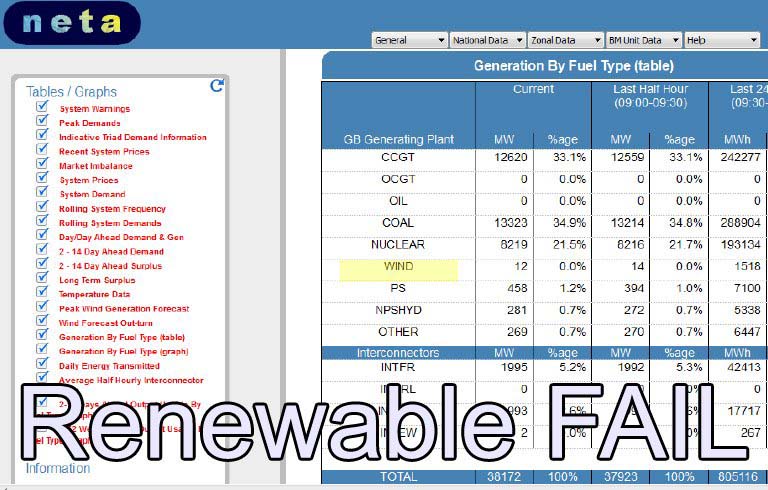

MP: Monumental Prat Friday 10 August 2012 Tom Greatrex is presently Shadow Energy Minister. On his Facebook page, he presents us with a piece from the Scottish Herald claiming that "More Scots in fuel poverty than in any other UK region". That is of little surprise. But in the same breath, he complains that "Gov infighting over #ccs (Carbon Capture Storage) funding puts UK potential as world leader at risk" citing Teh Graudnian. This is also the man who confidently proclaimed "Any increase in renewable generation is welcome. The investment needed to make Scotland's renewables potential a reality is supported by consumers across the whole of Britain, not just in Scotland." However, Andy Scrace, of EUReferendum.com forum, this morning pointed out to me the above data from bmreports.com, whereby wind energy was whacking out a whopping 12MW of energy. That in terms of supply of is 0%. Installed capacity of UK wind is 4686MW. Far be it from us to spoon-feed you conclusions. Do the math. COMMENT THREAD Peter North 10/08/2012 |

Eurocrash: German mood music Friday 10 August 2012 And here we go again. Handelsblatt this time is running an interview with a stock market guru by the name of Dirk Müller. His name doesn't mean much over here, but he's widely respected in German financial circles. Greece is "blessed" with the wrong currency he says. With the euro, the Greeks can never stand on their own feet. Their debt could be cancelled five times without changing anything. So, says Müller, Greece will leave the euro. From an economic point of view there is nothing else left. But then, there's one born every minute. Economist Marcel Fratzscher, the new chief of the German Institute for Economic Research, thinks that all EU members should join the euro. His dream is "a European Monetary Union with all 27 member countries", then arguing that "the eurozone has been established without a political, fiscal and banking union". Long term, these steps are necessary, he says, to make the currency crisis-proof. That idea, I think, isn't going to fly. Müller is more likely to prevail. His voice is yet another setting down the mood music that says Greece is on its way out of the euro. Its exit is getting to be a self-fulfilling prophesy. COMMENT THREAD Richard North 10/08/2012 |

