Gulf now face a growing threat from a new quarter: an erosion of the very savings they are counting on to cushion them.

At the root of the concerns is the dramatic increase in the amount of money the US government will need to borrow for its financial rescue package. Also, with calls growing for a second massive economic stimulus package, economists say the US government’s fund raising is likely to push down the value of the US dollar and with it the massive dollar holdings of central banks and sovereign wealth funds from Asia and the Gulf.

Fearing Debt Reduction and Delayed Payments

Some fear the ballooning US debt could even force Washington to go farther, asking creditors to accept delays or even reductions in its repayments.

“At current run rates, this is inevitable,” said Paul Schulte, the regional strategist at Nomura International in Hong Kong, who estimates the US budget deficit could exceed US$1 trillion (Dh3.6 trillion) next year.

The prospect of getting lower returns on money they have lent the US, or of seeing the value of those holdings drop further, could put Asian and Gulf governments in a bind. Many governments are already dipping into their savings to offset the effects of the global slowdown.

Most of those savings are stored in central bank reserves and sovereign wealth funds. Much of that money is, in turn, invested in assets denominated in US dollars, including US stocks and government bonds.

Printing Greenbacks to Pay Debts

The notion that the US government might need a break on its debt is a radical one. US government debt has long been considered the lowest risk around, partly because the US dollar is the world’s reserve currency. If America’s debts become too large, the Federal Reserve can simply print more greenbacks to pay.

But either possibility – a massive increase in US borrowing or a flood of newly minted dollars – would eventually push up the price that Washington would have to pay creditors to borrow and push down the value of existing US bonds.

The US economy is clearly getting worse. America’s unemployment rate jumped in October to 6.5 per cent, the highest in 14 years, while consumer spending slumped to its lowest level since 2001.

The International Monetary Fund (IMF), meanwhile, is forecasting a recession in the US, Japan, the EU and the UK.

Downturn Hitting Emerging Markets

The resulting downturn on tourism, trade and commodity demand is likely to hit emerging markets some thought to be insulated from the US economic cycle.

In its latest World Economic Outlook, the IMF projected that growth in emerging economies would slow next year to 5.1 per cent, from 6.6 per cent this year.

Members of the Group of 20 developing nations (G20) responded at a meeting of their finance ministers this week in Sao Paulo by pledging to create a co-ordinated economic stimulus. Many have already been cutting interest rates, but some are planning additional fiscal measures like that announced on Sunday by China to spend 4 trillion yuan (Dh2.1tn) to stave off recession.

“It represents a change of thinking at the top,” said Andy Xie, an economist in Shanghai. “Until one month ago, the official line was still that China was doing fine despite the global crisis.”

The Gulf is not Immune

The Gulf is also not immune. With oil prices falling, the investment bank EFG-Hermes last week lowered its forecast for Gulf economic growth to 4.8 per cent next year, from 8.5 per cent this year.

Global investors trying to cut their exposure to risky markets or scrambling to raise cash to pay off debts have pulled more than $40 billion out of emerging markets this year, according to Nomura International. The selling has pummelled emerging market stocks: in the past month, benchmark stock indexes in Dubai and Kuwait have tumbled roughly 20 per cent.

This exodus of overseas funds has also been punishing emerging market currencies, pushing some indebted countries to the brink of default. Iceland, Hungary, Ukraine and Pakistan have even been forced to seek help from the IMF.

Richer exporting economies like the UAE are far from such straits. But revenues are declining with oil prices and borrowing costs are rising, forcing companies and governments in the region to reconsider whether to launch some new projects.

Governments like China and the UAE have accumulated budget surpluses and foreign currency reserves to keep money flowing into their economies. Governments like the US, however, will have to borrow – a lot.

Click here to continue reading.From Bust to Boom: Geothermal Energy Could Help Fuel Bankrupt Iceland's Resurrection and Recovery

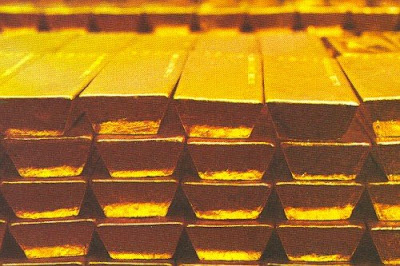

Buy Gold? But Why Isn't the Price Rising?

UPDATE: Gold futures dropped as much as $16 an ounce Tuesday, giving up gains made in the previous session as other metal futures registered steep losses.

Gold for December delivery dropped $12.90, or 1.7%, to $733.60 an ounce in electronic trading on Globex. It touched a low of $730.20 earlier.

Silver, platinum and copper futures all fell nearly 3% or more.

