Saturday 11 August 2012 Friday 10 August 2012 Friday 10 August 2012 Friday 10 August 2012 Friday 10 August 2012 Thursday 9 August 2012

Eurocrash: Germany holds the key

And, according to Die Welt, the stresses are building to intolerable levels, the paper saying that Merkel is going to have to choose between keeping her coalition going and saving the euro. She is not going to be able to do both.

With the EU now being called, in derogatory terms a "liability union", "it is not clear" how Merkel can convince her troops to approve her rescue programme. Every additional million that flows to Athens destroys the credibility of her centre party.

Handelsblatt is basically saying the same thing although, oddly enough, this is nothing new in German politics. We were writing in similar terms in May 2004, which just goes to show that there is nothing new under the sun.

What is new, though, is talk of an EU referendum in Germany. Raised in June by Schäuble in an interview in Der Spiegel, and then by others, we find Reuters reporting that support is growing for a referendum on further European integration.

Earlier in the week, leader of the opposition Social Democrats (SPD), Sigmar Gabriel, backed the idea. And latest of the politicians to repeat the call is Horst Seehofer, the head of the Bavarian Christian Social Union, the sister party to Merkel's Christian Democrats (CDU). He is saying that ordinary Germans should be consulted more on big European decisions, emphasising that the EU could not remain a "project of the elite".

Der Spiegel, which broached the referendum meme on June, is now assessing the odds, also citingThe Economist, which is offering a trivial piece, backed by an editorial which asserts that, "for all you know, Angela Merkel is even now contemplating how to break up the euro".

Greece is buckling, it says, much of southern Europe is also in pain, while the northern creditor countries are becoming ever less forgiving: in a recent poll a narrow majority of Germans favoured bringing back the Deutschmark. A chaotic disintegration would be a calamity. Even as Mrs Merkel struggles to find a solution, her aides are surely also sensibly drawing up a plan to prepare for the worst.

As always, though, the grasp of European politics is scant, and the role of the EU institutions under-played. And, while German politics are doubtless going to play a crucial part in the EU's fate in the short-term, which we ourselves acknowledge in our opening, the likes of Barroso and van Rompuy have yet to make their plays.

However, in an event that has an interesting historical resonances, on 25 July, Merkel opened theBayreuth Festival, the annual Wagner fest which offered drama every bit as gripping as that to come with the fall of Greece.

Another notable to attend the festival on the brink of great events was Adolf Hitler. On 23 July 1940 – just as the Battle of Britain was unfolding - he attended a performance of Wagner's Götterdämmerung– the last time in his life he was ever to see a live performance of Wagner.

His childhood friend, Augustus Kubizek, recalled the chancellor telling him: "I am still tied up by the war. But, I hope it won't last much longer and then I'll be able to build again and to carry out what remains to be done".

Thus year, Merkel could have been thinking much the same, with the long war for European union once again interfering with the leader's plans. What comes round goes round. The current chancellor, politically at least, may not survive the experience either.

COMMENT THREAD

Richard North 11/08/2012 The Harrogate Agenda: local democracy

Yet Iceland is a sovereign nation. It has its own government, its own parliament (pictured above), its own laws, its police and even its own fishing policy. And, despite its small size, the country does tolerably well, making its own mistakes and also solving them. It has a GDP of $12.57 billion (146th in the world) and a GDP per capita of $38,500, the 24th highest in the world (higher than the UK's $36,600, the 33rd highest).

The idea then that much larger units of population in the UK need a beneficent central government to create all their laws, to control virtually everything they may do, to fund them and even define their boundaries and their very existence is, frankly, absurd. Furthermore, we tolerate this situation, and even call it democracy. That is really absurd.

Thus the second of our demands is that democracy should be redefined, located in smaller, semi-autonomous units based on county and former county borough areas, with possibly some newly defined areas.

Basically, what we need are units with populations in the order of 3-500,000, making up between 150-200 primary areas in the UK, each responsible for most of their own government, with their own constitutions, legislatures, laws and revenues.