Eurocrash: on Britain leaving the EU Thursday 9 August 2012 The former prime minister and full-time europhile also – rather predictably - warns that Britain should not turn away from "Europe", while conceding that it is unlikely that the UK would agree to any new treaty commitments. Commitments. Nevertheless, said Blair, the euro crisis would lead to a "huge political transformation of the EU", about which he had "deep concern" that Britain could have a referendum and leave the EU entirely. It seems, though, that Blair is not the only one to be thinking about Britain leaving the EU. According to Ambrose Evans-Pritichard, Japan's biggest bank, Nomura, has been considering the possibility. In an 11-page report written by Alastair Newton, senior political analyst at Nomura International plc since October 2008, the bank comes up with the stunning statement that: The effect a looser relationship with the EU would have on the UK economy in general and on the financial services sector in the UK in particular is not clear at this time, even though British eurosceptics argue that being freed from EU regulation would be a booster.That really sets the tone for a report which rehearses all the old clichés, although Newton is also kind enough to tell us that the prospect of Britain leaving is, in our view, "bound to raise concerns" – indeed, is doing so already in the City". The core point, we are told, is that the eurozone "may have to take drastic steps in integration (fiscal union, etc) to save the euro, making it nigh impossible for a fully sovereign state to remain part of the Project". Possibly, I would suggest, it might even make it difficult for the UK to remain in the UK, so we are still in "now tell us something we don't know" territory. Alastair Newton, by the way, is an ex-British diplomat and former head to Tony Blair's G7 team. He was also intelligence co-ordinator in the first Gulf War. Unfortunately, that means he is a europhile, FCO clone, which makes his work suspect, as well as quite evidently superficial. Even occasional visitors to this blog will, for instance, know full well that, if the eurozone does not collapse completely, "it is only a matter of time, in our view, before crisis-related steps are agreed which necessitate treaty changes". If you are Alastair Newton, however, writing that gets you into the Failygraph, complete with the speculation that: "In those circumstances, the British government will almost certainly demand 'treaty change for treaty change' in an effort to repatriate powers", looking to win repatriation of powers to London for every concession on treaty reform. Newton then acknowledges that which we have been saying for some months, that the UK would "likely be looking to repatriate powers which EU partners may be unwilling to concede within he context of the single market", which means that he does not rule out the possibility of a serious schism between the EU and the UK. From this, we get the stunning observation that Cameron could find himself in "a very difficult position indeed", under even more intense pressure from within the ranks of his own party to call an immediate referendum. Thus, we learn, "Mr Cameron's current roadmap to get from where he stands now on the EU to the other side of the next election looks to be a very tricky one to navigate successfully". As one delves more into this derivative tripe, one wonders why Ambrose spent the time and effort reviewing it, although he does then observe that this is the first time that he has seen a global bank issue such a report. To paraphrase Johnson, therefore, we could suggest that a global bank talking about Britain leaving the EU is like a dog walking on his hind legs. It is not done well; but you are surprised to find it done at all. Namura, in fact, have a poor record for producing intelligent analysis of EU politics, having published in March 2011 an "optimistic" report on the fate of the euro. While the euro area monetary union had design flaws from the outset, it said, "there is strengthening evidence that the policies that are to be announced by Europe's leaders in the 'Grand Bargain' on 24 March are likely to fix many of these issues". As a result, the report went on, Europe stands to become less prone to the sorts of problems that have been afflicting it, and better able to deal with new types of shock should they occur. Putting in place the requisite policies to ensure the survival and further development of the euro area into a robust monetary union depended ultimately on political will, the bank said. "And the evidence is that this is, and is likely to remain, strong". Nevertheless, Ambrose uses the current Namura report as a springboard to tell us that it has been his "gut feeling" for some time that the EMU debt crisis – or rather the intra-EMU currency misalignment crisis since debt as such is not the root problem (except for Greece) – has already led to de factodivorce. Britain is no longer part of the Project. Furthermore, he says, this is proving less traumatic than supposed. It is quite possible to imagine various forms of semi-detached, or mostly-detached status where we carry on trading much as before. In the Ambrose scenario, Britain would tilt more towards Asia, the Americas, and Africa. UK relations with Europe would settle down over time and would probably prove better. But he doesn't like the Swiss or Norwegian analogies since Britain "is not remotely comparable. It much bigger and more diversified, much more difficult to push around. The fact that Norway feels it must go along with almost all EU law – a point invariably made by status-quo defenders – is irrelevant. It tells us nothing about Britain". Ambrose thus, is not excelling himself in his own analysis, and is clearly bouncing along the margins without giving any serious thought to Britain outside the EU. His views on the EU without Britain, though, are interesting: it would become less free-market, more protectionist, more dirigiste, more prone to quarrel with the US. Thus does out man look forward to another report by Nomura – or perhaps a Chinese bank next time – on the investment implications for Europe without Britain in it. But don't hold your breath. With the quality of analysis on offer, it is not surprising that the banks are making such a mess of their affairs. Like the markets as a measure of political developments, they are grossly over-rated. COMMENT THREAD Richard North 09/08/2012 |

