No Cutting Back: The Bernanke Money Printing Story When the Price of Silver Doubles in a Month Bill Gross: Fed Actions Could Lead to a 20% Weaker Dollar Joel Bowman The Mogambo Guru Rocky Vega![]() The Daily Reckoning U.S. Edition

The Daily Reckoning U.S. EditionHome . Archives . Unsubscribe

The Daily Reckoning | Thursday, November 4, 2010

-------------------------------------------------------

Exclusive Offer from Mayer's Special Situations - Closes Midnight TONIGHT!

Did You See The Video About The American Nuke Bomb LOST Under Ancient Ice Fields?

Way back in 1968, an American B-52 crashed in northwest Greenland...

Unfortunately, the nuclear bombs on board got forever swallowed by an ancient ice sheet...

But there's an unknown penny stock set to rise 2,000% from this sorry situation.

Sound unbelievable? Watch this presentation for proof...![]()

China’s Leg Up in the Rare Earths Market How the West is falling behind in one major market sector

Reporting from Laguna Beach, California...

Eric Fry

The so-called "rare earths" would not be rare earths...unless they were rare.

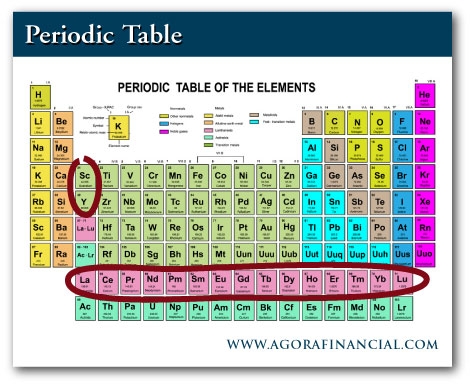

"Basically, rare earths are exotic elements that are critical to the future of high tech, clean energy, Big Science and - oh by the way - national defense," explains Byron King, editor of Outstanding Investments. "The list includes 17 elements like terbium, ytterbium, and yttrium."

And these exotic elements have become almost as rare as Democratic congressmen. But the global demand for these impossible-to-spell elements continues to grow. The result is that the prices of rare earths are soaring.

"Back in chemistry class," Byron continues, "you may have heard of the 'Lanthanide Series' of elements, which includes 15 of the 17 elements. Also back in chemistry class, somebody doubtless raised their hand and asked the teacher what you needed to know about the Lanthanides. If your chemistry class was like most chemistry classes, the teacher probably said, 'Don't worry, they're not on the test.'

"Well, these elements are on the test now," Byron warns. "Why? Because the Chinese control 97% of world output of rare earths, and have tight control over much else as well in the realm of technology metals. Recently the news is that the Chinese have been restricting exports of rare earths, and apparently some other metals. That's a problem."

Byron continues: All of the rare earth elements have one or more excellent atomic properties. These include incomparable chemical, electrical, magnetic and/or optical properties. For example, neodymium (Nd) makes strong magnets even stronger. Europium (Eu) is necessary for television screens to show color images. Lanthanum (La) is useful in high energy- density batteries, as well as being critical in petroleum refining.

Right now, there is NO publicly traded Western company that has a mine, refinery or plant up and running, let alone producing commercial amounts of rare earths for sale as useable end product. But that's about to change, as Chris Mayer, editor of Mayer's Special Situations, explains below...

Now think about all the rhetoric you've heard about how "we" are going to transition to a high tech/clean tech future of solar panels, windmills, electric cars, smart grid, wired-world. Oh yeah? Problem is, most of these technologies simply WILL NOT WORK without large amounts of rare earths.

That is, the electric cars, wind turbines, solar panels, miniature electronics, smart grid, etc. will not get built in the US (or Canada, Japan, Europe, Australia, etc., for that matter) if industries cannot secure long-term supplies of rare earth minerals. And, oh by the way, that goes double for advanced defense technologies. For example, EVERY missile in the US arsenal uses some quantity of rare earths - every single one!

What's the problem? In the past 15 years or so, the West closed down essentially all of its rare earths refining capability. The entire market (well, 97% of it) was conceded to the Chinese, for a lot of reasons - economic, wages, resource-base, environmental and much more. Now that the West wants to build out a different energy and technology future, the Chinese control critical substances from ore bodies through to final oxides and metals.

It's as if somebody (the West) wants to set up a fancy, Napa Valley- style winery (new, clean, high tech), but doesn't have any grapes (rare earths). This vintner-wannabe will have to buy the grapes from a producer in China. Do you really think that the Chinese will sell the guy the best grapes, and help him create a world-class brand of wine?

What do the Chinese say? They say that they're just acting rationally. They're closing down unsafe mines and controlling past environmental pollution. They're consolidating the industry, as most other industries consolidate over time.

