Failed Auctions, China’s Tumble, Ireland’s Austerity Costs & Fleeing Stocks

June 29th, 2010 by

Respond

Stacy Summary: I love that there is still a debate as to whether or not we are in a Depression.

- ECB fixed term deposit FAIL

- Shanghai index tumbles

- High cost of austerity in Ireland

- Two year yields fall to fresh record as investors flee stocks

Russian Spy Ring, a Financier and Gold [UPDATED]

June 29th, 2010 by

Respond

Stacy Summary: Just a compilation of links to the bizarre story. If they are spies, Moscow should just say they were hikers that got lost.

- Russian ‘secret agents’ arrested in USA

- Moscow says it is investigating arrest of alleged Russian spies

- The gold connection in Russian spy case

From MaxKeiser.com Images

**UPDATE** – Here is RT on the story:

**UPDATE 2** - Another update from RT on the timing of story:

PirateMyfilm: Richard Bluestein’s “The Chicago Way”

June 29th, 2010 by

Respond

This short documentary will include interviews of city and state politicians in addition to everyday Joes in an attempt to explain to the European just what is going on here in Illinois. From Mayor Daley’s croneyism to The Blago Monkey Trial: What is really going on in Chicago and does it reflect what American politics as a whole in some way.

Peak Gold?

June 29th, 2010 by

Respond

Global gold production has been waning for the last ten years as all the easy gold has already been dug up. Demand for this gold is on the rise, as the average central bank is now a net buyer of the metal. Adding to this demand are hundreds of millions of newly wealthy middle class Chinese who are now allowed to buy gold – with the government positively encouraging them.

Cantor Recants: Abandons Box Office Futures Trading

June 29th, 2010 by

Respond

Score one for MaxKeiser.com. We lobbied relentlessly to keep these dangerous products off the market. The basic problem was that Cantor Fitzgerald had modified my design (they acquired in 2001) and created a Frankenstein version that would do tremendous harm. Sources inside HSX told me repeatedly that Richard Jaycobs, the executive working on HSX/Cantor, was in way over his head with this and had no understanding whatsoever of how the exchange worked or how markets in general operate.

Supreme Court Declares Sarbanes-Oxley Unconstitutional

June 28th, 2010 by

Respond

Stacy Summary: Supreme Court has just struck down part of Sarbanes-Oxley. They have also struck down Chicago handgun law. **UPDATE** – Bloomberg now reporting that the Supreme Court decision will not strike down Sarbox if the SEC is granted broader authority: “The 5-4 decision stopped short of ordering the work of the Public Company Accounting Oversight Board to stop, instead saying the Securities and Exchange Commission must have unfettered power to fire the board’s members. The board was established by the 2002 Sarbanes-Oxley law.

Economics is hard, so you should only trust the experts

June 28th, 2010 by

Respond

Stacy Summary: Oh boy. This paper from The Federal Reserve Bank of Richmond is doing the rounds all over the blogosphere this morning. Would love to have your thoughts on their argument. I know we had one ‘there is no housing bubble in Canada’ commenter who is no longer on the site, but he would agree as he believed you must have an economics degree to qualify to comment on the economy around you. But your thoughts? And how long before heretics start being burned at the stake?

Monster printing, deficit cutting and seeing no bubbles but one

June 28th, 2010 by

Respond

Stacy Summary: Gee, I wonder if they are as committed to their promise to halve deficits in 3 years as they were to their commitment three years ago to double aid to poor countries?

Dead Zones and Toxic Bribes

June 30th, 2010 by

Respond

Stacy Summary: Some oil stories for you . . .

Class war, IMF gold and the taxpayers/AIG rights forfeited

June 30th, 2010 by

Respond

Stacy Summary: All the headlines are adding up to seismic changes coming for sure. And the outright immunity the elite feel they have in the U.S. is astounding. It seems their feeling is accurate, for they clearly see that they have the perfect ponzi as the victims of their perpetual fraud are the most ardent supporters of the schemes to defraud. What do y’all think about the rapid build up of gold reserves in Russia, China and Saudi Arabia over the past year?

Failed Auctions, China’s Tumble, Ireland’s Austerity Costs & Fleeing Stocks

June 29th, 2010 by

Respond

Stacy Summary: I love that there is still a debate as to whether or not we are in a Depression.

- ECB fixed term deposit FAIL

- Shanghai index tumbles

- High cost of austerity in Ireland

- Two year yields fall to fresh record as investors flee stocks

Russian Spy Ring, a Financier and Gold [UPDATED]

June 29th, 2010 by

Respond

Stacy Summary: Just a compilation of links to the bizarre story. If they are spies, Moscow should just say they were hikers that got lost.