Media: trivial coverage on foreign prisoners Thursday 9 August 2012 Yesterday, it was about the huge cost of foreign prisoners in British jails and then, today we learn how hard-pressed British taxpayers are "paying to make jails in Jamaica and Nigeria more comfortable in a desperate bid to persuade foreign criminals to serve their sentences at home". This is all done in lurid style as the Wail "reveals" that by March this year, there were 11,127 foreign prisoners from "a staggering 156 countries" behind bars - up from 10,778 in 2011. And the estimated cost to the UK public purse, we are told, is more than £420 million. For the unwitting reader, the stories pop out of the blue, with the focus very much on David Cameron, as the Wail breathlessly informs us that it has "emerged" that "the dire need to create space in our packed jails has prompted ministers to take the extraordinary step of establishing a £3million annual pot to make it easier for convicts to serve their sentences back home". Splashing money on prisons abroad, says the paper, "is certain to prove controversial. But officials insist it will be cheaper in the long run than the annual £38,000 bill for keeping a single prisoner locked up here". But what is quite remarkable about this style of reporting is that it almost completely lacks any background or context. Only in the second piece do we get a hint of it, as the paper parades the claim that: "In November 2010, the Mail revealed how the Prime Minister had decided to spearhead a campaign for foreign criminals to serve their sentences back home". Little would the readers guess from the coverage, however, that this goes back to October 2007 and before – with there being considerable controversy over foreign prisoners and deportation in 2006. But it was on 27 October 2007 that The Guardian was announcing that Gordon Brown was holding out the prospect that "up to 3,000 foreign prisoners could be sent back home to finish their sentences as a result of prisoner transfer agreements that Britain is poised to sign". We were then told that the prime minister had disclosed to MPs that "agreements were to be signed with Jamaica, Nigeria, Vietnam and China to enable foreigners in overcrowded jails in England and Wales to serve out their time at home". Intriguingly, this had followed a piece in – you guessed it – the Daily Wail on 25 July 2007, headlined: "I'll kick out 4,000 foreign prisoners, vows Brown". That story, five years ago, told us that there were "currently more than 12,000 foreign convicts in Britain's overcrowded prison system - 15 per cent of the 80,000-strong jail population" - suggesting that current levels have been reduced. The report then had Brown saying: "We are going to take a far tougher line. I want a message to go out - if you come here you work and learn our language. If you commit a crime you will be deported. You play by the rules or you face the consequences". Despite the lurid immediacy of today's and yesterday's stories, then, the facts of the matter are that this issue has been going on for a long, long time. And, on the face of it, the real story would appear to be the extraordinary length of time taken to fulfil Brown's promises: five years ago, he makes the pledge, and it is only now that we see the results. A clue as to why there was such a delay can been seen here in a Nigerian newspaper. Although undated, it shows that one of the receiving countries had to change its own law to allow prisoners to be returned and then to be jailed in the home country. Clearly, this was an unpopular law in certain quarters, and not until September 2011 did we see news that the Nigerian legislature had nearly completed the legal process necessary to permit the transfer of prisoners. First of all, though, British law had to be changed but it was then that we saw "the presumption shall be that the public interest requires deportation", with the proviso that "the European Convention on Human Rights (ECHR) or Refugee Convention" should not be breached. Given the appalling condition of some foreign jails, it was not going to be possible under British law to deport many of the prisoners held in our jails, so spending an amount of money on improving some foreign establishments is probably making the best of a bad job for the British taxpayer. So, what do we learn from all this? Well, we certainly find that government is a little more complex than the Wail makes out, and solutions take a lot longer than we would prefer. Doubtless, things could have been done better, and we are still hampered by human rights agreements. Overall though, the story is very different from that presented by the Wail - and other newspapers. Trailing in the wake of its tabloid competition is the Failygraph, repeating the line about this government's "desperate attempt" to repatriate foreign criminals. Small wonder this is a failing industry. Why should people bother to pay for being so ill-informed, especially when they already pay to be ill-informed by the BBC? COMMENT THREAD Richard North 09/08/2012 |

Eurocrash: how much longer before the Greeks exit? Thursday 9 August 2012 A few days ago the markets were tanking and then they were surging, and then Ambrose was telling us everything in the garden was rosy - all because Draghi had a plan. And now, on just as much evidence as there has always been – i.e., very little indeed - the marketsare dropping again as "doubts grew on the prospects for early central bank action to bolster the global economy and tackle the euro zone debt crisis". Most likely though, what is actually happening is the normal cycle of speculation and profit-taking, all on very thin trading, and much of it initiated by computer algorithm, the "trades" untouched by human hand. The teenage scribblers and hacks then over-interpret the data and come up with conclusions that are as slender as the data on which they base them. What can't be gainsaid, though, is that the euro crisis is having a significant and adverse effect on the German economy. And, equally significantly, the Germans are open about blaming the "mess in the eurozone". The salad days for German exports are over – jobs, production and turnover are all falling. Then, after Helmut Schmidt has admitted that letting Greece into the Euro, and Juncker has said that Greece leaving the euro would be "manageable", we have Otmar Issing, styled as the "euro architect", conceding that "some members" could leave the single currency. Meanwhile, Die Welt is reporting that Greeks are "devious", with one in ten pensions possibly being wrongly claimed, in what might be wholesale fraud. Tedious the ups and downs of the market might be, but the mood music is getting interesting. Softly, insistently, the German public are being prepared for a Greek exit. It is no longer whether, or even when, but how much longer. COMMENT THREAD Richard North 09/08/2012 |

Friday, 10 August 2012

Posted by

Britannia Radio

at

09:08

![]()