The Chinese say that they're just encountering natural issues of depletion, from mining their ore bodies over the years. They say that they just don't have "more" rare earths to export, because of natural economic and market forces.

Of course, the Chinese also say that if you move your factory to China, they'll put you on an allocation for rare earths. You'll have enough to operate. That is, you'll have enough raw materials as long as you set up a joint venture with a Chinese firm and share all your technology. Of course.![]()

Byron King's Energy & Scarcity Investor Reveals...

Video Presentation: Check Out This Canadian Penny Stock!

This Canadian penny stock play just won the rights to an estimated $172.5 billion oil bonanza... The profit potential could be enormous for investors who get in early.

Resident geologist Byron King has all of the details in this exclusive video presentation. There's still time to get in...

Click here to watch the presentation immediately. (Turn your speakers on.)![]()

The Daily Reckoning Presents The Rare Earth Bonanza

Rare earths have gotten a lot of attention lately. Deservedly so, as you'll see. And this creates some opportunity for nimble speculators. Let's take a look...

Chris Mayer

Last month, China cut its shipments of rare earth exports to Japan. China and Japan have a maritime spat going on and this ban is probably fallout from that. In any event, the ban alarmed Japanese manufacturers who depend on China for rare earths.

The term "rare earths" refers to a group of obscure minerals, such as cerium, rhodium and neodymium. They are critical to a host of cutting- edge technologies. We use them in everything from hybrid cars to low- energy light bulbs. They are also used in all kinds of electronics, from cell phones to laptops. You'll also find rare earths in batteries, polished glass, exhaust systems and more.

Japan makes all these things. In fact, it is the world's largest consumer of rare earths. China is the world's largest producer of rare earths, with 97% of the market. So you can see this is a matchup of heavyweights.

Japan has vowed to find new supplies.

New supplies are out there, but there is not much production coming on line until a couple of years from now, if all goes according to plan. In the meantime, rare earths prices are up as much as fourfold this year.

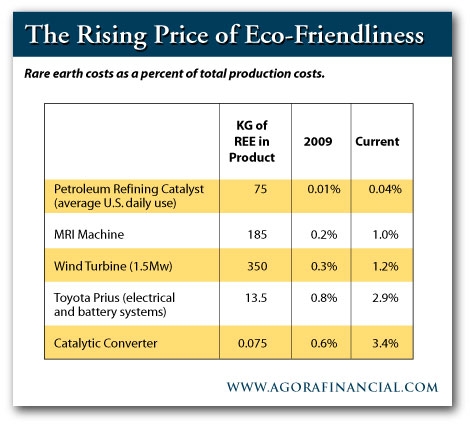

This has not had as dramatic an impact as, say, a fourfold increase in the price of oil would. That's because for most applications, rare earths are only a small percentage of the cost of the final product. The following is from Stratfor, an intelligence firm, which shows you that even now, rare earths often make up 1-2% of the total costs of a product.

Still, prices have gone up enough - and availability is tight enough - to cause some alarm in Japan.

I think the situation is alarming not only for Japan, but for users of rare earths everywhere. This will stimulate the search for alternative suppliers. And China may want it that way anyway. The production of rare earths is tough on the environment. As the FT reports, commenting on China's approval to develop a new rare earths mine in Jiangxi province:For the industry as a whole...there are signs that the Beijing government does not wish it to get too big. The consolidation of China's rare earths sector is part of a broader national effort to shift away from this type of low value-added, high environmental impact products.

To that end, China has raised export taxes on rare earths as high as 25%.

Stratfor, too, points to the fact that China's rare earths industry was often not profitable. Stratfor mentions some the other things China is doing that impact both supply and demand:That its prolific, financially profitless and environmentally destructive production of REE [rare earths elements] has largely benefited foreign economies is not lost on China, so it is pushing a number of measures to alter this dynamic. On the supply side, China continues to curb output from small, unregulated mining outfits and to consolidate production into large, state-controlled enterprises, all while ratcheting down export quotas. On the demand side, Chinese industry's gradual movement up the supply chain toward more value-added goods means more demand will be sequestered in the domestic economy.

So China's production of rare earths may fall...and it may consume more of what it produces at home. That means less for the rest of world.

Most of the production went to China in the first place because it was cheaper. And miners didn't have to worry about the environmental damage they caused.

Both those things are changing.

The Japanese are out looking for rare earths outside of China. The FT reports Japanese firms checking out deposits in Vietnam, India, Canada and Brazil. Most of these projects are still in the early stages. And even the near-term projects need significant funding. But when they come online, they will be significant new sources of supply.