- Russian ‘secret agents’ arrested in USA

- Moscow says it is investigating arrest of alleged Russian spies

- The gold connection in Russian spy case

From MaxKeiser.com Images

**UPDATE** – Here is RT on the story:

**UPDATE 2** - Another update from RT on the timing of story:

PirateMyfilm: Richard Bluestein’s “The Chicago Way”

June 29th, 2010 by

Respond

This short documentary will include interviews of city and state politicians in addition to everyday Joes in an attempt to explain to the European just what is going on here in Illinois. From Mayor Daley’s croneyism to The Blago Monkey Trial: What is really going on in Chicago and does it reflect what American politics as a whole in some way.

Peak Gold?

June 29th, 2010 by

Respond

Global gold production has been waning for the last ten years as all the easy gold has already been dug up. Demand for this gold is on the rise, as the average central bank is now a net buyer of the metal. Adding to this demand are hundreds of millions of newly wealthy middle class Chinese who are now allowed to buy gold – with the government positively encouraging them.

Cantor Recants: Abandons Box Office Futures Trading

June 29th, 2010 by

Respond

Score one for MaxKeiser.com. We lobbied relentlessly to keep these dangerous products off the market. The basic problem was that Cantor Fitzgerald had modified my design (they acquired in 2001) and created a Frankenstein version that would do tremendous harm. Sources inside HSX told me repeatedly that Richard Jaycobs, the executive working on HSX/Cantor, was in way over his head with this and had no understanding whatsoever of how the exchange worked or how markets in general operate.

Supreme Court Declares Sarbanes-Oxley Unconstitutional

June 28th, 2010 by

Respond

Stacy Summary: Supreme Court has just struck down part of Sarbanes-Oxley. They have also struck down Chicago handgun law. **UPDATE** – Bloomberg now reporting that the Supreme Court decision will not strike down Sarbox if the SEC is granted broader authority: “The 5-4 decision stopped short of ordering the work of the Public Company Accounting Oversight Board to stop, instead saying the Securities and Exchange Commission must have unfettered power to fire the board’s members. The board was established by the 2002 Sarbanes-Oxley law.

Economics is hard, so you should only trust the experts

June 28th, 2010 by

Respond

Stacy Summary: Oh boy. This paper from The Federal Reserve Bank of Richmond is doing the rounds all over the blogosphere this morning. Would love to have your thoughts on their argument. I know we had one ‘there is no housing bubble in Canada’ commenter who is no longer on the site, but he would agree as he believed you must have an economics degree to qualify to comment on the economy around you. But your thoughts? And how long before heretics start being burned at the stake?

Monster printing, deficit cutting and seeing no bubbles but one

June 28th, 2010 by

Respond

Stacy Summary: Gee, I wonder if they are as committed to their promise to halve deficits in 3 years as they were to their commitment three years ago to double aid to poor countries?

Failed Auctions, China’s Tumble, Ireland’s Austerity Costs & Fleeing Stocks

June 29th, 2010 by

Respond

Stacy Summary: I love that there is still a debate as to whether or not we are in a Depression.

- ECB fixed term deposit FAIL

- Shanghai index tumbles

- High cost of austerity in Ireland

- Two year yields fall to fresh record as investors flee stocks

Russian Spy Ring, a Financier and Gold [UPDATED]

June 29th, 2010 by

Respond

Stacy Summary: Just a compilation of links to the bizarre story. If they are spies, Moscow should just say they were hikers that got lost.

- Russian ‘secret agents’ arrested in USA

- Moscow says it is investigating arrest of alleged Russian spies

- The gold connection in Russian spy case

From MaxKeiser.com Images

**UPDATE** – Here is RT on the story:

**UPDATE 2** - Another update from RT on the timing of story:

PirateMyfilm: Richard Bluestein’s “The Chicago Way”

June 29th, 2010 by

Respond

This short documentary will include interviews of city and state politicians in addition to everyday Joes in an attempt to explain to the European just what is going on here in Illinois. From Mayor Daley’s croneyism to The Blago Monkey Trial: What is really going on in Chicago and does it reflect what American politics as a whole in some way.

Peak Gold?

June 29th, 2010 by

Respond

Global gold production has been waning for the last ten years as all the easy gold has already been dug up. Demand for this gold is on the rise, as the average central bank is now a net buyer of the metal. Adding to this demand are hundreds of millions of newly wealthy middle class Chinese who are now allowed to buy gold – with the government positively encouraging them.