This is not "localism" in the David Cameron sense, or anything like "The Plan" offered by Hannan and Carswell. We are not impressed by the idea of central government reaching down, condescending to bestow on the "little people", some tiny fraction of power held by the centre, under carefully controlled conditions, ready to claw it back at a moment's notice.

What we are proposing here is nothing short of a revolution, where the fundamental building block of our democracy becomes the county-type body.

In the present structure, sovereignty is vested in parliament which – in theory, at least – makes laws defining the nature and powers of local government. In fact, of course, it is central government which call the shots, making councils little more than local agents, doing the bidding of their Whitehall masters.

In our revolution, the people are sovereign and they define the powers, shape and financing of their local areas, via the medium of referendums, setting up constitutions which can only be changed by the people and are beyond the reach of central government.

By this means, local government becomes the property of the people, doing its bidding, and not a government agent imposing central government diktats.

As to the powers of our local units, we would expect most domestic policy issues, and the related law, to be taken over. Local government would be responsible for most of the policing and local justice administration, emergency and health services, welfare, transport, education, agriculture where appropriate, energy, water policy, and much more.

In what would effectively become a federal-type structure, central government would concern itself with strategic issues, but focus mainly on foreign policy and relations, defence and cross-county and serious, organised crime.

This is the "small government" which so many people profess to want, but even then – despite the local units being constitutional bodies - that does not guarantee their freedom from central government interference.

Here, as we see in the United States where there is constant tension between federal and state governments, the problem is money. The federal government, with its own vast income stream, far larger than states revenues, is able to bribe the states with cash inducements or bludgeon them by withholding cash.

The answer to this, as always, is to control the money. Borrowing from the EU, which is not totally devoid of good ideas, the local units should be the tax raisers, with central government financed by precept from each of the units. The centre should have no taxation powers – and nor should it be allowed to borrow to finance a deficit.

Taking in for the moment, the idea of referism (which the EU lacks), we then see budgets at local and central levels controlled by annual referendums, firmly limiting the expansionary tendencies of all governments.

What's more, there is one important side-effect of such changes – Westminster MPs become even less important than they are now, while democratic representation at local level becomes more important.

As to representation in Westminster, it would be my suggestion that each unit was allocated roughly one seat per 120,000 population. How those seats were organised, and on what terms the representatives should be sent to Westminster – including their pay and expenses – should then be determined locally.

Thus do we see democracy closer to the people, with government under the direct control of the people. And when you think about it, anything else isn't really democracy.

COMMENT THREAD

Richard North 10/08/2012 The Wail: getting it wrong again

The two actions, though, are very different. As a more considered report in Deutsche Welle points out, the French specifically targeting the Roma who have set up long-term caravan encampments in defiance of local laws, causing considerable friction with local communities.

The raids are part of the ongoing war against the Roma, but are the first since Francois Hollande took office in May. They took place in Lille, with police descending on the camps in the early morning hours of yesterday, clearing one camp of around 150 people and another of 50.

"The tensions with (local residents) had become untenable," said Maryvonne Girard, deputy mayor of the town of Villeneuve d'Ascq, near where one of the camps had been located.

This is more comparable with the Italian action in 2007 and again in 2008, the latter in Naples where Gypsy shanty towns were burned to the ground as Italian police swooped on Roma encampments.

But what makes the French action really interesting is the contrast with the attitude of the British authorities. Readers may recall a recent report about an illegal gypsy camp in Meriden, Solihull. It told us that, when local residents established a camp, to maintain a 24-hour vigil in protest at the gypsy encampment, the local council threatened action against the residents rather than the gypsies.

And the source of this report – you guessed it – is the Daily Wail. Perhaps it should be making this comparison, between the robust French and our pusillanimous, vindictive authorities, rather than looking to Greece.

COMMENT THREAD

Richard North 10/08/2012 MP: Monumental Prat

Tom Greatrex is presently Shadow Energy Minister. On his Facebook page, he presents us with a piece from the Scottish Herald claiming that "More Scots in fuel poverty than in any other UK region". That is of little surprise. But in the same breath, he complains that "Gov infighting over #ccs (Carbon Capture Storage) funding puts UK potential as world leader at risk" citing Teh Graudnian.

