The Daily Reckoning Weekend Edition ------------------------------------------------------- --- Buy This OTC Penny Play on August 16! --- AM: (My area is ) the Atlantic Basin... If you look down at the southern part of the Americas and Africa, people are ignoring the contribution it’s making worldwide. BWK: I had a chance to visit a Chevron operation in the Gulf of Mexico (GOM) in March. Chevron had the Transocean vessel, Discoverer Inspiration, drilling in over 6,700 feet of water, about 200 miles off the Louisiana coastline. The target depth was over 30,000 feet. It was quite an operation. Gold: The Truth About Gold Fiat Currency: Using the Past to See into the Future

![]()

![]()

![]()

![]()

![]()

![]()

Saturday, August 7, 2010

San Antonio, Texas

On Sunday, August 15, Bulletin Board Elite editor Greg Guenthner will announce his next big OTC penny stock play, giving his readers plenty of time to get in when the markets open on Monday if they want in on the action.

If you want a chance at substantial gains, you need to watch Greg’s brand new presentation. In it, he details how readers could have already turned $500 into $15.1 million in just 30 days.

Click here to watch the presentation immediately... It gets removed from our servers at midnight on Saturday, August 14.

-------------------------------------------------------

Joel Bowman, scribbling from San Antonio, Texas...

“The sun has risen, the sun has set...and you ain’t outta Texas yet.”

As the old saying above suggests, your editor is meandering between today and the many tomorrows promised by the seemingly endless roads of the Lone Star State. The sweeping landscape here, with its reverent plateaus, undulating hillsides and sweltering heat, is as breathtaking as the state is wide. Nodding donkeys line the highway and windmills dotting the great rocky shelves cast long shadows in the afternoon sun. Giant trucks and SUVs careen along the winding routes. The path ahead fades into a hazy apex some point far off in the distance.

Fellow reckoners will recall that we’re currently on a Coast-to-Coast Correction Tour, traversing the country from busted real estate bubble in the west to busted real estate bubble in the east. We’re trying to get a general sense of what the Great Correction feels like on the ground. What, for instance, do the locals think about the “recovery” we all read so much about in the papers? Have housing prices in local neighborhoods stabilized? Are factories and regional companies hiring again? What is the general mood regarding the immediate future? We came armed with questions and a mobile Internet connection. The rest we leave to the wide-open roads and bar room conversations along the way.

But more on these and other lines of inquiry next week, after we find a place to rest our weary bones for a while...

Speaking of informative conversations, our resident geologist and editor of Energy & Scarcity Investor, Byron King, recently spoke with a man whose name you probably won’t recognize...at least not yet. In this weekend’s guest essay, Byron shares his conversation with one major oil president who covers an unlikely swath of the planet. With all the kerfuffle regarding the Gulf oil spill – and the subsequent moratoriums, lawsuits and various other toxic, legal leakage choking up progress closer to home – we thought it might be worth while digging a little deeper into the industry abroad. Read on below for Byron’s interview...

-------------------------------------------------------

Urgent: Byron King’s Video Presentation Goes Offline Monday, August 8.

Here is the Free Presentation: Tiny Canadian Penny Stock Discovers a MASSIVE $172.5 Billion Oil Field!

Harvard geologist Byron King just released this new online video presentation.

Watch it to hear about a tiny Canadian penny stock potentially sitting on $172.5 billion barrels of oil...

Because this company is so small, this huge discovery could mean a potential3,577% gain for fast movers!

Click here now to watch Byron's presentation instantly.

-------------------------------------------------------

Going Deep

By Byron W. King

Pittsburgh, Pennysylvania

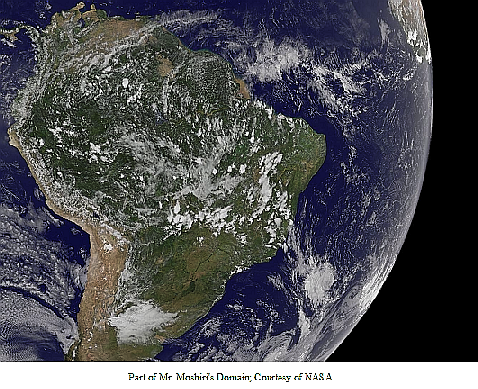

Recently, I had a long talk with Ali Moshiri, President of Chevron Africa and Latin America Exploration and Production Company. Mr. Moshiri has been working for Chevron for over 30 years. He’s one busy man, whose responsibilities begin in the southern waters of the Gulf of Mexico and extend to the cold reaches of the southern Atlantic Ocean.