Cantor Recants: Abandons Box Office Futures Trading

June 29th, 2010 by

Respond

Score one for MaxKeiser.com. We lobbied relentlessly to keep these dangerous products off the market. The basic problem was that Cantor Fitzgerald had modified my design (they acquired in 2001) and created a Frankenstein version that would do tremendous harm. Sources inside HSX told me repeatedly that Richard Jaycobs, the executive working on HSX/Cantor, was in way over his head with this and had no understanding whatsoever of how the exchange worked or how markets in general operate.

Failed Auctions, China’s Tumble, Ireland’s Austerity Costs & Fleeing Stocks

June 29th, 2010 by

Respond

Stacy Summary: I love that there is still a debate as to whether or not we are in a Depression.

- ECB fixed term deposit FAIL

- Shanghai index tumbles

- High cost of austerity in Ireland

- Two year yields fall to fresh record as investors flee stocks

Russian Spy Ring, a Financier and Gold [UPDATED]

June 29th, 2010 by

Respond

Stacy Summary: Just a compilation of links to the bizarre story. If they are spies, Moscow should just say they were hikers that got lost.

- Russian ‘secret agents’ arrested in USA

- Moscow says it is investigating arrest of alleged Russian spies

- The gold connection in Russian spy case

|

| From MaxKeiser.com Images |

**UPDATE** – Here is RT on the story:

**UPDATE 2** - Another update from RT on the timing of story:

PirateMyfilm: Richard Bluestein’s “The Chicago Way”

June 29th, 2010 by

Respond

This short documentary will include interviews of city and state politicians in addition to everyday Joes in an attempt to explain to the European just what is going on here in Illinois. From Mayor Daley’s croneyism to The Blago Monkey Trial: What is really going on in Chicago and does it reflect what American politics as a whole in some way.

Peak Gold?

June 29th, 2010 by

Respond

Global gold production has been waning for the last ten years as all the easy gold has already been dug up. Demand for this gold is on the rise, as the average central bank is now a net buyer of the metal. Adding to this demand are hundreds of millions of newly wealthy middle class Chinese who are now allowed to buy gold – with the government positively encouraging them.

Cantor Recants: Abandons Box Office Futures Trading

June 29th, 2010 by

Respond

Score one for MaxKeiser.com. We lobbied relentlessly to keep these dangerous products off the market. The basic problem was that Cantor Fitzgerald had modified my design (they acquired in 2001) and created a Frankenstein version that would do tremendous harm. Sources inside HSX told me repeatedly that Richard Jaycobs, the executive working on HSX/Cantor, was in way over his head with this and had no understanding whatsoever of how the exchange worked or how markets in general operate.

Supreme Court Declares Sarbanes-Oxley Unconstitutional

June 28th, 2010 by

Respond

Stacy Summary: Supreme Court has just struck down part of Sarbanes-Oxley. They have also struck down Chicago handgun law. **UPDATE** – Bloomberg now reporting that the Supreme Court decision will not strike down Sarbox if the SEC is granted broader authority: “The 5-4 decision stopped short of ordering the work of the Public Company Accounting Oversight Board to stop, instead saying the Securities and Exchange Commission must have unfettered power to fire the board’s members. The board was established by the 2002 Sarbanes-Oxley law.

Economics is hard, so you should only trust the experts

June 28th, 2010 by

Respond

Stacy Summary: Oh boy. This paper from The Federal Reserve Bank of Richmond is doing the rounds all over the blogosphere this morning. Would love to have your thoughts on their argument. I know we had one ‘there is no housing bubble in Canada’ commenter who is no longer on the site, but he would agree as he believed you must have an economics degree to qualify to comment on the economy around you. But your thoughts? And how long before heretics start being burned at the stake?

Monster printing, deficit cutting and seeing no bubbles but one

June 28th, 2010 by

Respond

Stacy Summary: Gee, I wonder if they are as committed to their promise to halve deficits in 3 years as they were to their commitment three years ago to double aid to poor countries?

Dead Zones and Toxic Bribes

June 30th, 2010 by

Respond

Stacy Summary: Some oil stories for you . . .

Respond

Stacy Summary: All the headlines are adding up to seismic changes coming for sure. And the outright immunity the elite feel they have in the U.S. is astounding. It seems their feeling is accurate, for they clearly see that they have the perfect ponzi as the victims of their perpetual fraud are the most ardent supporters of the schemes to defraud. What do y’all think about the rapid build up of gold reserves in Russia, China and Saudi Arabia over the past year?