Japanese firms are finding ways to use less rare earths in some cases. For instance, Japanese engineers found a way to use half the rhodium used to make catalytic converters. There are other experimental efforts ongoing that try different materials altogether. As Stratfor notes, the rare earths boom "means many industries are in a race against time to see if alternative REE supplies can be established before too much economic damage occurs."

So there is a window of opportunity here. I agree with Junji Nomura, who is in charge of research and development at Panasonic. "Rare earths will be a big problem for two-three years, but in four-five years, the problem will be gone."

That's a wide enough window to make good money speculating in rare earths. There are a handful of quality deposits out there that will begin production in the next few years.

You can find out more about four of them in our new special report on rare earths here. One of them - in Greenland - you may remember, as I wrote about it this past summer. New developments there have made the story better since.

Keep in mind these are high-risk plays. If the rare earths boom unravels, these stocks will do poorly. But if the rare earths boom can hold together for a just a year or two, these stocks could soar. We'll follow the stories of these four and see how things play out.

Regards,

Chris Mayer,

for The Daily Reckoning![]()

Why Some People DIDN'T Go Broke In The Bust

From 2008 until now, some people watched their gains go UP...as high as 448%, 556%, and even 579%...

On what? Not gold or blue chips. And obviously not real estate. Yet they could soon do it - and so could you.

Click here to watch the free new video that shows you how.![]()

Bill Bonner Why Printing Money Won’t Correct the Correction

Reckoning from Delray Beach, Florida...

Bill Bonner

Well, dear reader, you know the story as well as we do.

"US Stocks Rise as Fed Announces Additional Treasury Purchases," saysBloomberg.US stocks advanced, with banks helping benchmark indexes erase losses, after the Federal Reserve announced an additional $600 billion of Treasury purchases through June in a bid to boost growth in the world's largest economy.

What? Does he just make this stuff up? Maybe stocks will go up. Maybe they'll go down.

The S&P 500 climbed 0.4 percent to 1,198.03 as of 3:16 p.m. in New York. The measure had fallen as much as 0.8 percent. The Dow Jones Industrial Average added 26.64 points, or 0.2 percent, to 11,215.36.

"Nothing in here tells me that we should be selling stocks," said Paul Zemsky, the New York-based head of asset allocation for ING Investment Management, which oversees $550 billion. "The latest economic figures have been good. We have the Fed and the elections behind us. So there's less uncertainty."

The S&P 500 surged 17 percent since July 2 through yesterday as odds increased that Republicans would take control of the House. The GOP, while falling short of winning the Senate, narrowed the chamber's Democratic majority yesterday in an election shaped by voter anxiety over jobs and the economy.

Republicans gained at least 60 House seats across the country, capitalizing on concern that government spending has increased over the last two years and delivering a rebuke to the domestic agenda of President Barack Obama.

The S&P 500 may rally as much as 16 percent in the next six months because the election will stymie legislative initiatives in Congress, billionaire investor Kenneth Fisher said.

We don't know. And we don't care. Stocks aren't cheap. And the country is still at the beginning of a major adjustment...a Great Correction that will probably depress business profits for many years.

Besides, the stock market never has completed its historic rendezvous with the garbage pile. Yes, every investment asset class goes from the trash heap to the penthouse - and then back. By our calculations, US stocks are on the downside of that slope. We'll wait 'til they reach the dump - that is, when they're at giveaway cheap prices - before we get excited about them again. We want to pick them out of the trash at pennies on the dollar.

Of course, we could wait a long time. From trough to peak typically takes 16 to 20 years. If you take the peak as of January 2000...when the NASDAQ hit its high...we have another 6 or so years to wait. But if the peak was the peak in the Dow of 2008...heck, we could wait until 2028 until we finally hit bottom.

And don't forget. Japan waited 20 years between its glory days of 1989 and its low of 2009. We could do the same. But so what? We can wait....

But let's talk about happier things. This year the voters - God bless 'em - threw out more bums than usual. The Republicans gained 60 house seats.

That means Congress is gridlocked. Obama doesn't seem to understand what is happening. And Ben Bernanke is cranking up the presses.

The Fed announced a $600 billion purchase program, from here until June. Even in dollars, that's a lot of money to throw into a market. The stated purpose is to lower interest rates even further...trying to coax business into hiring and consumers into spending.

Will it work? Will it create real prosperity...growth...and wealth? Ha. Ha. Nope. No chance.

How can we be so sure? Well, theory and practice. In theory, it makes no sense. Real jobs require real investment by real investors, entrepreneurs and businesspeople. It takes time. Skill. Luck. Giving the banks more money (which is what happens with QE) merely destabilizes serious producers. They don't know what to expect. Cheap money forever? Will inflation increase? What should interest rates be? They don't know. So, they wait...and watch...and the slump gets worse. Besides, the economy is correcting for a reason. Any interference is bound to be a mistake.