In our talk, Mr. Moshiri and I looked at the future of offshore oil and gas exploration and development. Here’s part of what we discussed...

Byron W. King: Mr. Moshiri, you run a division of Chevron that includes Africa and Latin America. How much oil and gas do you pull out of the ground every day?

Ali Moshiri: For Africa and Latin America, on a gross basis, Chevron is producing somewhere around 840,000 barrels per day.

BWK: That’s about 1% of all the oil that the world uses every day, at 85 million barrels per day. Can you say some more about what’s happening in the areas with which you deal?

The basins in this area are different. It’s not necessarily like the Middle East, that they are huge fields. But there are many accumulations. On the aggregate, they’re significant. Not only to the Chevron portfolio, but overall to the supply of oil to the market.

If you look at this area, they’ll always be a net exporter. They’ll always produce more than they can consume. My personal view is that if they continue their level of economic growth, that they assume is going to be above global, they’ll still be an exporter.

It creates an environment for industry to include them as part of the energy equation. The barrels can move to other locations where they don’t have that balance.

BWK: Are you only looking for oil? What’s the larger hydrocarbon picture?

AM: The (Atlantic) basins have similarity, but at the same time the basins have both oil and gas. It’s not just oil. At the moment, the focus has been tremendously towards oil. I believe that both basins in West Africa as well as in Latin America have tremendous potential for gas for the future. But because of lack of infrastructure, they haven’t got to the point similar to Asia Pacific of the Middle East yet.

But if you look ahead 15 years, they’ll get to the point of contributing natural gas, through LNG (liquefied natural gas) or pipeline... That’s the next phase. Today it’s very much focused on the oil side.

BWK: In the Middle East, you’re looking at a mature, 60-70 year old concept of exploration. Also, culturally, you’ve got similarities of climate, ethnicity to some extent, religion too. Not that everybody’s the same. But by comparison, if you’re moving from the Caribbean Basin to West Africa to Brazil to Angola, you’re going to see a lot of different people and different governments and different cultures that you’re going to have to work with. Can you comment?

AM: Absolutely. If you look at the Chevron operations, we deal with ten different countries. Three of them are in OPEC. Two of them are observers in OPEC. Therefore five of them are very much within the framework of the OPEC community. That shows that each of them have (their) oil policy and different view compared to when you look at places like the US, Australia, UK and Europe.

For that matter, you have to deal with each country separately. You have to understand, first of all, the geology, the technical aspects of it. And also the policies. The policies vary.

I’m not saying it’s good or bad, whether it’s in the hands of the government or the private sector. That’s what we deal with in this area. Not only do we have to worry about the technical side, but also about the fiscal, commercial aspects of it as well.

BWK: Can you comment about what you’ve seen over the past 20 years, with the rise of the national oil companies (NOCs) in these regions, and how you’ve had to adapt from the way you used to do business to the way you have to do business now in the NOC environment?

AM: The reality is that with the truly conventional aspects of oil and gas, the technology is there. The know-how is there. Whether or not we have it, or a service company has it. It’s there. So the view of the NOC is that they have more than one option on just the conventional (development).

For example, (what) if you discover an oil field on land, say light oil? Then building it, developing it, putting it into the market is relatively conventional. So what we would focus on is increasing the recovery factor. We focus on getting more out of the ground.

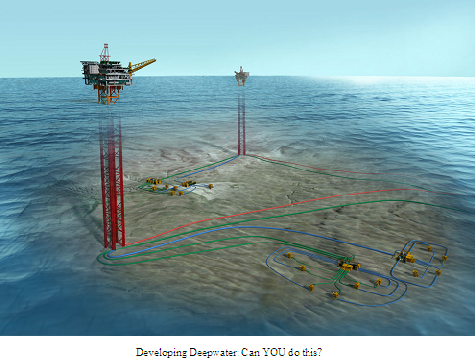

The next phase is what I’d say depends on technology. You get into deepwater. The technology is different. The incremental cost is significant. Room for efficiency becomes a greater part of how we develop things. Yes, everybody (says that they) can develop deepwater. But how do you manage expensive wells that you’ve got to drill? How do you test the basin? How do you commit to the investment? Those are significant.