New UN Report Urges World to Ditch US Dollar as Reserve Currency

June 30th, 2010 by

Respond

Stacy Summary: UN report urges ditching dollar as reserve currency and replacing with something like SDR, with no gold included in basket. Here is the full report, still reading it but they seem to slam globalization as well in section 5.

Reflexivity and Fraud: Manipulating Polls, Prices, Perceptions, and Outcomes

June 30th, 2010 by

Respond

Any serious student of markets knows the ‘Efficient Market Theory’ is hokum. George Soros’ ‘Reflexivity Theory’ rules. In short, prices change perception and since most trading is done based on perception the case for fundamental analysis goes out the window. Example: dot coms in 2000. Into this mix add the fraudsters on Wall St. who manipulate prices – not to make or lose money per se – but to manipulate perceptions. We saw this in 2008 when stock prices were manipulated by Wall St. to give the impression that the banking sector was about to collapse. The government acted on that perception and handed trillions over to the fraudsters.

The same can be said of rigged polling results. Changing the perception of the public mood can change the outcome. Because people act based on perception, not reality. The popular website DailyKos is suing a pollster for this very reason.

Recently, I called for some favors from friends who are connected with the MPAA (I served on the board of theCreative Coalition) to stop Cantor Fitzgerald’s box office futures contracts because I knew from my experience running HSX/Cantor that insiders were abusing their position in ways that were not consistent with free market capitalist principles and I hated the thought of another American industry getting torched by Wall St.

In the case of Cantor Exchange and Trend Exchange, this means moving prices outside of the ‘price discovery’ mechanism; producing exogenous results for nefarious ends.

Government officials hoping to restore balance and accountability to markets are, unfortunately, beholden to the market riggers and perception manipulators who throw a few dollars at the politicians to finance their election campaigns. We cannot expect anyone working inside government to stop this abuse. Only through direct citizen action can any change happen. The recent boycott of BP, in my opinion, should be expanded until BP’s stock is driven down to zero. And if ExxonMobil comes in and takes them over, then the boycott should move over to Exxon.

In a more perfect world, the Federal Reserve Bank should have kept interest rates high enough to deter the market riggers and perception distorters in the vein of Paul Volcker (now marginalized for obvious reasons). In other words, the tools to rectify the economy are within government’s grasp.

The government needs to fight the perception, put out by a complicit media, that doing the right thing is somehow counter productive. America needs to stop worrying about what the rest of the world perceives as its short comings and focus instead on taking the necessary actions required to give markets what they need to restore vitality, transparency, and integrity across all the various trading platforms that comprise the backbone of our economy.

Broker bought 7 million barrels of oil on drunken binge

June 30th, 2010 by

Respond

Stacy Summary: Of course, the broker was in London. Story sounds as suspicious as the Russian ‘spies’ story.

Heidi Moore: Russian ‘spies, goldbugs and the struggling dollar

June 30th, 2010 by

Respond

Stacy Summary: Currency wars?

Guest Post: Goldman Sachs’ Psychology and Spirituality

June 30th, 2010 by

Respond

As a perfect case study illustrating how our economic system feeds our psychology and spirituality, one ofCSPER’s tenets, I thought I’d characterize what some of my old colleagues from Harvard b-school and firms like Goldman have been saying…

“I know I add value to my clients and to society at large and I am very comfortable with that.”

Of course claiming to “add value” is just repeating empty talking points from fraudulent Economics 101 they learned as students (see the first 4 lessons of Renaissance 2.0 to revisit the flaws of the economics taught in colleges today). This is an example of how the “best and brightest” have no real ability to think independently, but simply a good ability to memorize what the system tells them as kids so they become its best servants (no surprise, the latter half ofLesson 6 pt 3 mentions how the system builds conformity in us, not free thinking).

Most of you know the truth about Goldman by now–a parasite that uses debt and its membership in the unconstitutional money cartel (lesson 1) to feed on the productive economy, what little of it exists anymore–so I won’t go into that. What I want to do here is show how this ties to self-esteem (psychology) and sense of purpose in life (spirituality).

Psychology: They are “comfortable” with their roles in firms like Goldman. You can imagine the level of internal disconnect they have with the real impact their firm has on the population–the fact that their huge paychecks come from the indebtedness of the American people and being an inside cartel member. Not only do they have no intellectual understanding of it, but a big reason they don’t have an understanding is because they can’t face the truth. They stay in the academic clouds believing they “add value” because they can’t look for the truth without losing belief in their identity. It would be a psychological blow. The role we play in the economic system is inextricably tied to our psychology. So by avoiding the truth, they’re psychologically “very comfortable.” But this also means they’re psychologically narcissistic–narcissism is a dangerous disconnect from reality and truth.

