![]()

![]()

![]()

![]()

![]()

![]()

The Daily Reckoning Weekend Edition

Saturday, June 26, 2010

Taipei, Taiwan

-------------------------------------------------------

Joel Bowman, from under a small pile of his worldly possessions in Taipei, Taiwan...

No time for our usual rambling this weekend, fellow reckoners. We're knee deep in boxes and suitcases, trying to pack for a two-month, tri- continental journey to our new home.

Maybe it was all those reader mails about expatriation and world travel you sent us last week (check them out in the weekly archives, below)...or maybe we've just got a case of the 18-month itch...or maybe three years roaming between the Middle and Far East is enough for one stint. Whatever it is, we've got packing to do, tickets to buy, hotels to book, meetings to arrange, and only a week left to wrap everything up here in Taipei before we depart.

We'll have more details about our final destination, and various ports of call along the way, in next weekend's issue. For now, please enjoy the latest commentary from Jeff Clark, senior gold editor with our friends over at Casey Research...

For the Last Time, Is Gold in a Bubble?

By Jeff Clark

Stowe, Vermont

While a few mainstream outlets are coming around to at least acknowledging gold's stellar run, most remain skeptical or outright bearish. And the blasphemy they purport is that gold is in a bubble.

Let's settle it, right now, and shut these naysayers up.

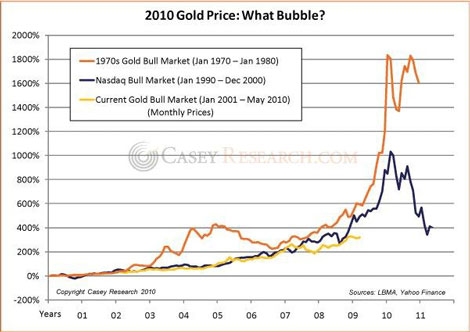

Gold returned 10 (and as much as 14) times your money in the 1970s bull market, and the NASDAQ advanced over 1,900% during its run. Our current gold price is up about 400% (when measured on a daily basis, not monthly as in the chart).

In fact, the NASDAQ gained 182% in the final year of its peak, and gold surged 80% in four weeks during the blow-off top of January 1980. None of this is happening to our current gold price.

Note to doubters: we've got a long way to go before we start legitimately using the "bubble" word.

Besides, the fact that these skeptics aren't buying - and don't even own any gold in the first place - is further proof we're not in a bubble. Ever notice none of them claim to own it?

And they definitely need to catch up on world affairs. The World Gold Council (WGC) reported that Russia, Venezuela, the Philippines, and Kazakhstan all bought gold in the first quarter. Central bank sales, meanwhile, remain depressed.

Russian President Medvedev won't quit his quest to move international reserve assets away from the dollar. And his country's central bank is backing up his words; it increased its gold reserves by $1.8 billion and decreased its currency reserves by $6.6 billion so far this year.

China, the world's largest gold producer, already buys all the gold produced within its country. But the WGC recently forecasted that overall gold consumption in China could double in the coming decade, a demand that production certainly won't be able to match.

The Iran/Israel showdown appears closer almost every week. As further evidence that each side is preparing for conflict, Saudi Arabia recently agreed to permit Israel to use a narrow corridor of its airspace to shorten the distance for a bombing run on Iran - all done with the agreement of the US government. Simultaneously, the UN Security Council imposed a new round of sanctions on Tehran. Nobody appears to be backing down.

And the current run in gold is with no inflation. Core CPI has fallen to the lowest level since the mid-1960s - but what happens when inflation does set in? And what if it's as bad or worse as the 14% rate we got in the '70s? Sure, deflation is the immediate concern, but with a US federal debt of $13 trillion, unfunded future liabilities exceeding $50 trillion, and a current budget deficit of over 10% of GDP, a massive debasement of the dollar is virtually ensured, triggering an onslaught of inflation. It's coming.

With all these concerns, these guys don't want to own gold?

Bubble, schmubble. Stocks are vulnerable, bonds are toast, currencies are fiat. Other than cash, where are you going to put money right now?

Gold could correct, of course, and I frankly hope it does. I'm not counting on it, though. The price is just as likely to head the other direction. But if it does temporarily fall, while the bubble-heads are smirking, I'll be buying.

Someday I think we'll be reversing roles.

Regards,

Jeff Clark

for The Daily Reckoning

P.S. How far could gold and silver fall? And precious metal stocks? Check out our annual Summer Buying Guide in the current issue of Casey's Gold & Resource Report, which identifies buy zones for all our recommendations. You can try it risk free here...