As you see in the market today, it’s almost becoming like there are a lot of people who can explore. But there are not a lot of people who can develop deep water.

AM: I’m glad you took a visit to some of our operations. (You should see) some of the other remote places like offshore, deepwater off Nigeria. You can see how those places are highly technically driven.

And for as much as we’ve gone so far into developing these (deepwater) fields, the technology is not there to work over the wells when there are problems. The technology is not there to create efficiency for working over some of these wells. For example, if a well goes off production in West Africa, and it’s in the swamp, or in Block Zero, off Angola, in shallow water, we move a rig in and we know how to work over the well.

But if a well goes off production and it comes to a work-over, if it’s in deepwater, in say 8,000 feet of water, then you almost have to spend as much to work over a well as you spent to drill the well. Therefore, we are looking for the technology, and expanding our expertise, how to go back and do some of that work. To work those kinds of wells over.

BWK: Can you describe how Chevron’s relationships are changing over time, with the NOCs?

AM: Yes, our relationship with the NOCs is changing, moving to a different direction. The next phase goes several years down the road and gets into the non-conventional hydrocarbons. Like tight sands and shale gas. I always use the US as the base, where we started.

I’ve been in this business 32 years with Chevron. I remember when 500 feet of water was deep water. But now 500 feet of water is a conventional development, or work-over, with high recovery factor. And I think we need to expand that one all the way.

In some of the other regions, especially my region, we are not to that point yet. Again, it’s because some of these basins have not matured yet.

BWK: Can you elaborate on that concept of maturity? How are things different between, say the US and further south in the Atlantic Basin?

AM: (The US) Gulf of Mexico shelf is mature. But if you look at it south, from Mexico down to Argentina, or West Africa or sub Sahara or East Africa, we are still at the first phase of understanding the basins, understanding the potential, developing the technology around it, and being able to transport it.

Some of the discoveries (that) some of the companies have, in sub Sahara Africa, the transportation is going to be the issue. That region is going through a different phase. The transportation is about one phase behind where we are in the US.

According to Chevron’s Mr. Moshiri, there’s great potential for future energy development in the Atlantic Basin. The hydrocarbon resource is there – both oil and natural gas – and development is at an early stage.

The future will see more exploration and development, moving from oil into gas. The local markets will doubtless expand, but there’s still quite a bit available for export. But to accomplish this, the transportation infrastructure needs to expand. In short, there’s much left to accomplish in an immense swath of the world.

The Future Challenge of Energy Development

There are great opportunities for future exploration and energy development in Latin America and Africa. This will require trillions of dollars of capital over many years. That, plus world-class technology, superb and skilled people, as well as close coordination between developers and the national host governments.

Chevron, the subject of this article, is one of the world’s best independent oil companies. From its roots in the California oil patch of more than a century past, Chevron has a solid record of successful exploration and development. Chevron has great financial strength, and a deep pool of technical competence. Chevron’s success – certainly in deepwater development – is built upon its highly skilled and talented people such as Mr. Moshiri and the many members of his extensive team.

That said, there are many other companies working on deepwater oil exploration and development projects across the world. They range from very big to not very big, from independent to nationally-owned and operated.

If you’re interested in learning about another aspect of deepwater development, I can tell you about a small, Canadian company that is developing a remarkable play in offshore Africa. To access my full presentation, just click here.

Until we meet again,

Byron W. King

for The Daily Reckoning

-------------------------------------------------------ALSO THIS WEEK in The Daily Reckoning...

Son of Subprime

By Addison Wiggin

Baltimore, Maryland

In 2007, the writing was on the wall. The famous “perfect storm” had gathered above the US housing market, its eye hovering over subprime loans. As you know, the storm came...and it rained, and rained, and rained... Ultimately, it washed away trillions of dollars in investor wealth.