Bill Cara:There are so many junior oil and gas companies that are selling at minuscule cash flow multiples, and have very low debt service costs. Obviously, if the companies are in North America, they have no trouble selling their products. As traders start to take on more risk, the junior energy stocks will soar.

And I agree that food is going to be in huge demand, which makes the need for fertilizer a given. In China for instance, I think the government has committed to a policy of moving hundreds of millions of people from their tiny farms to homes in the city, which will help (i) create a broader-based consumer economy, and (ii) organize the development of large farms like in the U.S., which are far more efficient. That policy will help the fertilizer companies and the manufacturers of farm machinery.

As for gold, I see that governments around the world have been working out economic rescue programs. The problem there is that money doesn’t come on trees. It’s expensive. You can print it from paper from trees, but the cost in devaluation of what it represents is very high. Nobody more than Americans are committed to these bailout programs. So, ultimately the winners will be those who avoid bonds and who buy physical commodities and gold.

Paper Gold vs. Physical Gold

But why is the price of gold falling when it should be rising? Daniel Gschwend offers an intriguing explanation: paper gold is depressing physical gold. He writes:In times where the entire financial system is on the edge, you would expect gold to soar because of its safe haven attributes. Obviously something is seriously wrong. Right now, we are experiencing two forces to fight with each other: the physical market and the paper market. To understand what’s going on you have to know that the paper market is the short term market and the physical market is the long term market.

Click here to read his entire essay. It is brilliant.

But John Nadler has a different take on gold's "Failure to Launch." He writes:The current gold price is about $750/oz, which we have shown by the vertical line; we estimate that 750t-800t currently held in the gold ETFs was bought at prices below this level, with just 300t or so above. So even at today's relatively low gold price it seems that many investors in the gold ETF are still sitting on large profits. This is in stark contrast to the silver or PGM ETFs, which were launched at a much later stage in the commodities bull market and might explain why gold investors have stayed the course more than those in the PGM ETFs. But note, however, that if the gold price were to fall to $600/oz, then a lot of investors in the ETF would then suffering losses, which could make them more likely to sell up and see large outflows of gold."

Liquidations and risk-aversion are back on the radar. The recessionary/deflationary trend is keeping players parked on piles of cash for the moment.

Gold Coins and Gold Stocks

Meanwhile, there is one less way for people to buy physical gold, thanks to moves by the U.S. Mint. Read all about it here.

As for gold mining equities, one securities analyst makes a compelling case that most producing mines are still profitable. Click here.

Maybe that's true. But Reuters reports from Lima that one of the world's largest gold miners, Newmont Mining Corp. (NYSE: NEM), said on Tuesday it will delay a development decision on its Minas Conga copper-gold project in Peru until the first semester of 2009 because of uncertainty and the global financial crisis.

The company had previously said it would announce a decision by the end of this year.

Oil and Gold

Goldbug connects the dots to OPEC:The president of the Organisation of Petroleum Exporting Countries (OPEC) hinted over the weekend that another oil production cut could be on the cards in the near future.

The 13-country cartel announced at an emergency meeting in October that it would slash output by 1.5 million barrels per day in an attempt to boost flagging oil prices.

Now Chakib Khelil, who is also Algeria's energy minister, has explained that further reductions may be required when OPEC meets next on December 17th in his home country.

Any such move could boost the price of gold - which tends to follow the movement of the crude oil price - and herald a surge of investment in the yellow metal.

Speaking at an energy industry seminar on Saturday (November 8th), Mr. Khelil stated: "We have always said that our objective is 70 to 90 dollars a barrel. If the barrel price does not reach this level, there will probably be another (production) cutback."

Oil prices have plummeted considerably from the record levels of $147 per barrel seen in July, while gold prices fell by 16 per cent in October - the highest monthly fall for 25 years.Israeli PM Calls for Retreat to Pre-'67 Lines

Foreign Confidential....

Israel should cede parts of eastern Jerusalem and retreat to near its pre-1967 borders, Ehud Olmert said.

Speaking at a ceremony marking the anniversary of the assassination of Prime Minister Yitzhak Rabin by a Jewish extremist, the current Israeli prime minister said Rabin "understood that if we want to maintain Israel as a democratic Jewish state, we must concede to a lack of choice and to our great torments and give up parts of our homeland for which we dreamt for generations of yearning and prayers."

By returning to its pre-1967 borders, Olmert said, Israel will be able to "cultivate a new Zionism that is practical, realistic, responsible and courageous." But, he added, "If, God forbid, we procrastinate, we could lose support for a two-state solution," with an eventual Palestinian majority overwhelming the Jewish state.

Olmert was among several dignitaries who spoke at Rabin’s gravesite on Jerusalem’s Mount Herzl. Israeli President Shimon Peres used the opportunity to slam Jewish extremism. In recent months, extremists from Israel’s far right have stepped up violent attacks against Palestinians and Israeli soldiers. Several weeks ago, a prominent left-wing professor, Zeev Sternhell, was bombed at his home, sustaining light injuries. He blamed Jewish extremists for the attack.