Spirituality: They say they add value to “society at large.” That’s the key. They reach the realm of religion when they say that. It’s their raisson d’etre. They think they’re saving the world. Remember Goldman CEO Blankfein saying his firm does God’s work? Well, these folks show that they’ve been fully baptized into the cult. This is the type of mentality necessary to fuel the catastrophic destruction of society we’ve witnessed. Your average low-rent criminal mentality would NOT be enough to fuel what the Wall Street cartel has done to the world over the last several years. It takes spirituality, a belief that you’re serving a higher purpose, warped though it may be, to pull that off.

So I hope this helps make the case for CSPER and explain why I connected the S P and E together. The connection is critical. The economic system defines what we spend most of our waking hours doing, which means it can’t help but be a primary determinant of our psychology and spirituality. So an economic system built on an immoral, unhealthy monetary system cannot help but breed immoral spirituality and unhealthy psychology over time. It must be changed.

A gigantic ponzi, average charter schools and wild inefficiency

July 2nd, 2010 by

Respond

Stacy Summary: Some bigger picture stories to ponder over the weekend. The common thread being that policy set by and for the oligarchy is invariably bad for the people.

- Credit crisis a ‘gigantic ponzi scheme, lies and fraud & the current financial ‘reform’ will do nothing to address

- On average, charter schools do no better than public schools

- How the US became ‘wildly inefficent at creating American tech jobs’

UK government’s experiment asking the little people what laws they want repealed results in people demanding that the Digital Economy Act be scrapped!

July 2nd, 2010 by

Respond

Stacy Summary: Too funny. Of course, the government will not allow the people freedom from cartels and monopolies, so I doubt the people’s wishes will be heard. I predict that this little experiment in talking to the little people will be scrapped.

Squaring up for curbs on payouts to bankers

July 2nd, 2010 by

Respond

Stacy Summary: Where do you stand on this issue? Recall that, in his interview with us, John Authers thought that ultimately curbs on how bonuses were paid would have to be adopted in order to reduce instability in the financial system.

- EU putting serious curbs on payouts to bankers

- EU squares up to bankers and their bonuses, where does that leave the City?

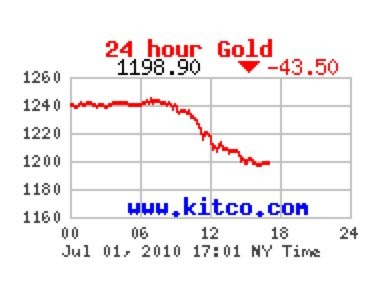

Gold got killed!

July 1st, 2010 by

Respond

Stacy Summary: Mike/Liverpool . . . I blame you. Ha ha, will post links below the gold chart as I find them.

|

| From MaxKeiser.com Images |

- Gold shock and awe

- Gold falls below $1200 on asset liquidations

- Gold has biggest one day fall since February

Ditch the Dollar! Its demise is months away!!

July 1st, 2010 by

Respond

Stacy Summary: A number of states, including Russia and China, have repeatedly called for a new reserve currency system. The UN has now suggested using a basket of currencies for this purpose. London-based markets strategist Nick Parsons believes it’s only a matter of months before the dollar will start to go down.

[KR56] Keiser Report – Markets! Finance! Heretics!

July 1st, 2010 by

Respond

Stacy Summary: We look at the latest scandals of economic bloggers branded heretics as the high priests of economics are busy preparing “monster” money-printing and refusing to recognize housing bubble “time bombs”. In the second half of the show, Max talks to Josh Brown ofTheReformedBroker.com about hexopolies and financial reform.

[1143] The Truth About Markets – New Zealand – 30 June 2010

July 1st, 2010 by

Respond

Stacy Summary: Forgot to post this yesterday!

For more download & listening options, visit Archive dot org

Bailed-out Anglo racks up biggest losses in history; Ryanair to sell standing room only plane tickets

July 1st, 2010 by

Respond

Stacy Summary: News from Ireland. h/t @Danny

- Bailed-out Anglo Irish Bank racks up biggest losses in world

- Ryanair hopes to sell standing room only tickets

L’Oreal heiress says she gave gifts of only 450 million euros “very far from one billion”

July 1st, 2010 by

Respond

Stacy Summary: Remiss of me not to have posted yet onthe scandal gripping the French capital. This woman sounds like she could single-handedly bail out Greece.