How to Get the US Back to Full Employment in 30 Days The Surprising Price of Wheat Russia Plans to add More Gold, Eventually Yuan, to Reserves Joel Bowman The Mogambo Guru Rocky Vega![]() The Daily Reckoning U.S. Edition

The Daily Reckoning U.S. EditionHome . Archives . Unsubscribe

The Daily Reckoning | Friday, January 21, 2011

-------------------------------------------------------

Why China Is About To Bring America To Its Knees...

The world is 97% dependent on supply of these little-known resources from the red dragon.

At stake is America's ability to create cell phones, hybrid car batteries, even our high-tech military equipment...

They are about to shut supplies of this vital resource off from the rest of the world... FOREVER!

Click here to see how to make 8,577% gains or more from the greatest global supply squeeze in modern history.![]()

China is to Gold as the US is to Paper Currency One more way the Middle Kingdom is distancing itself from America

Reckoning today from Baltimore, Maryland...

Bill Bonner

Big drop in gold yesterday - down $23. Oil fell hard too. Otherwise not much action...

We'd still like to see a deep decline in the gold price. Too many people are getting onto gold. Most of them have no idea of what they are doing. Like readers of MONEY magazine, they're buying the yellow metal as a speculation. Most likely they're going to lose money. Almost everyone who speculates on gold loses money. Don't ask us why. It's just one of those Iron Laws of investing.

Gold goes up for 10 years straight. Speculators notice. They jump on board. And then the train runs off the tracks.

That's just the way it works.

Besides, remember that this Great Correction is not over yet...not by a long shot. It has barely begun to correct the excesses of the Bubble Era. A quarter of all homeowners are said to be underwater on their mortgages - that still needs to be sorted out. And the whole financial industry - with the collusion of the Fed - is sitting on trillions of dollars' worth of mortgage backed securities, pretending that they are good credits.

There are still major bankruptcies ahead...and deflation of assets prices. And in all the sturm and drang of it, the price of gold could go down too.

But if you're acquiring gold, you have some powerful competition. As nations become rich and powerful, they accumulate gold. Those that are getting weak and poor give it up. Here's The Financial Times with the latest news:Traders said that gold sales to China had jumped 30-50 per cent since Christmas, driving the cost of kilo bars in Hong Kong more than $3 per ounce above the market price of gold, the highest level since 2008 and an indication of the tightness in the physical market.

Asians build their holdings of gold. Americans add to their supplies of paper money. The Fed is adding some $600 billion of it in the first half of the year. And it is already considering what to do next.

"Physical demand has rocketed in China at the start of the year," said Walter de Wet, head of commodities research at Standard Bank.

The wave of Asian buying has propped up gold prices at about $1,360 a Troy ounce, traders and analysts said.

The metal's price has dropped 4.6 per cent from its December record price of $1,430.95, trading at $1,364.10 on Friday, as optimism about prospects for US growth has led western investors to turn their attention away from gold to other commodities and equities. "We have a balanced situation where one part of the world is buying and the other part is selling," said a senior trader in Hong Kong. Chinese and Indian investors are increasingly turning to gold to protect savings against sharply rising food prices.

Investor buying of gold bars jumped 80 per cent to a record 144 tonnes last year in India, according to GFMS, the precious metals consultancy, while across east Asia bar hoarding was up 125 per cent at a 15-year high.

How about this: stop. Admit that you've been a fool. Renounce QE, Keynes and the devil too. And all their works.

But that's not going to happen. Because liquidity masks insolvency; and inflation disguises deflation.

The feds are providing liquidity and inflating the money supply with the only thing they have left - paper money. And as long as the money flows...they can pretend that everything is okay. Things are quiet. Everybody is happy. Confident.

"...experience suggests that quiet periods do not extend indefinitely," wrote Reinhart and Rogoff in their history of monetary crack-ups.

Meanwhile, smart investors are buying gold...and hoping the price falls so they can buy more.

More thoughts, after today's guest essay...![]()

Good Only Until MIDNIGHT TOMORROW - Saturday, Jan. 22 - Give This Profit Engine a Risk-Free Try

$100,000 fits on a dinner plate. $1 million fits in a grocery bag. Act before midnight Sat., Jan. 22 and find out how you can start stuffing your own grocery bag with cash.