-------------------------------------------------------

Even though you've paid into Social Security all of your working life... and even though they promised to pay you back...you can no longer count on getting what you're owed.

Take a look at this from The New York Times:"This year, the [Social Security] system will pay out more benefits than it receives... accumulated revenue will slowly start to shrink, as outlays start to exceed revenue... [and] by law, Social Security cannot pay out more than its balance in any given year."

We all knew this day would come. But nobody expected it to come so fast - six years ahead of schedule. Want to know how to protect yourself? Get the inside scoop on this "other" pension payment plan, right here.

-------------------------------------------------------ALSO THIS WEEK in The Daily Reckoning...

Getting Outta Dodge

By Daily Reckoning Readership

Edited by Eric Fry and Joel Bowman

Were I without family ties, I might consider expatriating to one of the quiet, out-of-the-way towns in Central- or South America that I drove my VW bus through in 1977-1978. Spending a year and a half living life at a slower pace and speaking in a second language was world view- opening for this California born American. Through it all, I met many wonderful, amazingly generous people. Unfortunately, I also saw a lot of grinding poverty and misery. I finally lost count of how many times I stared into the barrel of a loaded submachine gun held by an edgy 19 year-old soldier at some border crossing or roadblock.

The American Dream, Revisited

By Daily Reckoning Readership

Edited by Eric Fry and Joel Bowman

I have a cousin and two very personal friends who decided to leave America permanently to reside in France. They sold everything they owned and moved to France with just one suitcase. Within two years, all three returned to America. Summing it up, they said, "You just don't have any idea what it is like to live in another country until you actually do it. If you think politics are bad in the US, you should try living somewhere else. You just can't believe the nonsense that goes on in France regarding jobs, politics, and social programs."

The American Dream, Re-revisited

By Daily Reckoning Readership

Edited by Eric Fry and Joel Bowman

I have been reading your publication for a while now and generally agree with your conclusions about the financial condition of our country. This is my home. It is where my job, family, and friends are here to support me. Someday I will have grandchildren. I don't want to give up on, or leave our country. After the health care bill passed I decided to see what I could do to help get us back to freedom and fiscal responsibility. I have always been a libertarian at heart, but not politically active. I have no interest in telling anyone what to do. I live my quiet life until government gets too involved in mine. I don't have any horror stories, but I see a storm on the horizon for everyone.

Stimulus, Austerity, and the Spiral of Decline

By Nathan Lewis

Binghamton, New York

In an economic decline, mediocre governments typically bounce back and forth between "stimulus" and "austerity." They are the ketchup and mustard of bad recession policy. "Stimulus" - favored by the left- leaning politicians - rarely amounts to more than a form of welfare spending. This is appreciated in hard times, but it tends to be extremely expensive and does little for the economy as a whole. Deficit worries increase. Then comes the "austerity," often favored by conservative politicians.

Phony Choices From a Bogus Profession

By Bill Bonner

Baltimore, Maryland

Several things have become obvious: first, a 'recovery' is not going to happen; second, after 60 years of credit expansion, the world has entered a long period of financial adjustment and debt destruction; third, most economists should be put to work picking up trash along national highways. Not that they would do a very good job of it, but at least they would be kept out of mischief.

-------------------------------------------------------

With over 40,000 copies now in print, read your free online review copy of the brand new breakthrough financial report from Gold, Silver, and Energy expert Byron King...

The Curse of the Incas

Gold's Untold Story and the Shocking New Role It Could Play in Your Financial Survival

A 476-year old mistake could soon cost you your retirement. How so?

To understand, you have to let me share a little-told story. It starts like this...

-------------------------------------------------------

The Weekly Endnote: So, where are we heading next? Aww, c'mon...where's the fun in giving it away now? We could give you the approximate coordinates, but that would be way too easy. We could tell you the color of the national football team's uniform, except we don't watch sports. We could even give you the name of a popular local bar in the city's downtown area, but our fellow reckoners are probably too well traveled to miss that one.

Actually, we're not entirely certain ourselves. But rest assured, we'll have some colorful backdrops from which to bring you your daily issues along the way, including a midway stopover in Vancouver for our annual Agora Financial Investment Symposium. Feel free to meet us there, if you'd like. There's a stellar lineup for this year's event, including one speaker from the continent we have loosely penciled in as our final destination.

Have we given away too much already?

Until next time...

Cheers,

Joel Bowman

Managing Editor

The Daily Reckoning

Saturday, 26 June 2010

Posted by

Britannia Radio

at

16:05

![]()