The lessons from experience are even more damning. There is no instance in all of history when printing press money actually turned around a correction. And if you really could make people better off by printing money, Zimbabweans would be the world's richest and most prosperous citizens. Followed by the Argentines; they've got 25% inflation right now.

Nope; it isn't going to work. And even if it seems to be working...it will actually be making people worse off.

And more thoughts...

Here's Bloomberg on the subject of QE:The Federal Reserve may be underestimating the inflation outlook for the second time in less than a decade as it prepares to pump more money into the US economy.

*** And here's an item from Reuters' "Business Banking News:"

The Fed today will probably restart purchases of bonds to spur the economy even as growth is likely to accelerate at a 2.6 percent annual pace in the second quarter of next year from 2 percent last quarter, according to Bloomberg News surveys of economists.

"By expanding Fed assets, Chairman Ben S. Bernanke may go down the same policy path taken in 2003-04, when he and other central bankers kept rates near a record low as inflation rose faster than initially measured. Bernanke may risk increasing expectations for higher inflation by too much, causing a shake-up in currency and bond markets," said James D. Hamilton, a University of California, San Diego economist.

"That perception alone would bring about a series of immediate challenges, such as a rapid flight from the dollar, commodity speculation and possible under-subscription to Treasury auctions," said Hamilton, a former visiting scholar at the Fed board and the New York and Atlanta district banks. "So the Fed has a careful tightrope act here."

Since December 2008, the Fed has kept interest rates near zero and used asset purchases to try to stimulate growth following the worst recession since the 1930s. New asset purchases would follow Fed acquisitions of $1.7 trillion in Treasuries and mortgage debt that ended in March.

"Wealth managers want to wean investors off gold."

What? Wealth managers are a threat to your wealth. No doubt about it. The US government runs $3 trillion of deficits since the end of '08. The Fed prepares to print $600 billion more, on top of the $1.7 billion it printed a year ago. In this situation gold is about the only thing you can depend on. It might go up. It might go down. But it won't go away.

And it will be here long after the US bond market collapses and the US dollar disappears.

Regards,

Bill Bonner,

for The Daily Reckoning

-------------------------------------------------------

Here at The Daily Reckoning, we value your questions and comments. If you would like to send us a few thoughts of your own, please address them to your managing editor atjoel@dailyreckoning.com![]()

What the heck, the markets absorbed $1.7 trillion of this QE in the last go ’round. It didn’t do any harm, did it? On the evidence, it didn’t do much good either. The money went into the banks and didn’t come out. They could probably take another $1 trillion or so without getting completely saturated. Who knows? If the Fed wanted, it could finance the entire US federal budget deficit…or eliminate the need for taxes completely.

A Movie Review: The Social Network

Private Sector Debt Burden About to Get More Burdensome

Feeling myself being squeezed into a making a precise prediction, I evasively said, “Well, James Turk of GoldMoney.com says that silver could double in price sometime this month! Within 28 days! Days!” She looks at me with a cold stare, and in a whispered monotone, asks, “So, are you saying that you will be gone in 18 days?” Suddenly, my instinct for survival kicks in, and I lash out like a cornered rat. I yell, “Not soon enough to suit either one of us, I’m sure! But soon!”

Investing in Gold Will Save Your Butt

Health Care Costs Go Up, Up and Away

The jitters continue as we near the Federal Reserve’s announcement of its new stimulation policy... which is likely to pump another half billion or so into the nation’s zombie economy through Treasury bond purchases. Perpetually influential Bill Gross, co-CIO & founder of PIMCO, which manages over $1 trillion in assets, is anticipating that Bernanke’s upcoming moves could lead to a precipitous 20 percent drop in the dollar’s value.

Elections Results Pour in, US Budget Cuts Still Likely to Come up Short

More Stealth Gold Buying, This Time it’s Iran to the Tune of $15B![]()

The Daily Reckoning: Now in its 11th year, The Daily Reckoning is the flagship e-letter of Baltimore-based financial research firm and publishing group Agora Financial, a subsidiary of Agora Inc. The Daily Reckoning provides over half a million subscribers with literary economic perspective, global market analysis, and contrarian investment ideas. Published daily in six countries and three languages, each issue delivers a feature-length article by a senior member of our team and a guest essay from one of many leading thinkers and nationally acclaimed columnists. Cast of Characters: Bill Bonner

FounderAddison Wiggin

PublisherEric Fry

Editorial Director

Managing Editor

Editor

Editor

Thursday, 4 November 2010

Posted by

Britannia Radio

at

19:12

![]()