This is also the man who confidently proclaimed "Any increase in renewable generation is welcome. The investment needed to make Scotland's renewables potential a reality is supported by consumers across the whole of Britain, not just in Scotland."

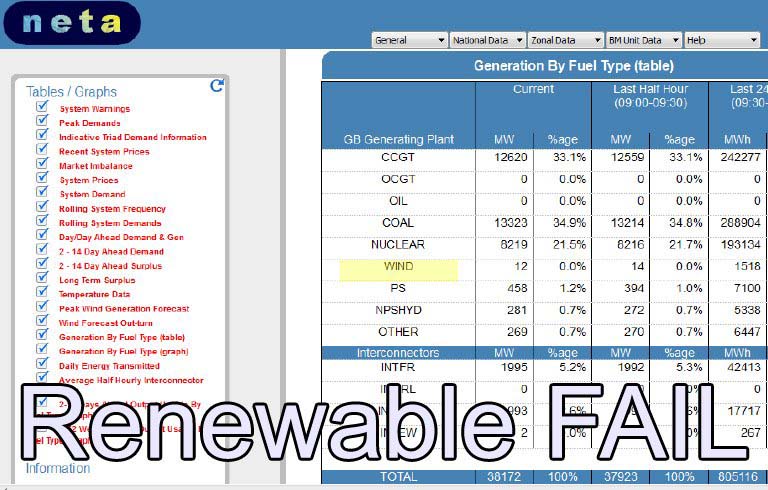

However, Andy Scrace, of EUReferendum.com forum, this morning pointed out to me the above data from bmreports.com, whereby wind energy was whacking out a whopping 12MW of energy. That in terms of supply of is 0%. Installed capacity of UK wind is 4686MW.

Far be it from us to spoon-feed you conclusions. Do the math.

COMMENT THREAD

Peter North 10/08/2012 Eurocrash: German mood music

And here we go again. Handelsblatt this time is running an interview with a stock market guru by the name of Dirk Müller. His name doesn't mean much over here, but he's widely respected in German financial circles.

Greece is "blessed" with the wrong currency he says. With the euro, the Greeks can never stand on their own feet. Their debt could be cancelled five times without changing anything. So, says Müller, Greece will leave the euro. From an economic point of view there is nothing else left.

But then, there's one born every minute. Economist Marcel Fratzscher, the new chief of the German Institute for Economic Research, thinks that all EU members should join the euro.

His dream is "a European Monetary Union with all 27 member countries", then arguing that "the eurozone has been established without a political, fiscal and banking union". Long term, these steps are necessary, he says, to make the currency crisis-proof.

That idea, I think, isn't going to fly. Müller is more likely to prevail. His voice is yet another setting down the mood music that says Greece is on its way out of the euro. Its exit is getting to be a self-fulfilling prophesy.

COMMENT THREAD

Richard North 10/08/2012 Eurocrash: on Britain leaving the EU

The former prime minister and full-time europhile also – rather predictably - warns that Britain should not turn away from "Europe", while conceding that it is unlikely that the UK would agree to any new treaty commitments. Commitments.

Nevertheless, said Blair, the euro crisis would lead to a "huge political transformation of the EU", about which he had "deep concern" that Britain could have a referendum and leave the EU entirely.

It seems, though, that Blair is not the only one to be thinking about Britain leaving the EU. According to Ambrose Evans-Pritichard, Japan's biggest bank, Nomura, has been considering the possibility.

In an 11-page report written by Alastair Newton, senior political analyst at Nomura International plc since October 2008, the bank comes up with the stunning statement that:The effect a looser relationship with the EU would have on the UK economy in general and on the financial services sector in the UK in particular is not clear at this time, even though British eurosceptics argue that being freed from EU regulation would be a booster.

That really sets the tone for a report which rehearses all the old clichés, although Newton is also kind enough to tell us that the prospect of Britain leaving is, in our view, "bound to raise concerns" – indeed, is doing so already in the City".

The core point, we are told, is that the eurozone "may have to take drastic steps in integration (fiscal union, etc) to save the euro, making it nigh impossible for a fully sovereign state to remain part of the Project".