"Now, just like back then," Peres said, referring to Rabin’s assassination by Yigal Amir, "there is a small minority of reckless, unrestrained people who boldly defy the state’s authority, attack Palestinians just for being Palestinian and challenge the law enforcement mechanisms which, among others, protect them, too."

- JTAHamas Says it Met with Obama Aides Before Election

Foreign Confidential....

Say it ain't so, Mr. President-elect.

As if to vindicate and confirm pre-election fears and criticism of The Candidate of Change, officials of Hamas--an Islamist group that the United States State Department has formally branded a Foreign Terrorist Organization--say its officials met Obama aides before the U.S. election.

Avi Issacharoff reports:The Arab daily Al-Hayat on Tuesday quoted a senior Hamas official as saying that United States President-elect Barack Obama's advisors met with members of the Palestinian militant group before the U.S. presidential election.

Ahmed Yusuf [sometimes spelled Yousef or Yusef], a political advisor to Hamas' Gaza leader Ismail Haniyeh, reportedly told the London-based paper that, "The connection was made via email and after that we met with them in Gaza."

Al-Hayat reported that Yusuf also said the relations were maintained after Obama's electoral victory last Tuesday. He said the president-elect's advisors requested that the relations be kept secret so as not to aid his rival, Senator John McCain.

During Obama's campaign, he pledged that his administration would only hold talk with Hamas if it renounced terrorism, recognized Israel's right to exist, and abided by past agreements.

On Saturday, Hamas political bureau chief Khaled Meshal told Sky News that he is willing to hold talks with Obama, and that he is challenging the newly elected leader to follow through on past statements indicating a willingness to sit down with America's chief adversaries on the world stage.

Obama's Senior Foreign Policy Adviser Denis McDonough told The Jerusalem Post on Tuesday: "This assertion is just plain false."

But Ayman abu Leilah, a spokesman for Yusuf, confirmed the statements as true, adding that the most recent meeting took place in early October “one month before the election.” He said Yousuf had first met the Obama people some years ago when he was studying in the U.S.

Mark Regev, foreign press spokesman in the Israeli Prime Mimister's Office, said the government had "absolutely no confirmation" that such a meeting ever took place, and said he would not comment on what they considered only a hypothetical situation.

A Victory for Islamists?

Is Obama's victory also a victory for Islamist Movements? Will Obama accelerate a policy of accommodation toward so-called acceptable Islamists--a concept that increasingly seems to only exclude Al Qaeda?

Elias Harfoush, writing in Al-Hayat's English-language edition, says the answer to the above question is yes, at least, for most of the groups. Islamist movements consider Barack Obama's victory to be a victory for them. It is as if the Democratic candidate had waged the battle on their behalf, or as if the fall of the slogan of the "New Middle East", which those movements fought to eliminate, was also the aim of the campaign led by the Senator from Illinois to reach the highest position in the United States, and even in the world.

This is why reactions to this victory by those who speak in the name of such movements were mostly positive. Indeed, they deemed that a new phase, characterized by realism, may begin with the new administration. Indeed in their view, realism means that the new administration learn from the mistakes of the Bush administration, and take into account the ability of those who are "defiant" to thwart any American plan in the region if it does not agree with their objectives and their interests.

It is true that a major part of Obama's campaign relied on criticizing the mistakes made under his predecessor, whether regarding Iraq or the war against Al-Qaeda, or even in dealing with Iran's nuclear issue. Yet the slogans of Obama's campaign were not those of Islamists, and its objective was not to undermine US influence in those regions. On the contrary, its objective was to reinterpret this network of issues objectively, and to improve the odds for a US "victory" in future confrontations. Any objective reading of Obama's view on the situation in Afghanistan, on the exit he seeks from involvement in Iraq, and also on handling the deadlock with Iran, would point to a strategic desire to take away the pretexts of exploitation, which Islamist movements currently use defensively in their (verbal) confrontation with US plans.

Unlike Bush, Obama does not consider that there is an open war waged by Islamists against the West, one that would necessitate a global full-scale war on terror. Rather, he looks at crisis zones individually and deals with them as such. Thus he makes a distinction between the war against the Taliban and the pursuit of Al-Qaeda leaders....

Click here to continue.

Tuesday, 11 November 2008

Edith Lederer reports from U.N. headquarters in New York that Arab leaders, including the Saudi king, and Israel's president will attend the same dinner Tuesday night, a rare encounter that the head of the United Nations hopes will promote understanding and talks.

Posted by

Britannia Radio

at

23:20

![]()