Amazing? Preposterous? Get all the details, and find out how easy it really is, right here.![]()

The Daily Reckoning Presents Stealth Symbolism, and a Rare Earths Update

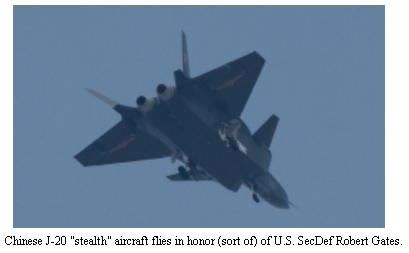

by Byron KingWhen US Defense Secretary Robert Gates visited China last week, his hosts chose that particular time to test-fly their new "stealth" aircraft, dubbed the J-20.

There appears to be symbolism at work here. The most direct interpretation is that the timing of the first flight of this new Chinese airplane was meant to insult Sec. Gates, the man who last year canceled the - far more advanced - US F-22 program.

Then again, perhaps we should all calm down and believe what a Chinese military spokesperson said. He helpfully explained that the weather at the test site, Chengdu, finally lifted and it was a nice day for a flight. Yes, of course.

What to believe? Hey, we may never know. Which leads to the next item.

Rare Earths Crackdown

This week, Chinese President Hu Jintao is visiting Washington, DC, to discuss US-China issues with President Obama and other dignitaries. One would think that the diplomats from each nation would pass the word for everyone to keep a lid on developments that could somehow cast a shadow over a high profile state visit.

So what are we to make of the announcement, out of Beijing, that the Chinese Ministry of Land and Resources has brought 11 rare earth mines under state control? The Ministry announced that the 11 mines, covering an area of 978 square miles, were the first batch of "state planned mining zones" for rare earths.

According to news accounts, Chinese authorities stated that the government's goal is to strengthen "protection and reasonable development" of the rare earths sector. Really? Why not just say that the weather was good, and it was a nice time to nationalize some more rare earths mines?

Consolidation and Higher Prices

This news about rare earths may not exactly be thunder out of China. But under the circumstances, it sure touches a nerve because China already controls about 97% of world's rare earth resources. Indeed, as you probably know, in recent months China has tightened control over rare earths by slashing quotas for overseas shipments, halting unauthorized exports, hiking export taxes and cracking down on heavily polluting mines.

The overall picture is that China is consolidating a formerly fragmented industry. The result is - and will continue to be - industrial consolidation, stronger state control and generally higher prices in the future.

China is already enjoying greater returns from its diminishing rare earths exports. Earlier this week, China's Ministry of Commerce reported that China's rare earths exports totaled 35,000 tonnes (metric tons) in the first 11 months of 2010, exceeding the posted annual quota of 30,300 tonnes. With soaring international prices, the value of China's rare earths exports jumped by 171% from 2009.

Looking ahead, the Commerce Ministry announced last month that it's slashing rare earths export quotas by about 35% for the first six months of this year.

According to an account in The New York Times, with very solid reporting by Keith Bradsher, mining in the "southern end of Jiangxi Province, ha[s] been placed under [China's] national planning authority. That step removes administrative oversight of mining from provincial and municipal control."

The Chinese View

Let me make a few points here, based on my observations over time, as well as what I heard Chinese representatives say during a recent trip to Hong Kong:1. China's leadership truly views rare earths as a current and future, strategic center of gravity for national economic development, future tech of many forms, and of course military power. In other words, they "get it." They will manage this rare earths issue from the top-down, making policy and directing assets and capital as appropriate.

Here's the bottom line. There's a great future for the rare earths industry in the West... but you have to be careful about chasing momentum. You need to invest wisely, with a focus on companies that can actually deliver an end product after managing years of capital expenditure, and forming-up many systems of systems.

2. Past mining practices have caused immense and immeasurable environmental damage within China. Meanwhile, much of the past practice used poor techniques that did not maximize output or return on investment. This is entirely unacceptable anymore, and the strategic nature of the rare earths issue makes now as good a time as any to clean up this mess - figuratively and literally.

3. The unlicensed, black market for Chinese rare earths materials has amounted to as much as 40% (maybe more) of total output, up until recently - the past two years or so. This is entirely unacceptable in a Communist state with a nominally "planned" economy. In other words, they're busting the rare earths Mafia in China.

4. Looking forward, China will "cooperate" with the international community on future RE exports - but ONLY to the extent that the overall process benefits China. Otherwise, the Chinese will always have an excuse for what they're doing or not doing.

5. I anticipate that, primarily, China will focus and prioritize its export of rare earths materials that go into value-added articles that then must come back to China to use in other manufacturing. One hand will wash the other. In other words, don't expect China to open the gates for rare earths exports, just to permit Western (non-Chinese) companies to manufacture stuff that doesn't somehow benefit China.