Son of Subprime, Part II

By Addison Wiggin

Baltimore, Maryland

The root of the problem is the nature of investing itself – at least, the public form of investing, as practiced by most investors and as tempted by Wall Street. The idea of it is that a man can get rich without actually working or coming up with an insight or an invention by careful study or dumb luck. All he has to do is put his money “in the market” by handing it over to Wall Street, and poof! – by some magic never fully described it comes back to him tenfold.

Sweet Profits in Sugar?

By Chris Mayer

Gaithersburg, Maryland

August, the eighth month of the year, is the last month before the traditional harvest time in the Northern Hemisphere. Thus, the old saying was “If the 24th of August be fair and clear, then hope for a prosperous Autumn that year.” So far, the month of August has been very fair and clear for the stock market...and for the commodities markets. These buoyant trading days of early August continue last month’s bullish action in both the stock and commodities markets.

Fields of Dreams

By Chris Mayer

Gaithersburg, Maryland

Imagine yourself standing in fields of soy and sugar cane that carpet the land out to the horizon as far as you can see and sweeping blue skies overhead. Only an occasional tree or silo gives you any sense of distance. You are standing on a vast savannah that is one of the most productive farming regions in Brazil. Called the cerrado, it produces 54% of Brazil’s soybeans, 28% of its corn and 59% of its coffee. It also supports 55% of Brazil’s beef industry.

Incredible Threat

By Bill Bonner

Ouzilly, France

Last week, Mr. James Bullard was being both cagey and clairvoyant. The president of the St. Louis Federal Reserve Bank noticed what everyone else has seen for months; the US economic recovery is a flop. Mr. Bullard told a telephone press conference he worries that the US economy may become “enmeshed in a Japanese-style deflationary outcome within the next several years.” That is exactly what is likely to happen.

--- Alex Green’s Momentum Alert ---

You MUST Hear This Urgent Message

Our friends at The Oxford Club have just put together a short presentation to help you navigate the swinging markets... and make a ton of money. But be forewarned, the information you’re about to hear may contradict everything you thought you knew about investing. Just CLICK HERE immediately to watch this video and please make sure your speakers are on.

-------------------------------------------------------

The Weekly Endnote: Last night we stayed in the Menger Hotel, on Alamo Square, in downtown San Antonio. Part museum, part hotel, the building was erected 23 years after the fall of the Alamo. Only three outfits (two of them families) have owned it since, the most recent having done so for the past 80 years. The corridors are lined with black and white photographs of many notable – and, as history would have it, controversial – patrons. Theodore Roosevelt, for instance, stayed there in 1898 and used the hotel bar as a meeting place to recruit the Rough Riders, who fought in Cuba in the Spanish-American War. Other recognizable guests include Babe Ruth, Mae West, Robert E. Lee, Ulysses S. Grant and, oddly enough, Oscar Wilde.

If, as the latter (and Shaw...and Russell) is said to have suggested, England and America really are “two foreign lands separated by a common language,” then perhaps Texas and Mexico are a common land separated only, perhaps merely, by mutually foreign languages. Outside the Alamo, which both sides occupied at various stages, camera-snapping tourists of both nationalities throng the time-worn pavement. A chaotic fusion of English, Spanish and, inevitably, “Spanglish” drifts over the relatively amicable crowds.

What must the Mexicans think, we wonder? “Hey, didn’t we win this one? Why the hell do we need passports and valid work permits to visit?”

The battle was won, yes, but the war went against the Mexicans. What’s more, history is written – and subsequent rules enacted – by the victor. It makes no difference that New Mexico was once simply “Mexico,” or that every red-blooded, flag-waving American patriot still enjoys a tasty taco from time to time. What matters is that The United States is the empire of today. At least for now. What record of events the visitors of next century will ponder, we cannot say. They might be etched in Chinese for all we know...and the photographs hanging on the walls of The Menger could well show an all-white staff of servants from the 2050s, the way they show all-black ones from the 1950s today.

Enjoy your weekend...

Cheers,

Joel Bowman

Managing Editor

The Daily Reckoning

-------------------------------------------------------

Here at The Daily Reckoning, we value your questions and comments. If you would like to send us a few thoughts of your own, please address them to your managing editor at joel@dailyreckoning.com The Daily Reckoning - Special Reports:

Saturday, 7 August 2010

Posted by

Britannia Radio

at

20:14

![]()