Possibly, I would suggest, it might even make it difficult for the UK to remain in the UK, so we are still in "now tell us something we don't know" territory.

Alastair Newton, by the way, is an ex-British diplomat and former head to Tony Blair's G7 team. He was also intelligence co-ordinator in the first Gulf War. Unfortunately, that means he is a europhile, FCO clone, which makes his work suspect, as well as quite evidently superficial.

Even occasional visitors to this blog will, for instance, know full well that, if the eurozone does not collapse completely, "it is only a matter of time, in our view, before crisis-related steps are agreed which necessitate treaty changes".

If you are Alastair Newton, however, writing that gets you into the Failygraph, complete with the speculation that: "In those circumstances, the British government will almost certainly demand 'treaty change for treaty change' in an effort to repatriate powers", looking to win repatriation of powers to London for every concession on treaty reform.

Newton then acknowledges that which we have been saying for some months, that the UK would "likely be looking to repatriate powers which EU partners may be unwilling to concede within he context of the single market", which means that he does not rule out the possibility of a serious schism between the EU and the UK.

From this, we get the stunning observation that Cameron could find himself in "a very difficult position indeed", under even more intense pressure from within the ranks of his own party to call an immediate referendum. Thus, we learn, "Mr Cameron's current roadmap to get from where he stands now on the EU to the other side of the next election looks to be a very tricky one to navigate successfully".

As one delves more into this derivative tripe, one wonders why Ambrose spent the time and effort reviewing it, although he does then observe that this is the first time that he has seen a global bank issue such a report. To paraphrase Johnson, therefore, we could suggest that a global bank talking about Britain leaving the EU is like a dog walking on his hind legs. It is not done well; but you are surprised to find it done at all.

Namura, in fact, have a poor record for producing intelligent analysis of EU politics, having published in March 2011 an "optimistic" report on the fate of the euro.

While the euro area monetary union had design flaws from the outset, it said, "there is strengthening evidence that the policies that are to be announced by Europe's leaders in the 'Grand Bargain' on 24 March are likely to fix many of these issues".

As a result, the report went on, Europe stands to become less prone to the sorts of problems that have been afflicting it, and better able to deal with new types of shock should they occur.

Putting in place the requisite policies to ensure the survival and further development of the euro area into a robust monetary union depended ultimately on political will, the bank said. "And the evidence is that this is, and is likely to remain, strong".

Nevertheless, Ambrose uses the current Namura report as a springboard to tell us that it has been his "gut feeling" for some time that the EMU debt crisis – or rather the intra-EMU currency misalignment crisis since debt as such is not the root problem (except for Greece) – has already led to de factodivorce.

Britain is no longer part of the Project. Furthermore, he says, this is proving less traumatic than supposed. It is quite possible to imagine various forms of semi-detached, or mostly-detached status where we carry on trading much as before.

In the Ambrose scenario, Britain would tilt more towards Asia, the Americas, and Africa. UK relations with Europe would settle down over time and would probably prove better.

But he doesn't like the Swiss or Norwegian analogies since Britain "is not remotely comparable. It much bigger and more diversified, much more difficult to push around. The fact that Norway feels it must go along with almost all EU law – a point invariably made by status-quo defenders – is irrelevant. It tells us nothing about Britain".

Ambrose thus, is not excelling himself in his own analysis, and is clearly bouncing along the margins without giving any serious thought to Britain outside the EU. His views on the EU without Britain, though, are interesting: it would become less free-market, more protectionist, more dirigiste, more prone to quarrel with the US.

Thus does out man look forward to another report by Nomura – or perhaps a Chinese bank next time – on the investment implications for Europe without Britain in it.

But don't hold your breath. With the quality of analysis on offer, it is not surprising that the banks are making such a mess of their affairs. Like the markets as a measure of political developments, they are grossly over-rated.

COMMENT THREAD

Richard North 09/08/2012

Saturday, 11 August 2012

I don't think it ever really registered with me, until now, quite how small is the population of Iceland. With 313,000 souls, this country boasts fewer people than the London Borough of Croydon (363,000) and very substantially less than the Metropolitan District of Bradford (501,000).

Posted by

Britannia Radio

at

07:31

![]()