6. The Chinese are smart enough to identify potential markets for rare earths that COMPETE against China. They'll do everything they can - active and passive measures - to divert exports away from these kinds of markets.

Regards,

Byron W. King,

for The Daily Reckoning

Joel's Note: Did you catch Byron's brand new rare earth presentation yet? He just released it yesterday...which means there's still time to get in on his favorite rare earth play before the rest of the investor crowd gets wind of it. See here for details.![]()

Byron King's Outstanding Investments Introduces...

Nine Simple Ways You Can STILL Get Rich With Gold in 2011

Even as gold soars to record new highs, a respected Harvard geologist reveals how you can STILL use gold nine different ways to get rich.

Get the details on this epic profit forecast - right here.![]()

Bill Bonner Long Term Investments for Continued Family Wealth

by Bill BonnerYesterday, we began telling you about our visits with our strategic advisors...that is, people who advise us about what to do with our family money. (Did you see our invitation yet?)

One of them runs a fund that focuses on India. The other runs a fund in Germany. Both are looking for bargain stocks - one in the Old World. The other in the New World.

Yes, Asia is the New World now...America is part of the Old World.

And both of our strategic partners told us the same thing: it's gotten a lot harder to find bargains.

So what do you do, we asked. "Just keep looking..." was the answer.

We were explaining the difference between investing for yourself and investing for your family. If you're investing for yourself you usually have fixed objectives - often retirement financing. Since you know when you will need the money, you need to focus on investments that will pay off in the allowable time.

Trouble is, the trends that pay off most tend to be very long term. And very hard to time. Gold, for example, is probably going to pay off in a big way - some day. It has been in a bull market for a decade. It is hard to imagine such a powerful bull market ending in a whimper... Most likely, it will end in a Big Bang...as the price goes vertical.

We've been saying for a long time that the Dow and gold will probably come to the same number, sooner or later. Maybe around 3,000. Maybe 5,000.

Whatever it is, it will be a big payday for people who've stuck with gold. But what if you need money next year...or the year after? And what if you buy gold today and it drops 50% - as it did during the early '70s...in the middle of a huge bull market? Bummer, right?

But if you're investing for the family, you can take the long view. You can buy gold, bury it...and forget it. Maybe the next generation will need it.

Just don't forget to tell someone where you buried it!

Regards,

Bill Bonner

for The Daily Reckoning

-------------------------------------------------------

Here at The Daily Reckoning, we value your questions and comments. If you would like to send us a few thoughts of your own, please address them to your managing editor atjoel@dailyreckoning.com![]()

Want to really fix the unemployment problem? Listen up. Eliminate all bailouts, subsidies, giveaways and support systems – both to business and to labor. Abolish all employment restrictions and employment paperwork... Cut taxes to a flat 10% rate for everyone. Abolish every government agency that begins with a letter of the alphabet. Then abolish the rest of them.

Misconceptions About the Consumer’s Role in a US Recovery

A Word of Advice to Financial Authorities

The price of food is up so much that we are burning things and looting grocery stores in mindless anger and desperation, and we are looking for the Fabulous Mogambo Seer (FMS) to pledge our undying allegiance and love because he predicted that this inflationary hell is Exactly What Would Happen (EWWH)...

Why the Fed Creates So Much Money

Defining Economics

As further evidence that central bank interest in gold accumulation continues unabated, Russia’s indicated that it’s going to continue increasing the proportion of gold holdings in its already third largest in the world foreign exchange reserves. The statement is consistent with the plan Russia has had in place since at least June of last year...

Euro Rallies on Strong German Business Confidence

From Squeeze to Crush (Part One of Two)![]()

The Daily Reckoning: Now in its 11th year, The Daily Reckoning is the flagship e-letter of Baltimore-based financial research firm and publishing group Agora Financial, a subsidiary of Agora Inc. The Daily Reckoning provides over half a million subscribers with literary economic perspective, global market analysis, and contrarian investment ideas. Published daily in six countries and three languages, each issue delivers a feature-length article by a senior member of our team and a guest essay from one of many leading thinkers and nationally acclaimed columnists. Cast of Characters: Bill Bonner

FounderAddison Wiggin

PublisherEric Fry

Editorial Director

Managing Editor

Editor

Editor

Friday, 21 January 2011

Posted by

Britannia Radio

at

22:09

![]()